UAE’s Crypto Landscape – Eliminating Financial Crime to Ensure Regulatory Compliance

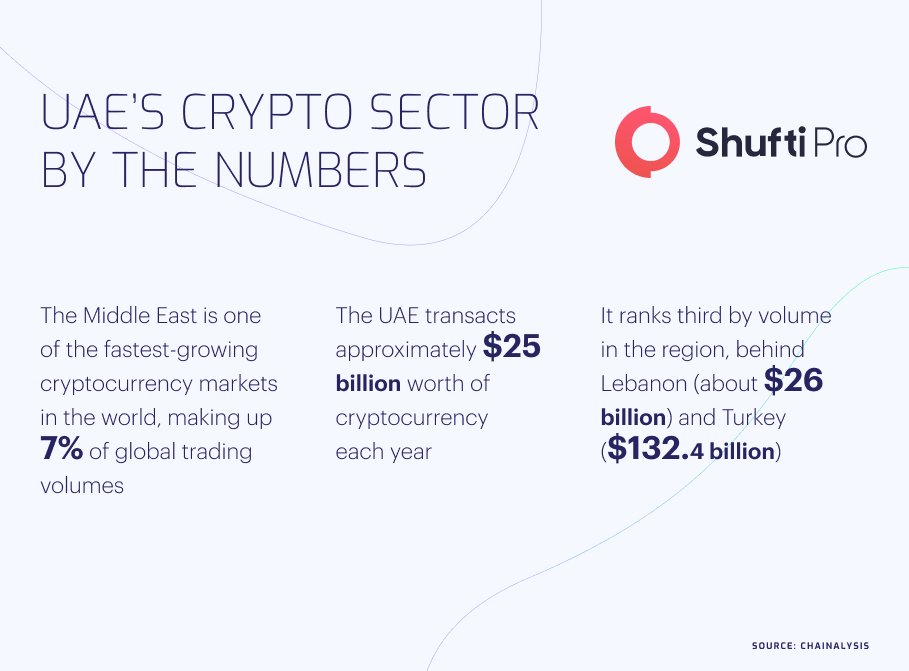

The UAE is the Middle East’s rapidly growing cryptocurrency hub that is experiencing a heated-up regional competition between prominent crypto firms. Kraken, a US cryptocurrency exchange recently announced its expansion into the UAE and said that its launch in the lucrative region is an important step to facilitate crypto access to global markets.

The emergence of OTC crypto trading has demonstrated Dubai’s transformation towards becoming a global crypto centre. The UAE’s business capital has therefore seen the establishment of over 1,000 blockchain companies in the last year, including big names like Binance and FTX.

OTC Crypto Trading

OTC companies like Coinsfera and dozens of others provide customers with the facility to buy crypto assets from any location using the local currency, which can include ill-gotten money, and sell them in Dubai to gain legitimate cash. At firms like Coinsfera, this is a short process and requires the submission of an ID document along with a few answers to some questions. Customers of such firms vary from normal crypto investors that like to keep an eye on trends and new regulations and also include sanctioned Russian billionaires that are looking to legitimize their illicit funds.

Unlike traditional banks or centralized exchanges that can keep track of transactions and trading, OTC platforms use offline systems for crypto data storage, known as “cold wallets”. This means that crypto users can make transactions, deposit or take out their assets without leaving any trace. OTC firms operate by charging a commission for these operations, just like the currency exchanges at airports. As a result, OTC shops are not affected by the crypto sector’s increasing volatility. Instead, they have profited from the recent instability in the crypto paradigm as crypto users hurried to sell their assets.

How the Crypto Sector is Regulated

Although the UAE has been pointed out as a safe haven for Russian money launderers after the invasion of Ukraine, this was not the start of it. Earlier on, Dubai was being used as the ideal destination for the dirty money and sanctioned entities coming from countries like Iran to get access to the Western market. After the Russian invasion of Ukraine in February, the UAE has joined Turkey in becoming a safe haven for the proceeds of crime coming in from Russia and the West.

As Russia does not face any international sanctions or penalties from the UAE, Russian money launderers that are sanctioned in other countries can use the UAE’s OTC platforms to perform crypto transactions. The lack of public reporting requirements and the use of cash-intensive trading means that money is being laundered through UAE’s crypto sector without any checks. It can’t be said how much money is being stashed using crypto firms or how much of these activities are known to regulatory authorities.

That being said, OTC crypto trading has contributed to an increase in the international scrutiny faced by the United Arab Emirates due to the flow of illicit money through its crypto sector. This has also led the UAE into the grey list of high-risk money laundering countries by the Paris-based Financial Action Task Force (FATF) in March. Considering the current scenario, crypto firms in the UAE are urged to implement robust identity verification checks to know who they are dealing with, and in order to combat illicit financing.

Grey-list Status

Despite the UAE’s efforts to bring in some of the world’s biggest cryptocurrency exchanges and establish itself as a global crypto hub, the Arab country has recently faced international scrutiny due to inadequate checks and measures to clamp down on money laundering. During the Russian invasion of Ukraine, the UAE was among other major financial centres of the world to be flooded with requests to clean illegally-obtained funds.

Just like Dubai’s property market, crypto firms also got the opportunity to make big revenues. However, the news wasn’t all good – as the FATF placed the UAE on its grey list of countries that needed monitoring. The UAE was placed along with Turkey, Syria, and Panama in the list of countries that the FATF requires to address the risks of money laundering.

How to Ensure Regulatory Compliance

Just like traditional banks and financial firms, regulated crypto firms in the UAE need to incorporate robust KYC verification measures. The common perception about identity verification measures is that they are time-consuming, labour intensive, and make customers run away. However, that’s not the case with today’s AI-driven KYC verification solutions. There are new and updated solutions to ensure that crypto firms know who they are onboarding while making the process quick and convenient for the customer. An effective KYC solution provides support of numerous languages and document templates to make the process as accurate as possible.

Most crypto firms operating in the UAE fall under the scope of Anti-Money Laundering (AML) regulations, and their customers include individuals and businesses from all over the world. For crypto firms, an effective KYC solution must include the verification of different types and templates of ID documents. Moreover, crypto firms must be capable of verifying the identity of their customers along with address verification through digital IDs, utility bills or driving licenses.

Crypto Regulations in Other Parts of the World

In countries like China, the government can restrict crypto operations in a specific territory or require additional regulatory steps in case of prevailing financial crimes. Similarly, in the US, regulators often require Initial Coin Offerings (ICOs) as securities for registration. Identity verification and address verification are not sufficient for overseeing crypto transactions, which means additional measures are required to check their accredited investor status.

What Shufti Offers

To address financial crimes and the anonymity associated with digital currencies, crypto firms require robust anti-money laundering and transaction monitoring solutions. Verifying customers’ identities while staying compliant with AML regulations allows crypto firms to capture the market and provide services without facing regulatory actions. Identity verification and background screening help businesses to maintain records with high transparency.

Shufti’s state-of-the-art anti-money laundering and transaction monitoring services are considered a viable option for cryptocurrency firms, as it allows customers verification by screening them against 1700+ watchlists in less than a second with 98.67%.

Want to learn more information on AML for the cryptocurrency industry? Talk to our experts right away!

Explore Now

Explore Now