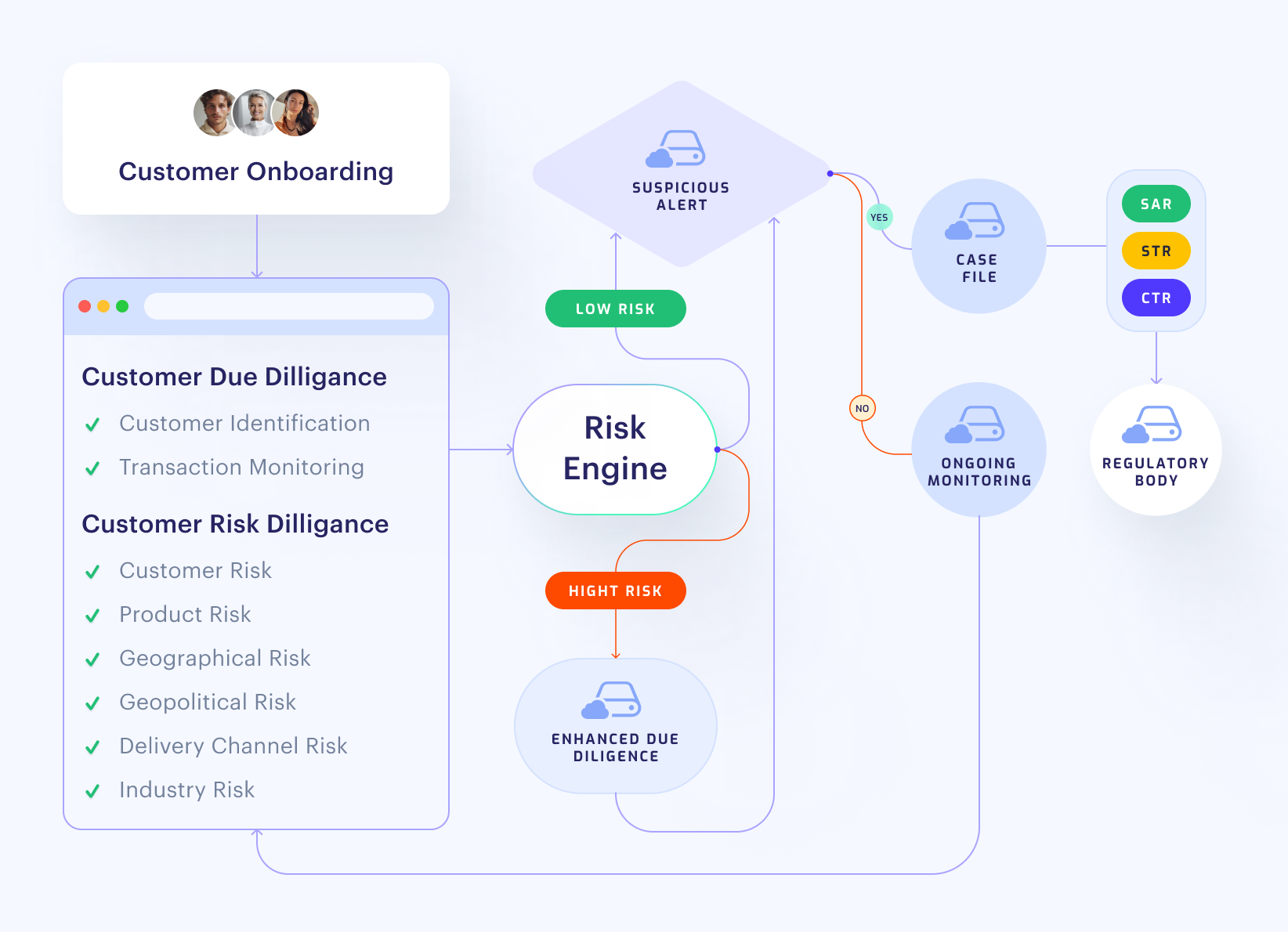

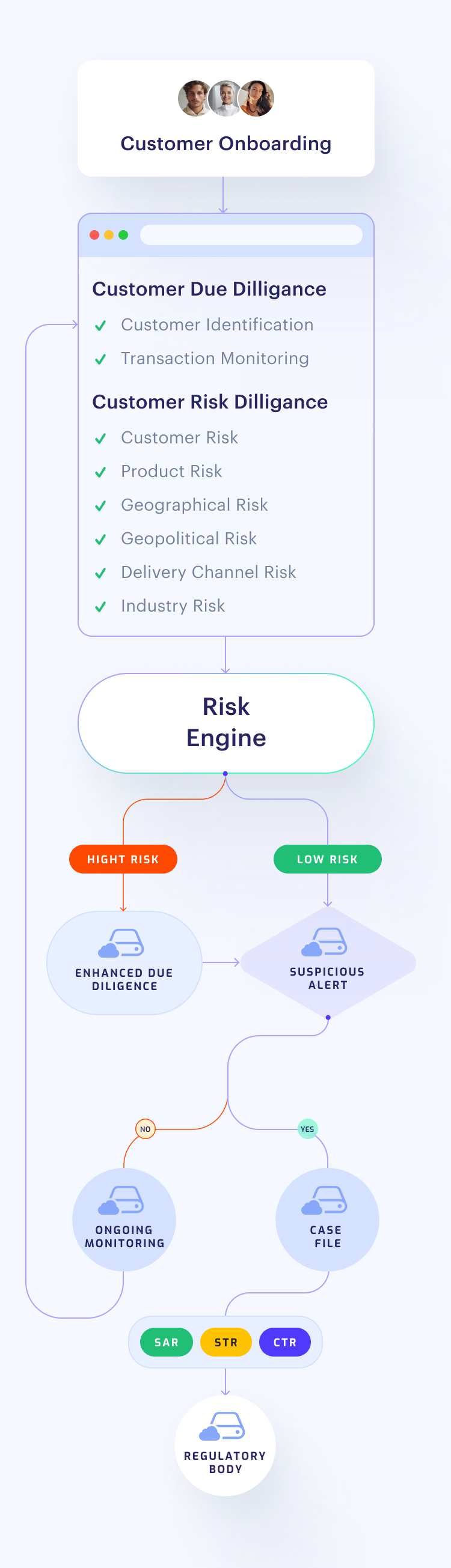

SHUFTI PRO’S RISK ASSESSMENT LIFECYCLE

The Risk Assessment Process

Safeguard your business against the omnipresent threats of identity fraud and wider financial crime with our intelligent risk assessment solution; empower your business with a comprehensive step-by-step process to protect and fortify your organisation.

- Robust process to identify potential risks

- Comprehensive analysis of customer profiles

- Uncovering signs of suspicious activity

- Ensuring regulatory compliance

- Staying ahead in the fight against financial crime

- Tailored KYC based on customer risk level

SHUFTI PRO'S ALL-IN-ONE RISK ASSESSMENT SOLUTION

Our state-of-the-art solution allows you to operate across all countries, regions and jurisdictions to seamlessly mitigate the risk of financial crime and meet global compliance – all the tools your business needs in one place.

