COVID-19 Pandemic – What it holds for businesses?

- 01 Lockdown amid COVID-19 - Impact on businesses and economy

- 02 Contactless technology - the need of the hour

- 03 Work from home

- 04 Contactless payments

- 05 Contactless verification

- 06 Businesses incorporating contactless technology to deal with Corona outbreak

- 07 Financial institutes incorporating KYC alternatives

- 08 Retailers incorporating cashless payments

- 09 Touchless verification at airports

- 10 Educational Institutes

- 11 The way forward

The year of the Rat, 2020, didn’t get a propitious start because of the deadly coronavirus outbreak. Emerged as a type of influenza in China, it turned into a fatal epidemic within days taking away the lives of thousands of people. Coronavirus, officially known as COVID-19, is gradually taking over the world emanating as a pandemic. To date, over 479,915 corona cases have been reported in 196 countries and territories around the world, out of which 21,577 people have died; as per worldometers stats.

How is COVID-19 Impacting KYC?

The COVID-19 pandemic has shifted businesses to virtual means of communication and operations. Fraudulent activities have significantly increased during the pandemic which is making it difficult for any of the companies to survive. The demand for Know Your Customer (KYC) verification is not the need of the hour.

Lockdown amid COVID-19 – Impact on businesses and economy

Corona pandemic is a sensitive topic these days that has caused an unknown panic and fear among individuals. Being an epidemic, it has taken the world into its clutches. Governments are taking necessary measures to fight this deadly situation. Cities are being locked down, travel restrictions are put in place, and people are forced to confine themselves to their homes. Above all, businesses are being closed leading to disarray among global trade, tourism, investment, commerce, and supply chains.

The coronavirus outbreak isn’t just a human tragedy affecting thousands of people globally, it is leaving a negative impact on the global economy. The business stats from around the world paint a bleak picture of the impact the corona outbreak is leaving on their businesses. In a statement to The Guardian, Dave Griffin, the managing director of Chauffeur Services Direct, claimed they have lost nearly 80% of their bookings amid corona lockdown. He stated that after the corona pandemic, their weekly turnover has slashed to about £500, contrary to £3,000-4,000 a week. The reason is that people are advised to stay isolated, firms are implementing work from home strategies and people aren’t traveling much.

Moreover, with the governments urging people to work from home, gig economy workers such as cleaners, event staff, and delivery and taxi drivers are facing the worst situations and seeing their work wither away because they are not getting any paid leaves from the company. The majority of the workers are on a zero-hours contract and hence, are out of work currently.

