Rising Concerns of Money Laundering and the Role of Global Financial Sanctions

Since 9/11, money laundering has become a global issue that has raised alarms for financial watchdogs. It has also been found in the investigation that the majority of terrorist groups are carrying out money laundering to get involved in heinous crimes in different parts of the world. All the major jurisdictions, along with global financial regulators, are working tirelessly to monitor and control money laundering, but it is still prevailing in the system, asking for more stringent measures.

The World Bank estimates that money laundering costs 3% to 5% of global GDP annually, which is approximately 2.17 to 3.61 trillion. The Financial Action Task Force (FATF), European Union (EU), and Interpol are the leading regulatory authorities overlooking money laundering while forming the framework for member countries to impose and eliminate criminals. Recently, FATF has imposed financial sanctions on different countries, including Russia, UAE, and Sudan by adding these countries to the grey list for not complying with global Anti-Money Laundering (AML) standards.

Threats of Money Laundering – An Overview [2022]

Although technology has become quite advanced to counter bad actors, they are also using sophisticated techniques to cheat the system. Almost all sectors, including banks, real estate, insurance, art & antiquities, and health, are equally exposed to the threats of money laundering. Although banks and insurance companies have imposed stringent AML regulations, which have halted the crimes to some extent, most sectors have not found suitable solutions, eventually leading to an increased crime rate.

On a global scale, money laundering is rising and investigations have revealed that banned organizations are also involved in it to carry out terrorism in the world. The Philippines, Dubai, Malta, Russia, and Sudan are the major countries contributing a lot to financial crimes. FATF has imposed sanctions on them by putting these states on the grey list. Once any country is put on this list, FATF gives them a comprehensive roadmap and guidelines to follow, which must be implemented in order to make it out of the list; failing to do so can result in the country falling on the blacklist. The year 2022 has witnessed landmark efforts by global financial organizations to curb money laundering. Many countries including Russia and Dubai, have been sanctioned for not following the AML protocols.

High Profile Cases of Money Laundering

FATF is the primary body responsible for overlooking financial crimes, particularly money laundering and terrorist financing in the whole system. Observing the prevailing cases in the member-state and their efforts to counter criminals, it decides the status of the particular country. In recent times, several major money laundering cases surfaced on a global scale leading the authorities to put responsible countries on the grey list until they form a regulatory framework against criminals. Let’s have a look at some of the recent criminal cases in these two countries:

$820 Million Money Laundered from Russia to UK

Transparency International has revealed that an amount of $820 million has been laundered from Russia to British companies. The investigations have found that criminals were trying to disguise black money under machinery sales. Several companies in England are involved in this scam and law enforcement authorities are making raids to arrest criminals finding out more transactions related to the fraud scheme.

UAE Imposes $11.2 Million in Penalties for Anti-Money Laundering Cases

UAE has been added to the grey list by FATF for not curbing money laundering from the country and providing safe havens to criminals. In the wake of this action, it has taken strict action against companies involved in this heinous crime. Law enforcement authorities have found a large number of such individuals and businesses involved in money laundering and imposed penalties of $11.2 million so far.

Global Financial Sanctions Curbing Money Laundering

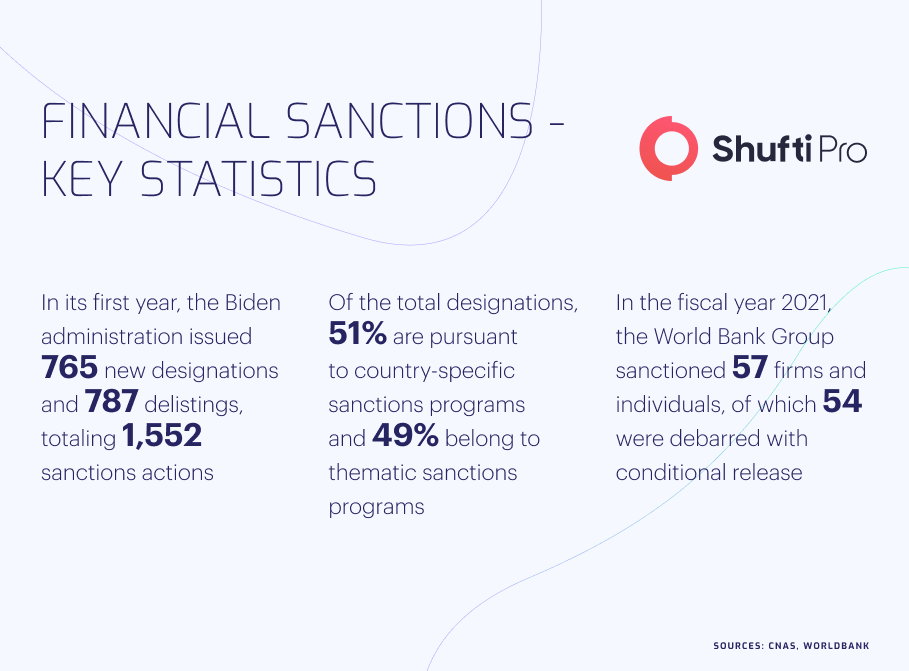

FATF has proposed a system of financial sanctions for all such countries not complying with the global AML standards. In the wake of this, several countries have been sanctioned this year, and let’s have a look at the statuses of some of the affected countries:

Sanctions Imposed on Russia

The Financial Action Task Force (FATF) has expressed its grave concerns over rising cases of money laundering in Russia and its invasion of Ukraine. It has been termed by the financial watchdogs that attacks on Ukraine are not only disturbing the global world order, but it has severe impacts on the economic system. It has overall increased money laundering and terrorist financing cases in both of these countries. FATF has further noted that after the attack Russian government is not complying with the global AML/CFT standards, which has encouraged the criminals to take advantage of the situation and carry out heinous crimes. All member-states have been instructed to remain vigilant to counter money launderers and terrorist financiers emerging from Russia while protecting the international economic system. Based on all these figures, FATF has placed Russia on the grey list and issued detailed guidelines for complying with the AML/CFT standards; otherwise, it could lead to severe consequences.

FATF’s New Sanctions on UAE

UAE is one of the countries thought to be the safe haven for money launderers, which urged the FATF to take firm action against it. Earlier this year, the financial watchdog added the UAE to its grey list due to increasing money laundering and terrorist financing. UAE is one of the leading economies in the global arena but not corresponding with the international standards of anti-money laundering, which has led the agencies to take a strict stance against it by imposing sanctions.

Ensuring Compliance and Avoiding Sanctions Through AML Measures

The global regulatory authorities are working tirelessly to eradicate money laundering from the economic system while making the whole system safe for sophisticated users. Interpol, FATF, and the European Union have collected huge data on money launderers in the form of several sanctions lists which all the countries must consult to track down the criminals while bringing them under the law. Not only the data but all the global financial watchdogs have also issued regulatory frameworks for countries to follow, which can help them in mitigating risks of money laundering and terrorist financing.

How Shufti Can Help

Eradicating financial crimes, particularly money laundering and terrorist financing, is quite crucial for all countries, which can ultimately help them in reducing the risks of global sanctions. Money launderers will always keep on exploiting the loopholes in the system so it is the right time for countries to invest in AML solutions and make their country responsible states.

Shufti’s AML/CFT solutions are the most viable solutions for incorporating anti-money laundering measures in the financial system. Having access to 1700+ global financial watchlists, it screens users’ against them to identify criminals and reports them to law enforcement authorities. Shufti’s AML/CFT solution is efficient enough to provide output in seconds with ~99% accuracy.

Want to get more information about AML screening solutions for countries?