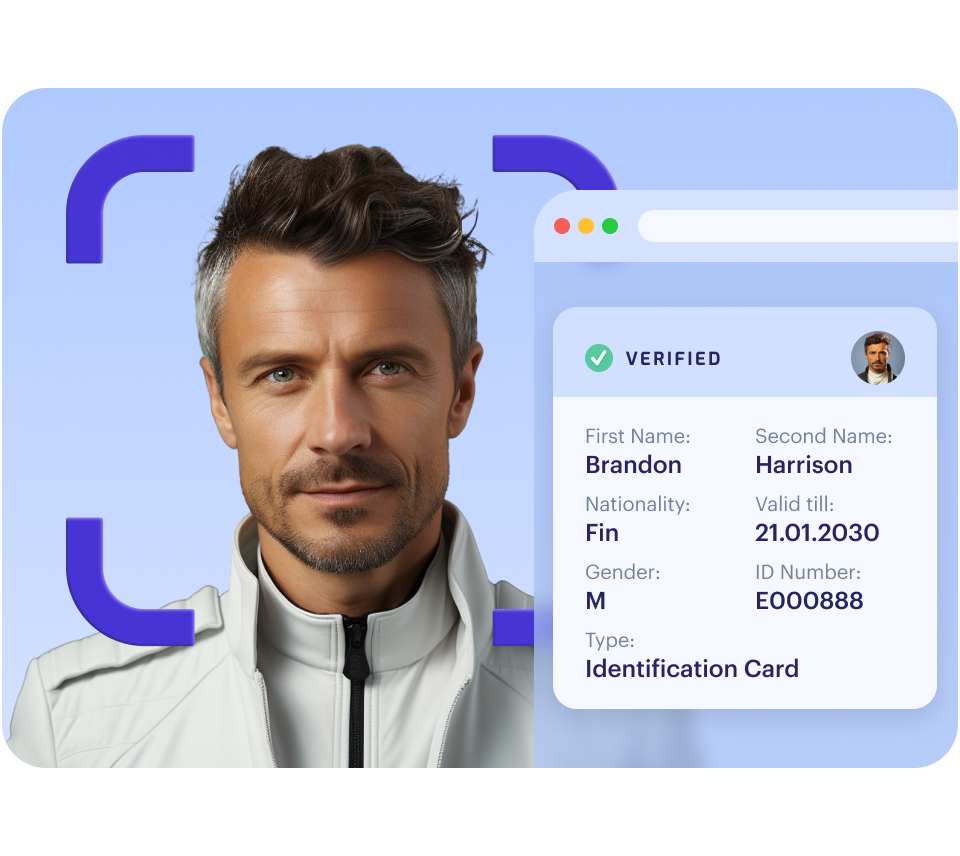

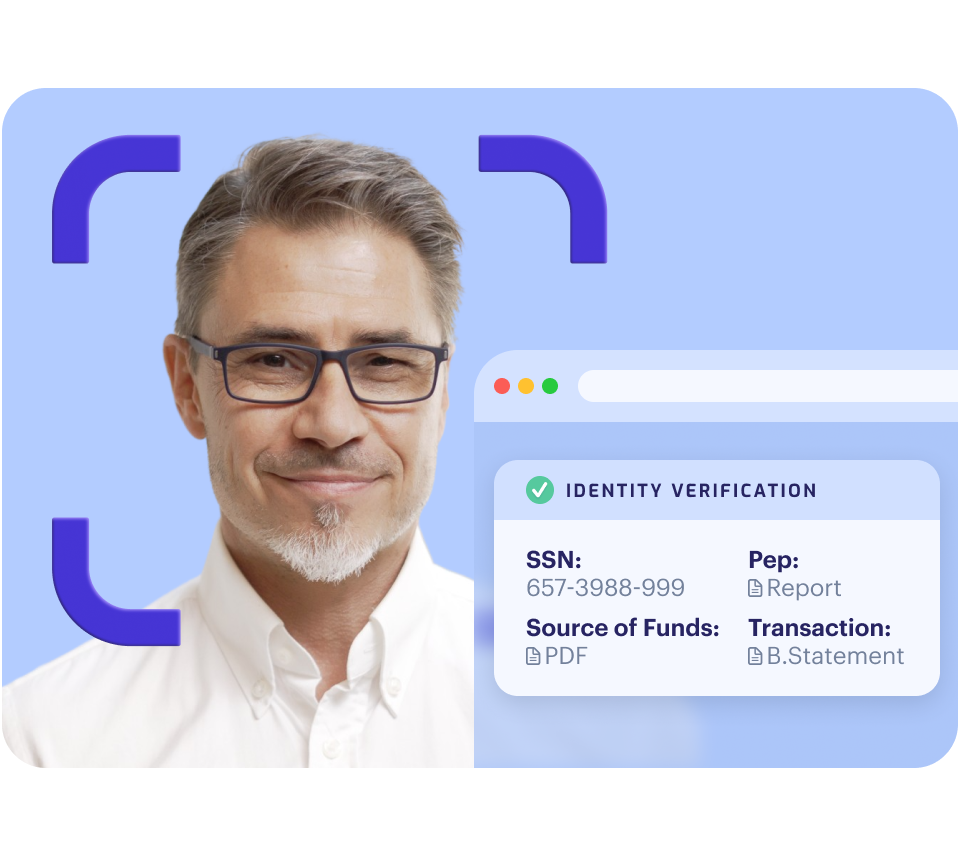

Secure Customer Onboarding

Verify customer identity using reliable sources like government-issued ID cards, passports, or driving licenses, along with authentication checks.