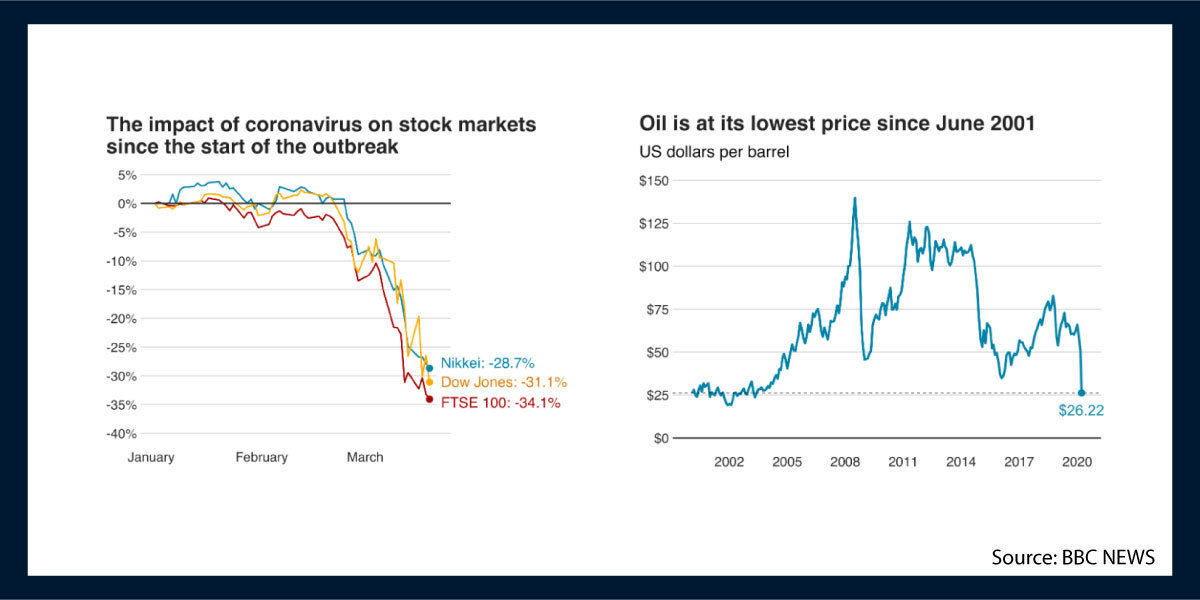

With the Covid-19 rattling the global economy, and every industry, including the supply chain, are being disrupted. Organizations are confronted with a well-understood reality that businesses won’t go as usual. According to the New York Times, the investors are reporting the fall in the U.S. stocks for a second straight day on Friday. Additionally, airline, energy, and tech companies’ shares had also lowered the market on Wall Street. The S&P 500 index closed lower than one percent, which was the worst day of the month. Oil and gas prices are no different.

Analyzing the current situation, most companies are not sure about the cost of delay in reopening their businesses. However, according to the survey, 10 percent of the companies claimed that they are losing around $71 million per day. Apart from it, now organizations are disclosing their losses amid the coronavirus outbreak.

Contactless technology – the need of the hour

Coronavirus outbreak is taking its toll on global businesses. To avoid the spread of this novel disease and protect themselves, people are advised to maintain social distance and confine themselves to their homes as much as they can. Moreover, people are advised not to touch anything outside and keep washing their hands to hinder the virus from attacking. Amidst these precautionary measures, businesses are badly affected because of the disruption in their business operation.

For instance, people are avoiding going to stores to buy things and using cash or ATMs, employees are forced to work from home, biometric attendance is being hindered and much more. Above all, con artists are ready to exploit the situation and fulfill their malicious intent. In all this, businesses are the ones who are most affected. In order to efficiently handle the situation, contactless secure technology is the need of the hour because completely shutting down the operations is not even an option.

Work from home

The complete lockdown of cities has pushed organizations to implement the work-from-home strategy. For regular organizations, it’s not easy to go remote within days. Everything has to be properly planned and managed before allowing remote work. The major concern of businesses is the security of data, and employee attendance and performance. With the trouble makers all set to misuse this opportunity, companies need a solution that can not only secure the business operations but also facilitate employees in carrying out their tasks efficiently.

Contactless payments

People have started reconsidering the cash that they handle every day as coronavirus continues to spread globally. According to some experts, the COVID-19 can latch onto the cash the same way as it survives on other surfaces including handrails, doorknobs, windows, gates, etc. Similarly, using cards for payments may not be a good idea as well as stated in one study, credit cards carry more germs than cash and coins.

People who took every possible preventive measure amid the corona outbreak are ready to embrace contactless technology in the form of digital wallets and contactless payments. These payment methods allow customers to pay through a single tap without coming in contact with other people or systems. They are the faster alternatives to cash and chip-and-PIN payments; requiring little to no physical interaction.

Contactless verification

One of the biggest challenges that organizations are going to face is the hindrance in employee and customer verification. For instance, financial institutes generally verify their customers through physical documents, organizations verify and track their employees’ attendance through fingerprint scanning, airports have different security checks in place to check travelers and passengers that involve physical interactions. All these business operations are being restrained as a result of the coronavirus outbreak.

This makes contactless verification a significant need for the business during this critical corona lockdown. Whether it’s about customer verification, employee authentication or client onboarding, touchless verification can prove to be an effective solution for the companies, not just that it’s safe but it is secure as well that can prevent digital frauds keeping the con artists at bay.

