E-KYC – The Next Step in the Evolution of KYC Verification

As the world shifts to digital applications, financial operations are being automated for added convenience. Customers are starting to demand quickness and ease of access to every type of product and service. eKYC is a way to automate the KYC process for improved customer experience. This has the potential to not only speed up the processes but also make them secure.

For this reason, regulatory bodies are allowing the use of eKYC methods that ensure the protection of customers’ sensitive data. The standard Know Your Customer (KYC) process implemented by banks and other financial institutions involves steps to verify the identity of customers.

eKYC – An Overview

KYC verification is a measure that allows businesses to not only mitigate the risks of financial crime but also comply with international standards. It also helps establish trust among businesses and their customers by eliminating the instances of fraud and money laundering. The process of verifying the identities of new customers is implemented during the onboarding stage, where the company has no background information about them. However, KYC does not stop after the onboarding – it is a continuous process throughout the customer’s journey with the company.

In recent times, there has been a fast-paced growth in terms of digitization across numerous industries. Banks and financial institutions have emerged as the top industry when it comes to shifting operations online, which is partly due to the restrictions brought forth by the Covid-19 pandemic. In simple terms, eKYC is also a more digitized and automated form of traditional KYC verification. It is a completely paperless, digital system that has the capability to verify customers remotely in a faster, more accurate way as compared to KYC verification.

A Digital Way of Verifying Customers’ Identities

With more and more banking and other financial processes being moved to digital systems, there is an increasing need for an online method of identity verification. As customers are provided the option of carrying out transactions and other banking operations online, they do not appreciate being called to a branch of a bank solely for the purpose of identity verification. Considering the updated demands of customers, institutions strive to provide their customers with the convenience of verifying their identities through online portals.

According to a study, the pandemic has contributed to taking companies seven years ahead in digital transformation. Although mass digitization in financial services was assumed to be difficult to achieve, technological advancements in the field of artificial intelligence have significantly taken financial institutions ahead of their time. But that is only applicable when they actually incorporate the right technological solutions to analyse the risks associated with their customers. Speaking of mass digitization, the leaderboard is topped by KYC verification, as AI-based systems have created a robust mechanism that runs numerous algorithms and analyses data at speeds that were not humanly possible.