Customer Due Diligence (CDD)

Instantly access customers’ vital information such as name, address, date of birth, etc. Efficiently analyze customer activities for risk assessment and regulatory compliance.

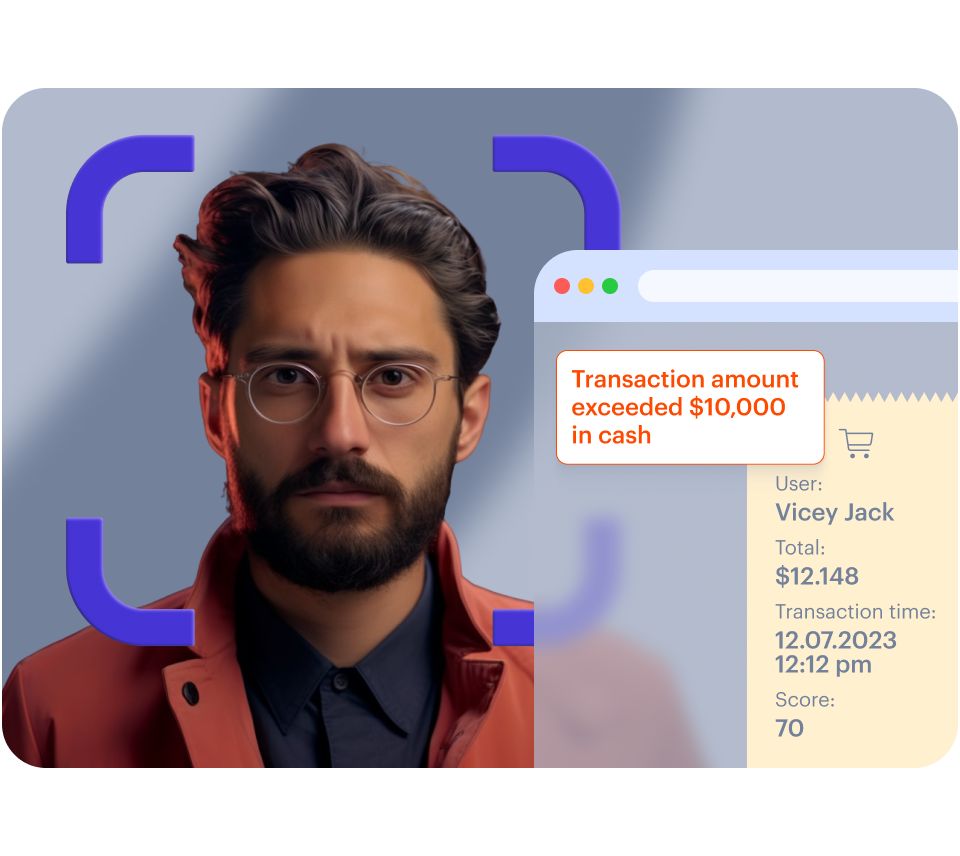

Comprehensive Transaction Monitoring

Identify transactions beyond thresholds, detect suspicious activities, and get a complete view of customers' activity, risk levels, and future behavior predictions.

Customer Risk Profiling

Shufti Pro assesses risk through customer profile, location, occupation, transaction history, and more, categorising them as low, medium, or high-risk for tailored risk management.

Enhanced Due Diligence (EDD)

Shufti Pro's risk assessment uncovers hidden data realms for valuable insights, including funds sources, transaction purposes, SSN verifications, and reputation analysis, surpassing standard due diligence.

