The Role of Biometrics in Combating Money Laundering and Identity Fraud

The fast-paced growth of biometric technology and its widespread adoption in the financial and healthcare sectors has brought monumental changes in AML/CFT measures. Continuous development in biometric technology has made identity verification systems more affordable, reliable, and easily accessible. Therefore, both financial institutions and regulatory authorities opt for biometric systems to enhance the accuracy, speed, and convenience of customer identification.

However, the real-world challenges faced by institutions in different sectors while implementing biometric identity verification systems are not limited.

Banks, insurance firms, and investment companies are all experimenting with biometrics to secure their clients’ accounts against financial crime.

Rising Fraud and Financial Crime

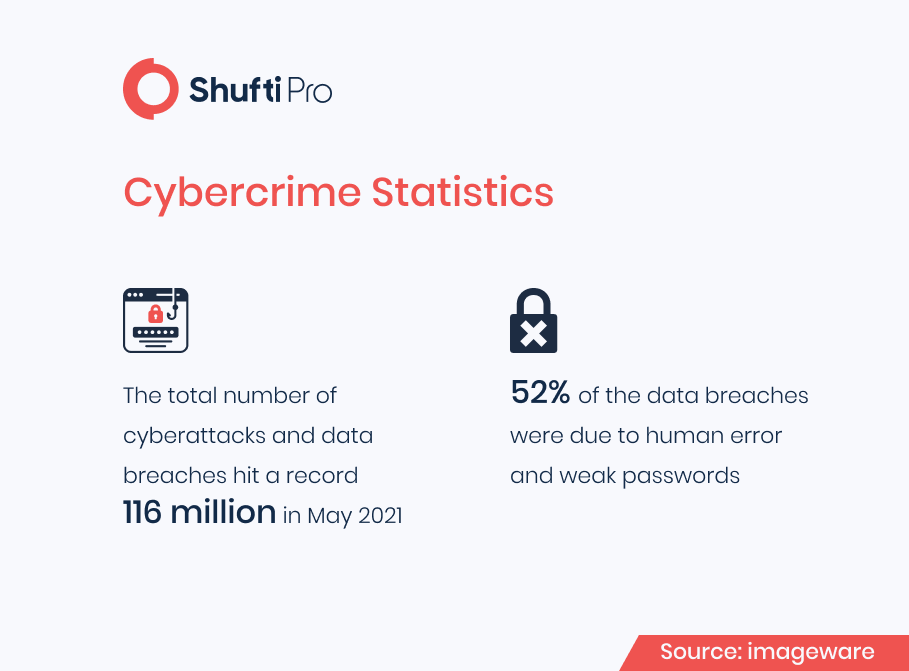

For quite some time now, cyber-attacks and data breaches have become a common issue affecting personal information and in some cases the lives of millions of people. In May 2021, a new record of 116 million cyberattacks was recorded. The majority of the data breaches were because of human error and weak passwords, which means traditional verification measures need to be updated and replaced with biometric authentication.

With the use of customized hardware, sensors, and detectors in mobile phones, organizations can secure their operations and avoid becoming part of financial crimes like money laundering and terrorist financing. Fingerprint detectors, AI-based facial recognition systems, and iris scanners have made biometric verification a popular choice among different sectors, especially when two-factor authentication is incorporated along with facial recognition in online banking platforms. The number of firms incorporating biometric verification is on the rise, but there are a number of aspects to be considered – growth, market size, and market volume.

Money laundering is made possible when there is a certain level of anonymity provided by financial institutions. Money launderers are criminals that are always on the hunt to find new ways to clean their illegally obtained funds through hidden channels. Anonymity in cash transactions leads to a large-scale problem when there is a lack of audit trails, making it harder for financial institutions to find records in events of criminal activities.

Inadequate controls in terms of Know Your Customer (KYC) requirements as well as Anti-money Laundering (AML) compliance lead to an increase in financial crime. In the future, regulatory authorities and financial institutions will need biometric authentication to put an end to money laundering as cash transactions cannot be completely stopped.

Industries that Make the Most of Biometrics

Major banks like JPMorgan Chase, Wells Fargo, and Bank of America are offering biometric verification for logging in to customer bank accounts and online portals. Barclays also handles 65% of its customers’ calls by verifying through biometric authentication. As legacy authentication systems like manual verification and passwords are now becoming obsolete, it’s clear that biometrics is the future.

In various industries and sectors, biometric facial recognition assists in streamlining operations, fighting fraud, and establishing customer trust. Finding the balance between upcoming and existing risks of fraud and financial crime is essential for businesses.

Financial Sector

The financial sector is the first industry that comes to mind when it comes to regulations. The banking sector is actively using the convenience and accuracy of biometric technology by incorporating different modes of verification, including facial recognition, voice recognition, and fingerprint recognition. Banking operations like payments, cash transfers, ATM transactions are all carried out using biometric verification.

Healthcare

The healthcare industry finds numerous benefits with biometric authentication as patients and medical staff can secure the exchange of internal information. Hospitals can verify the identity of personnel from lower to higher levels, and prevent the illegal use of prescriptions for drugs.

Airports & Sports Arenas

Airports and sports arenas also benefit from biometric technology to help in the process of verifying the identity of travelers and fans entering and leaving public places. Airlines and customs departments at airports face a major concern of identity fraud and money laundering due to the lack of robust verification measures. According to recent reports, prominent US airlines are adopting facial recognition to improve their security measures.

Law Enforcement Sector

Federal authorities and the law enforcement sector use different modes of biometric technology for identifying their clients. This includes the analysis of facial features, iris detection, speech, and even DNA matching.

How Does Biometric Authentication Prevent Spoofing and Bypassing?

Biometric authentication checks for the live presence of the customer. In case of stolen identities, the image in the government-issued ID document is verified through a selfie that the user has to submit during verification. Moreover, 3D mapping, skin texture analysis, 3D sensing, and various other techniques help in identifying spoof attacks within seconds. Users are asked to blink, nod, smile, and talk to the verification expert to prevent spoof attacks.

In 2021, we are expecting deep fakes to increase in number, while 2D and 3D masks are not expected to decrease at all.

Artificial Intelligence has made it easier for fraudsters to develop better spoofing measures. However, biometric authentication checks have become sophisticated too. A simple skin color change in a photo will not help criminals to fool authentication checks. Skin texture analysis and self-trained AI models in biometric authentication can detect any facial spoof attacks. Moreover, liveness detection is performed to ensure higher levels of accuracy in the biometric verification checks.

What Shufti Offers

Biometric authentication is one of the best ways to combat identity theft, especially 2D and 3D masks, and deep fakes. Skin texture analysis, 3D mapping, depth sensing, liveness detection, and other techniques enhance the accuracy of biometric authentication. There are two methods that fraudsters use for surpassing biometric authentication checks – spoofing and bypassing. Both these methods use advanced technology and criminals can achieve their illegal goals.

However, facial biometric authentication backed with artificial intelligence can easily prevent spoof attacks. Shufti’s enhanced biometric verification checks deploy thousands of AI models to authenticate identity and verify the live presence of the customer. With 98.67% accuracy, our solutions ensure that your company stays safe from facial spoof attacks.

Want to learn more about biometric identity verification for your financial institution?

Explore Now

Explore Now