Financial Institutions and Prevailing Crimes – How Shufti’s AML Screening Solution can Help

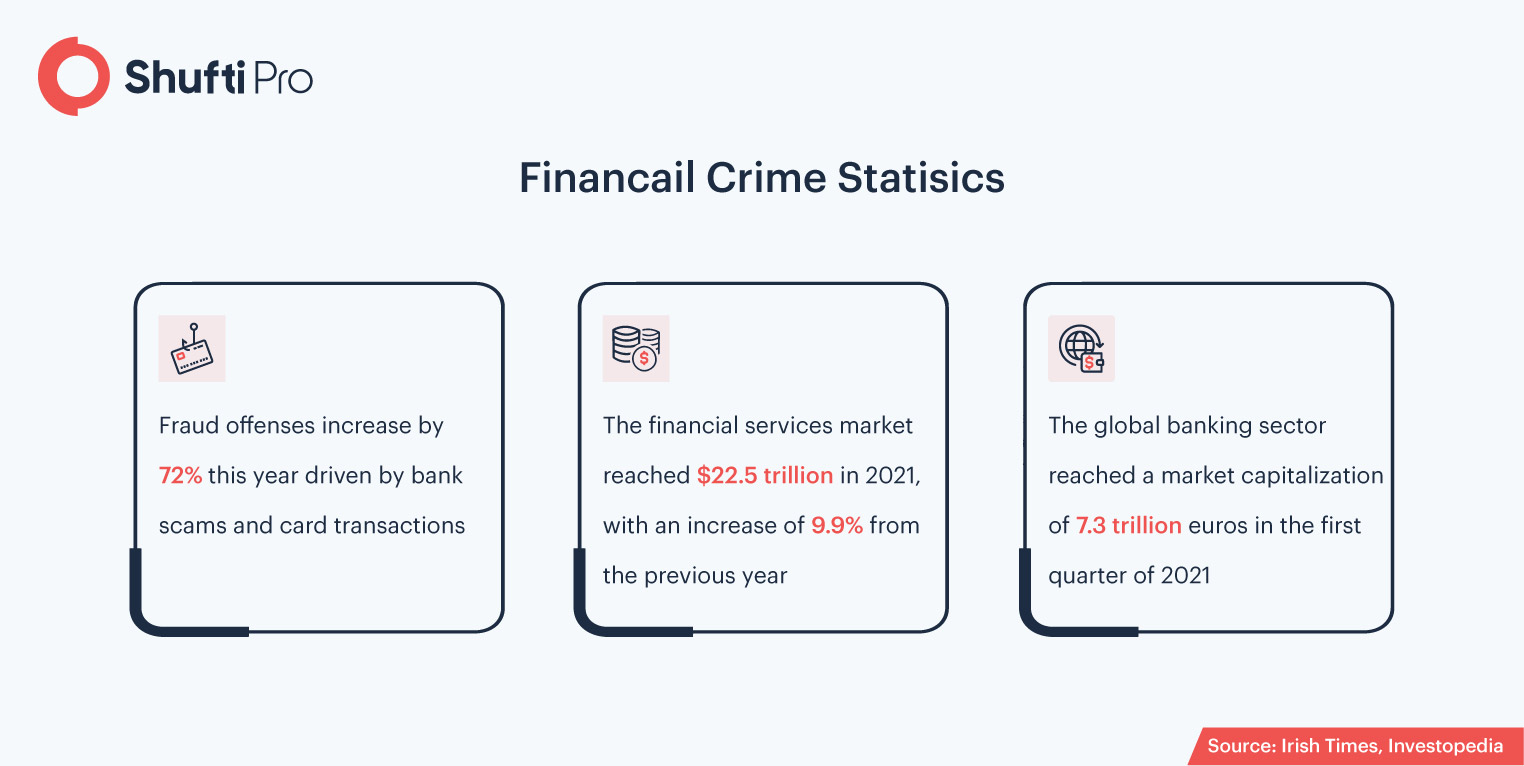

The year 2021 has been a year of two halves, the first businesses and individuals were dealing with coronavirus challenges, and the second half was all about vaccine programs to save lives and get things back to normal. Whereas, on another hand, financial crimes carried on, as pandemic conditions and overreliance on the tech-based tool was in favor of fraudsters. However, as per forecasts, financial crimes are wide-spreading in 2022 as well. Money laundering, terrorist financing, and other crimes are a crucial ongoing challenge for all financial institutions as well as individuals.