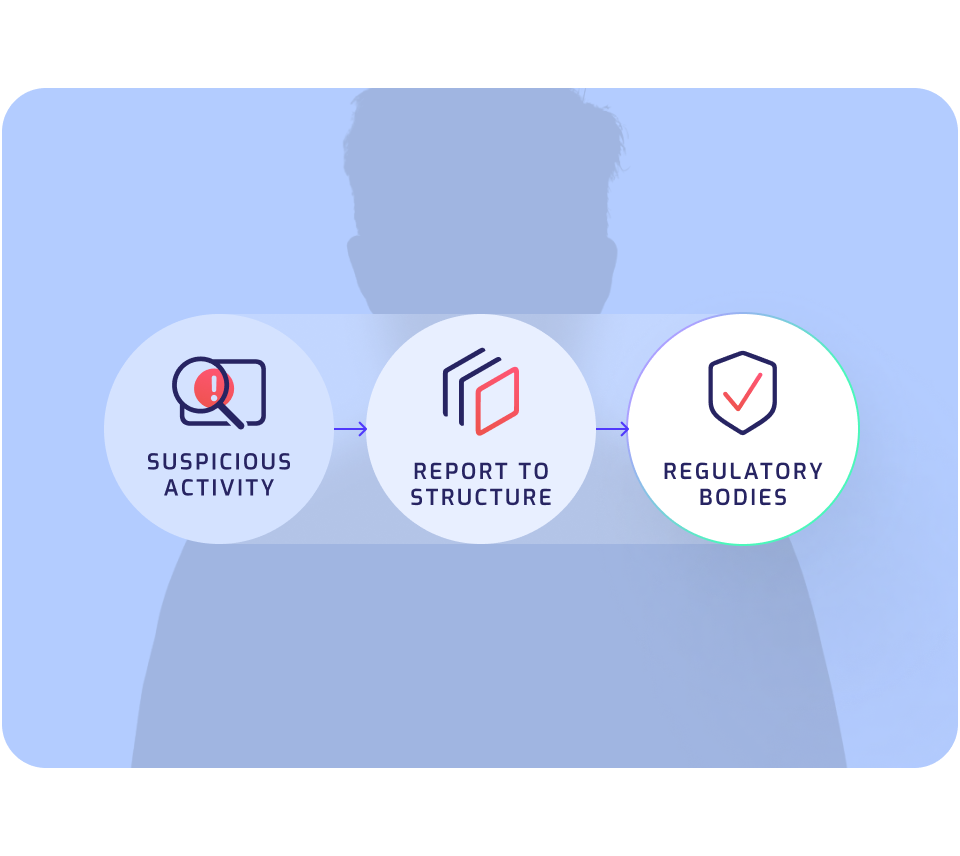

Compliance Reporting Solutions

Achieve effortless compliance with global AML reporting regulations. Generate and file SARs, STRs, and CTRs promptly, minimising financial crime risks and staying ahead of regulatory requirements.

Ongoing Monitoring

Stay ahead of evolving regulations and continuously observe customer activities to detect any suspicious behavior or changes in risk profile over time.

THE ESSENTIAL RISK FACTORS EVALUATE & MITIGATE

Risks vary across regions and industries, our fully-automated, customisable risk assessment journey allows you to evaluate and mitigate risks that are specific to you – powerful flexibility to ensure security and compliance.

Customer Risk

The nature of the customer's business, occupation, source of funds, location, and transaction history.

.Geo-Graphical Risk

Detecting customers from high-risk countries whilst identifying device location, web proxies, and anonymous web browsers.

.Geo-Political Risk

Factors include country risk, sanctions, Politically Exposed Persons (PEPs), and high-risk regions.

.Delivery Channel Risk

The channel used to deliver the financial product or service, including online, mobile, or in-person.

.Product/Service Risk

The type of financial product or service offered the level of complexity and the potential for misuse.

.Industry Risk

Industry-specific risk assessment based on regulations, reputation, and susceptibility to financial crimes.

.customisable models for an unmatched user experience

Obtain detailed customer information with multiple answer types to choose from. Set your own risk parameters and scores for each section of the questionnaire.

