Global Trade and Prevalent Crimes – How Shufti’s AML Solution Can Help

International trade is exchanging services, capital, and goods across borders or territories, generating profits for the countries involved. Global trade hits a record-high of $28.5 trillion in 2021, with an increase of 25% as compared to 2020. With the transformation of water-resistant vehicles, airplanes, and railway trains, global trade has evolved to a great extent. Investors are now preferring to increase the production of their goods to maximize trade, gaining more revenue and profit.

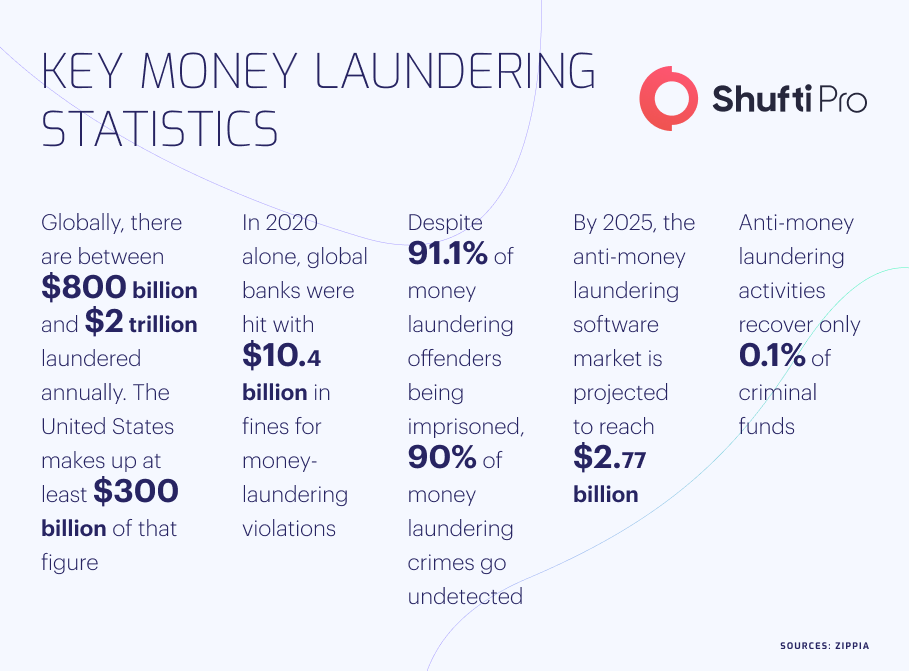

The huge volume of global trade and influx of considerable investments in this sector has created a myriad of opportunities for criminals to carry out financial crimes, including Trade-Based Money Laundering (TBML) and terror financing. Unlike the corporate sector, trading is expanded across borders, making it quite difficult for jurisdictions to curb prevalent crimes. As a result, TBML has become a massive risk as criminals exploit legal transactions to launder illicit money.

An Overview of Trade-Based Money Laundering

The Financial Action Task Force (FATF) has termed international trade system to be highly vulnerable to risks of money laundering and terrorist financing. FATF has stressed all the member countries to take strict actions against illicit activities involving global trade. Although several countries have legislated stringent regulations to eliminate financial crimes, they still prevail and affect the businesses adversely. In a world with a population exceeding 7 billion, no country can survive without exports and imports, so eliminating money launderers is imperative for making trading activities risk free.

The State of Financial Crime Survey 2022 indicated that compliance professionals worldwide termed trade-based money laundering the second most potent way to disguise illicit funds. Due to weak monitoring system, money laundering groups and terrorist financing organizations exploit complex models of international trade to sneak black money into the pool. Various methods, particularly overbilling, underbilling, and physical movement of goods or money, are generally used to disguise illicit funds under layers of legal trade money. With increasing global trade, money laundering cases are also keeping up the pace, and the overall sector has gained regulatory attention. The trading sector is in dire need of strict Anti-Money Laundering (AML) checks identifying and eliminating criminals from the system.