Businesses incorporating contactless technology to deal with Corona outbreak

The COVID-19 lockdown has enveloped the world, cutting off the major business operation and badly impacting the organizations. To deal with the ongoing situation, businesses are going to take advantage of technology. After years of reluctance, individuals and businesses are now incorporating touchless technology in the form of digital wallets, face verification, digital KYC and digital ID authentication. These tech solutions are a necessity for businesses. In this COVID-19 pandemic, only those organizations are going to survive who would reengineer their business processes as per technology.

Here are the few businesses that are implementing contactless technology to successfully carry out their business operations during the corona crisis.

Financial institutes incorporating KYC alternatives

With the coronavirus outbreak, financial institutions have to undergo a major loss because of their extra reliance on their employees and traditional customer onboarding processes. Though many institutions have allowed their employees to work from home, what about the onboarding process? How are they going to ensure the secure customer onboarding meeting the regulatory KYC and AML compliance? Banks and other financial institutes now have even more responsibility to identify the con artists who might be exploiting their systems.

In lieu of the current situation, the first Canadian bank has recently introduced digital identity verification to efficiently carry on their operation during the lockdown. Moreover, the institutions are incorporating KYC alternatives for the successful onboarding of customers. These alternatives include Shufti’s video KYC, Digital KYC verification and AML screening solutions.

Retailers incorporating cashless payments

With WHO’s instructions for the individuals to maintain social distance and avoid contact with people and other surfaces outside, customers are being confined to their homes and only go out in case of emergency. Even in such scenarios, they are avoiding physical contact with other people. Analyzing the critical situation, the retailers are already saying no to cash and accepting contactless payments. Moreover, the cities’ lockdown has forced retailers to shift their operations online and provide their customers with an e-commerce facility. This makes the whole shopping process entirely contactless; from adding things in the cart to check out.

Undoubtedly, it is an effective measure to prevent corona spread, but it is proving an opportunity for the fraudsters to exploit digital wallets and earn some extra cash. Just digitizing isn’t enough, the security of customers’ data is equally essential now. With the FTC warning individuals about potential coronavirus scams, proper measures must be kept in place to curb these frauds. For instance, verifying payments through face verification, as Amazon’s “smile to pay” feature is working.

Touchless verification at airports

Public places, especially airports are posing potential coronavirus threats to individuals. The reason is the unhygienic contact of travelers with the devices at various checkpoints, be it a ticket counter or airport entrance. Most airports have biometric scanners in place to authenticate people which is touched by almost every person raising concerns for coronavirus.

Understanding the severity of the situation, touchless biometric authentication is becoming more streamlined and essential for airports and other public places. Implementing touchless verification not only deals with the current COVID-19 issue but also enhances airport security and customer experience. People won’t have to wait in queues for their turn.

Educational Institutes

With the unprecedented situation caused by the COVID-19 pandemic, governments are taking measures to cope up with the novel outbreak and safeguard the well-being of the students. As a result, the educational institutes are advised to close down the institutions for the time being. In this current situation, many institutes are opting for online education to provide the students with quality education. This means every activity will be performed online, from attendance to lectures and exams.

It’s a well-understood fact that some troublemakers would try to take advantage of the situation and violate the policies through cheating in exams; for example, getting their paper solved by someone else. To deal with such issues, institutes are integrating digital verification services in the form of face verification to authenticate the students in real-time and prevent any unfair circumstances.

The way forward

Analyzing the current scenario, to successfully control the pandemic and getting back to normal life is going to take time. Till that time, sitting quietly and doing nothing is not the solution. Among the safety of the people, organizations need to take certain steps to explicitly deal with worsening business conditions during the COVID-19 pandemic.

![AUSTRAC’s ML/TF Risk Assessment 2021 – Other Domestic Banks Report [Part 2] AUSTRAC’s ML/TF Risk Assessment 2021 – Other Domestic Banks Report [Part 2]](https://shuftipro.com/wp-content/uploads/2021-09-08-blog.jpeg)