Furthermore, as financial firms and regulatory bodies are developing new rigid standards and strategies to halt criminal operations, fraudsters are also coming up with sophisticated methodologies to manipulate banking security systems to commit crimes. Therefore, financial regulations are becoming a global concern, as it is observed that compliance costs $180.9 billion per year.

Financial Institutions and Rising Crimes [2022 Overview]

Financial crimes have become a nightmare for the banking sector and other financial institutions across the globe. While it’s quite hard to determine the costs of crimes as it can include hefty regulatory fines, direct losses, and reputational damage. There is no doubt coping with financial crimes is becoming challenging.

Cybercriminal activities are a growing threat for all financial firms and anti-money laundering remains the central concern, as crime is increasing in size, sophistication, and frequency. Therefore, it’s crystal clear that technology-powered defense systems alone are not sufficient to overcome the crime rates as well as protect financial institutions’ reputation. Other than this, cyber crimes are periodically evolving from being vertically integrated to individualistic and to well-organized distributed operations, where stolen data and identities are traded by financial professionals.

Money laundering activities are also advancing in terms of both technological sophistication and complexity, to the point even financial firms are finding it hard to detect and eliminate the threat of illegal activities. Due to this, financial watchdogs are now increasing pressure on the banking sector to enhance their AML systems. This in turn makes several challenges for financial firms to embrace rigid control systems and render efforts to stay put with the regulatory obligations.

In addition to regulatory pressure, the financial institutions are also experiencing new challenges as new services and products are emerging in the global financial marketplace. For instance, mobile technologies and prepaid cards are becoming new payment options, hence making it easier for customers to make purchases as well as helping criminals to fulfill their money laundering goals. Thus, all financial institutions are in dire need of improving their security systems, including enhancing the data quality they hold to monitor transactions in a well-mannered way, in order to have utmost effective in-house AML systems.

Credit Suisse Alleged for Data Breaches and Money Laundering Activities

According to the Suisse Secrets investigations, Credit Suisse, Switzerland’s largest bank has been alleged for data breaches, dubious customers, and large volumes of illicit money being whitewashed. After this scandal, it’s time for law enforcement authorities to take strict action against financial criminals. Furthermore, anti-graft watchdogs also said in a press release, that the compromised sensitive documents show that the bank had onboarded high-risk customers for years while ignoring the crucial red flags they possessed. This continued even after the bank committed to initiating a crackdown on money laundering activities.

Journalists have also determined multiple legit clients, including Politically Exposed People (PEPs) across the globe. However, Credit Suisse has rejected the allegations and stated that it has taken all the necessary steps against flagged accounts. For instance, the regulatory investigations uncovered that the bank stored $273 million from Venezuelans that were suspected of laundering money from the state oil firm. In addition to this, other investigations also exposed that the bank continued the promotion of secrecy to attract criminals. Particularly, the bank suggested ways to assist African investors, while offering complex business structure and utmost privacy, while keeping identity anonymous, instead of questioning customers to overcome money laundering risk.

Meanwhile, addressing the latest developments, Maíra Martini, an anti-money laundering expert at Transparency International (TI), said: “The Suisse Secrets investigations prove once again that banks cannot be trusted to police themselves. The public is tired of hearing about how banks help corrupt officials from around the world launder their money – and how they will do better next time.