High Profile Cases of Trade-Based Money Laundering

Not only the global financial watchdogs but regulatory authorities of several countries are also taking strict action against money launderers. In the wake of this, several cases have been witnessed across the globe where courts have sentenced the culprits with imprisonment. Unless a strong global framework against money laundering and terrorist financing is not formulated, criminals will keep on exploiting the platforms causing monetary losses.

Money-Laundering Gang Involved in £100 million Scam

Britain Police conducted a raid and arrested the ringleader of the country’s biggest ever money laundering gang. The gang was involved in drug trafficking and laundering dirty money to Dubai through various trading means. The criminals laundered £100 million in one year by using multiple products particularly mouthwashes and coat hangers as a cover to disguise illicit cash The gang leader has been sentenced to nine years in jail, and cases of other participants are still ongoing in court.

Sting Operation by Australian Authorities Against Money Launderers

Australian Police recently conducted an operation against prevailing money laundering across the country. The law enforcement authorities seeded 12,000 encrypted cell phones into the criminal world to investigate money laundering network and channels used by criminals to carry out scams. Australian law enforcement authorities have revealed that transnational trade is one of the primary means used by the network to convert black money into legal assets. The Police have further vowed to take stringent action based on investigations against gang.

Global Regulatory Authorities Countering Trade-Based Money Laundering

Most countries affected by trade-based money laundering are legislating strict regulations and making their law enforcement agencies take hard action against criminals. FATF, Interpol and EU are some of the regulatory authorities working on a global scale to curb TBML. All these watchdogs are also assisting member countries to formulate regulations and enforce them.

US

United States (US) is considered as the most in FATF’s efforts to curb money laundering and terrorist financing. Financial Crimes Enforcement Network (FinCEN) is the main regulatory authority responsible for curbing money laundering and terrorist financing. In recent times, FinCEN has enforced several AML checks in a large number of import/export businesses and it is also monitoring cross-border trade. Moreover, the Trade Transparency Unit (TTU) is another important organization in US examining trade anomalies, and financial irregularities associated with TBML, customs, tax evasion, etc.

UK

The lawmakers in UK have legislated several laws to monitor money laundering activities in every sector. These laws may include; Proceeds of Crime Act (POCA), Sanctions & Money Laundering Act (SMLA) and Terror Financing Regulations 2017. UK authorities strictly monitor TBML in light of local regulations and FATF’s guidelines. The law enforcement agencies in UK are actively working to eradicate money laundering through cross-border trade and it has imposed strict penalties in case of violation.

Australia

Australian Transaction Reports and Analysis Center (AUSTRAC) is actively working in Australia to curb money laundering and other organized financial crimes. Financial regulatory authorities have recently issued a detailed report highlighting the vulnerabilities of international trade to criminal activities. The recommendations by FATF have largely been taken into account and it has advised to custom department to implement strict AML checks to discourage money laundering in cross border trade.

Why AML Compliance is Important Against Trade-Based Money Laundering?

Due to complex nature of trade-based financial crimes, it is quite hard to eliminate criminals without implementing strict AML checks. All the financial institutions and import/export businesses should maintain Enhanced Due Diligence (EDD) approach to verify the identities of all the entities on the system. In most of the cases, money launderers use fake identities while onboarding and carryout crimes without leaving any trail.

The global financial watchdogs particularly EU, Interpol, FATF and FTC have accumulated data of money launderers in the form of Politically Exposed Persons (PEP) and other sanctions lists. The trading businesses should implement a system of screening data of new clients against these lists to counter criminals. Through stringent AML checks, companies and countries can add an extra layer of protection on global trade preventing it from illegal activities.

How Shufti can Help?

Securing global trade from the crimes particularly money laundering and terrorist financing through efficient AML checks is inevitable. With high potential of investment, global trade is increasing every year and it is the right time for countries to invest in AML screening solutions.

Shufti’s AML screening solution can assist business owners to comply with global regulatory standards while eliminating money laundering. Shufti’s AML solution screens data of users against 1700+ sanctions lists and generates results in less than a second with 98.67% accuracy.

Want to get more information about AML screening solutions for your business?

Explore Now

Explore Now