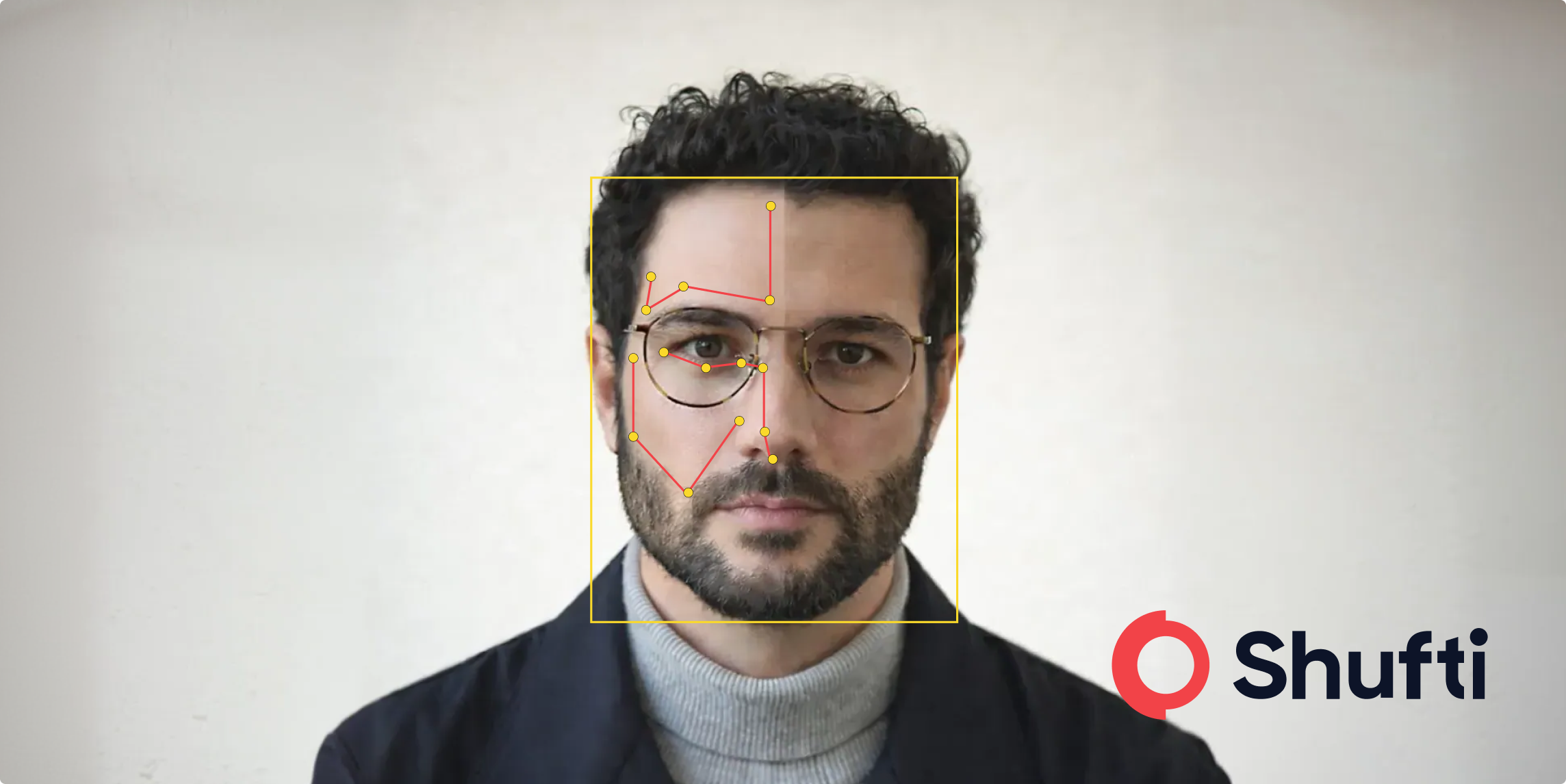

It was with the help of these advanced technologies that eKYC became an automated process. As of now, eKYC is the fully automated version of KYC, which means there is no requirement to fill out manual forms or appear before a verification agent. Instead, customers are simply required to submit their personal details and upload a selfie. The system then carries out the process of KYC and AML screening to run a complete background check on the clients. That being said, all these developments and the global adoption of eKYC measures would not have been possible without regulations. Amid rising cases of fraud and financial crime during the pandemic, financial regulators began to accept and encourage the use of measures like Video KYC and biometric facial recognition to verify customers’ identities digitally.

How eKYC Improves Identity Verification

First things first, in any given industry and any given service, customer satisfaction begins with speed and quality. eKYC significantly improves the process of KYC by making it faster, which means the process that took days or even weeks is now a matter of seconds. Secondly, eKYC makes the verification process easy for the customer, making the customer experience much better. Normally, financial institutions try to offer their customers products and services through a seamless, easily accessible process. They also prioritise the protection of the customers’ personal information that could otherwise be used by fraudulent entities for their illicit motives.

According to a survey, 89% of corporate customers have reported unpleasant experiences with KYC verification, and 13% of them even shifted to other banks. As a result of eKYC’s fast and easy verification, financial institutions can increase the conversion rates of customers. They can provide their customers with a secure platform that protects their sensitive information while complying with global regulations like AMLD and eIDAS.

The Steps in an eKYC Process

eKYC is a process that exceeds the capabilities of traditional KYC practices and can be implemented for ongoing customers as well. It is a single solution to cover all customer verification requirements including onboarding, customer due diligence, and ongoing monitoring.

Document Verification

The document verification stage of eKYC starts by requiring and verifying the scanned copies of customers’ identity documents through an automated process. Personal details of the customer are extracted from the scanned versions of ID documents using OCR technology. AI-based verification is done by matching the document templates with pre-defined, authentic document types.

Video KYC

Video KYC is a type of verification measure in the eKYC process that is designed to provide customers with an alternative way to get their identity verified. In Video KYC, customers’ identities are verified by matching their ID documents with their live video by a KYC expert.

Ongoing Screening

It’s not just the onboarding stage that is risky in terms of fraud and financial crime. It is often seen that existing customers in financial institutions turn out to be bad actors. In order to avoid getting manipulated by fraudsters, financial institutions are advised to conduct ongoing monitoring of customers’ transactions and report suspicious activities to the relevant authorities. The process involves checking the presence of ongoing customers in global sanctions lists and PEP lists.

What Shufti Offers

To establish themselves as industry leaders, financial institutions have demonstrated an increased demand for Electronic Know Your Customer (e-KYC) verification solutions. Shufti’s digital identity verification offers not only an easy to incorporate verification process of customer onboarding but also helps businesses comply with stringent AML and KYC regulations. Moreover, it allows businesses to eliminate fraud and scams that have prevailed for decades. Hence, financial service providers are now able to develop strategies to combat fraudsters through eKYC.

Shufti’s eKYC is the optimum solution to defeat the challenges of financial inclusion. It presents the provision of financial inclusion as a unique process, and all the relevant information is synchronized. Moreover, it is catering to the necessities of the digital world via online biometric and document verification.

Want to learn more about our eKYC solution for your business?

Explore Now

Explore Now