Metro Bank Fined £5,376,000 for Failing Reporting Governance and Controls

The prudential regulation authority (PRA) has imposed a fine of £5,376,000 on Metro Bank plc for failing to act sue skill, care, and diligence in relation to regulatory reporting of capital position and failing for reporting governance control as well as investments with respect to common reporting

Sam Woods, Deputy Governor for Prudential Regulation and Chief Executive Officer of the PRA said: “We expect firms to invest appropriate and adequate resources to ensure that they submit accurate regulatory returns. In this case, Metro Bank failed to meet the standards of governance and controls expected of it, resulting in today’s enforcement action.”

As per regulatory obligations, banks need to submit financial information to PRA, including reports as an essential part of the COREP framework, a reporting mechanism developed to standardize the capital reporting requirements along with prudential regulatory information.

Global Financial Regulations to Secure Banking Sector

Securities Financing Transaction Regulation (SFTR)

The European Union has legislated the Securities Financing Transaction Regulation (SFTR) with an aim of increasing transparency in the financial markets following regulations provided by the Financial Stability Board in the wake of the financial crisis in 2008. Although the EU is the first to enforce these sets of rules and policies in the financial space, its expected other financial watchdogs will follow similar steps.

Following are the key aspects on which SFT regulation must be applied;

- Repurchase Agreements

- Securities Borrowing & Lending (“SBL”) including Commodities Lending

- Buy-Sell Back or sell-buy back transactions

- Margin Lending (in a Prime Finance context)

Thus, it’s mandatory for the financial industry to stay put with SFT regulations, to do so they are heavily investing to meet the requirements. Crucial key aspects of focus is to ensure all the entities in the financial market have a Legal Entity Identifier (LEI) code and that all transactions are assigned a Unique Trade Identifier (UTI) which must be verified by both parties before submission.

Central Securities Depositories (CSDs)

Following the financial crisis in 2008, the European Commission introduced Central Securities Depositories (CSDs), which ensures that financial firms implement a vital post-trade process of securities settlement, along with maintaining records of securities accounts and transactions. It also came up with the objective of harmonizing the financial institutions’ practice, enhancing security measures, and making transaction settlements seamless.

Qualified Financial Contract (QFC) Stay Rules

The United States Banking Agencies have introduced the final Qualified Financial Contract (QFC) Resolution Stay Regulations that are systematically legislated to enhance the resolvability and resilience of US global systemically important organizations (“G-SIBs”) and the US operations of foreign G-SIBs by mitigating the risk of destabilizing closeouts of QFCs upon an event of a G-SIBs insolvency.

Under the US QFC Stay Rules, a wide variety of financial transactions are defined without limitation;

- swaps and other derivatives; repo and reverse repo transactions; securities lending and borrowing

- contracts for the purchase and sale of securities, mortgage loans, commodity contracts, master agreements for any of the foregoing transactions, and guarantees of or credit enhancements related to the foregoing

How Shufti Can Help

Shufti’s state-of-the-art anti-money laundering screening services are an optimum solution for financial institutions, as it allows them to carry out enhanced due diligence procedures along with ongoing customer monitoring. Powered with thousands of AI algorithms, Shufti’s background screening services authenticate customers against 1700+ global watchlists in less than a second with 98.67% accuracy to create client risk profiles. In addition to this, it also enables banks to stay put with the ever-evolving regulatory regime. Hence, making financial operations secure and risk-free.

Get in touch with the experts to know more about AML for financial institutions.

![Insights Into Austria’s Biometric KYC Onboarding [2022 Updates] Insights Into Austria’s Biometric KYC Onboarding [2022 Updates]](https://shuftipro.com/wp-content/uploads/b-img-austria.png)

![A Comprehensive Guide to AML Compliance [2020] A Comprehensive Guide to AML Compliance [2020]](https://shuftipro.com/wp-content/uploads/AML-Compliance-2.jpg)