Radio Buttons

Drop Down

Paragraph

File Attachments

Text

Float

Integer

Country CSV

Custom CSV

Date

Min-Max

Linear Scale

INDUSTRY-SPECIFIC RISK ASSESSMENT journeys

Shufti Pro also offers pre-made industry-specific risk assessment journeys to ensure you meet KYC and AML compliance effortlessly. Our AI-powered solution optimises security processes, reduces costs and enhances risk management across a plethora of global industries.

Gaming & Gambling

Identify high-risk individuals and minors to prevent access to gambling & gaming platforms and ensure compliance.

Crypto

Prevent financial crime and ensure your business is up-to-date with ever-changing KYC/AML crypto regulations.

Forex

Verify Forex customers and their transactions to evaluate risk levels to prevent financial crime.

FinTech & Banking

In the Fintech/Banking industry, risk assessment is crucial to mitigate customer risks and ensure only legitimate customers and transactions are authorised, in accordance with global watchlists and regulations.

WHY CHOOSE SHUFTI PRO’S RISK ASSESSMENT SERVICE

Case Management

Quickly check your risk assessment history and instantly access your old records in a matter of seconds.

.Reduce False Positive

Reduce false positives and accelerate your compliance process whilst enhancing customer risk.

.Enhanced Security

Ensuring uncompromising data security and privacy for absolute client trust and confidence.

.

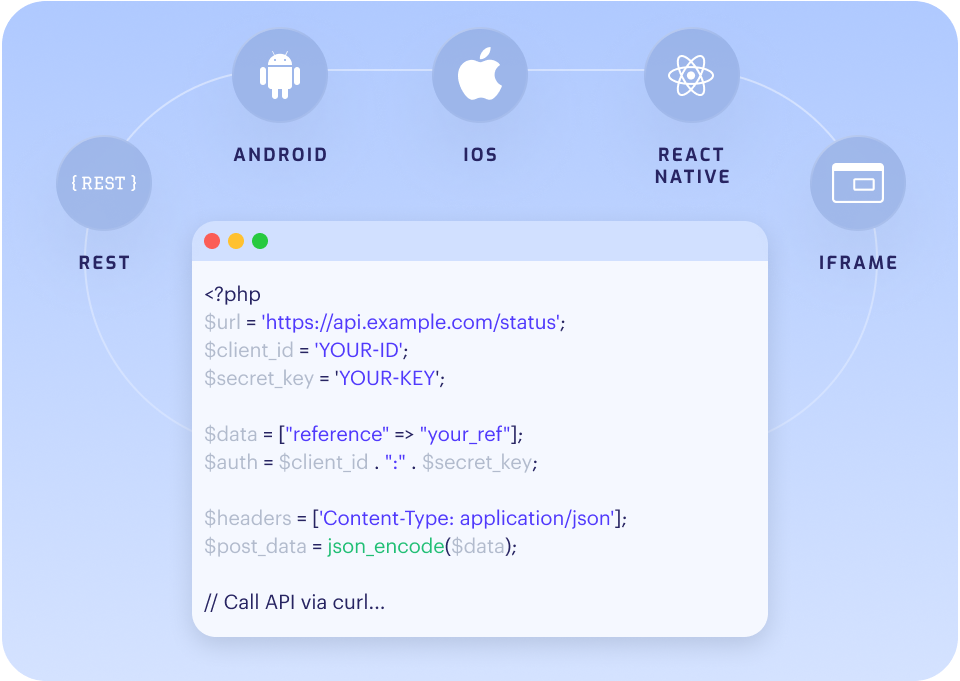

RISK ASSESSMENT Integration: Seamless, Secure, & Swift

Take the next step in digital identity verification. With our Risk Assessment integration, you're not only embracing technology but a promise of excellence, efficiency, and exceptional security.

Our Risk Assessment integration promises:

- Real-time Sync

- Robust Security Protocols

- Dedicated Support

- Flexible Integration Options

- Cross-platform Support

Ensure the Highest Standards of Privacy and Security with Shufti Pro

Shufti Pro keeps in check the international data and cybersecurity guidelines regarding the privacy and security of your customer data.

- DSS COMPLIANT

- GDPR QG

- GDPR