Real Time KYC & AML Solution For Eritrea

Offering KYC for Eritrea. Now Verify Identity & Know Your Customer in Seconds. Simply paste a few lines of code in your website or app, and integrate swift, bank-level identity verification system.

Shufti Pro

offers services

in

30

Seconds

in

230+

Countries & Territories

in

150+

Languages

The Fastest Online Identity Verification Service, Shufti Pro, is Proud to Offer KYC Services in Eritrea

Documents We Verify

Shufti Pro gives you all the tools to verify and onboard new users faster with real-time KYC for Eritrea.

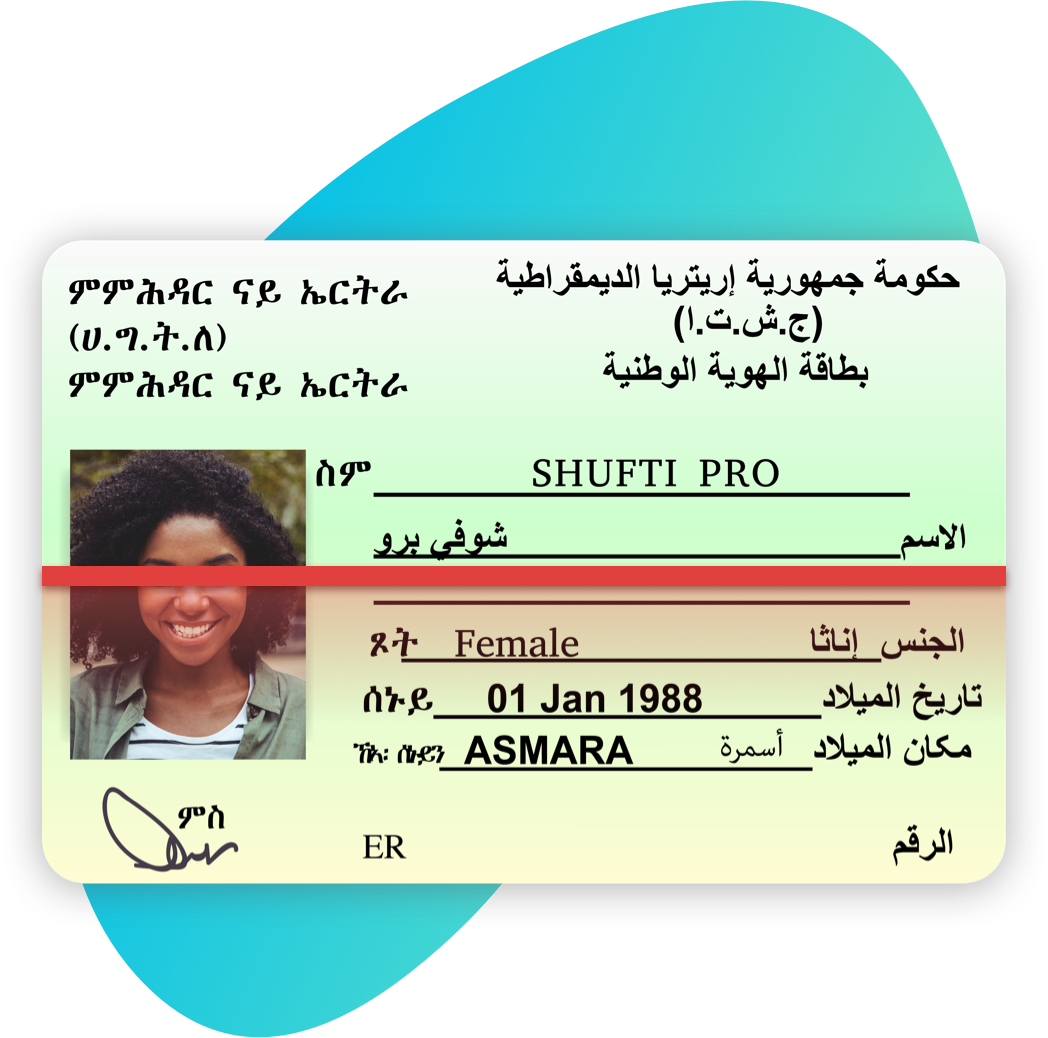

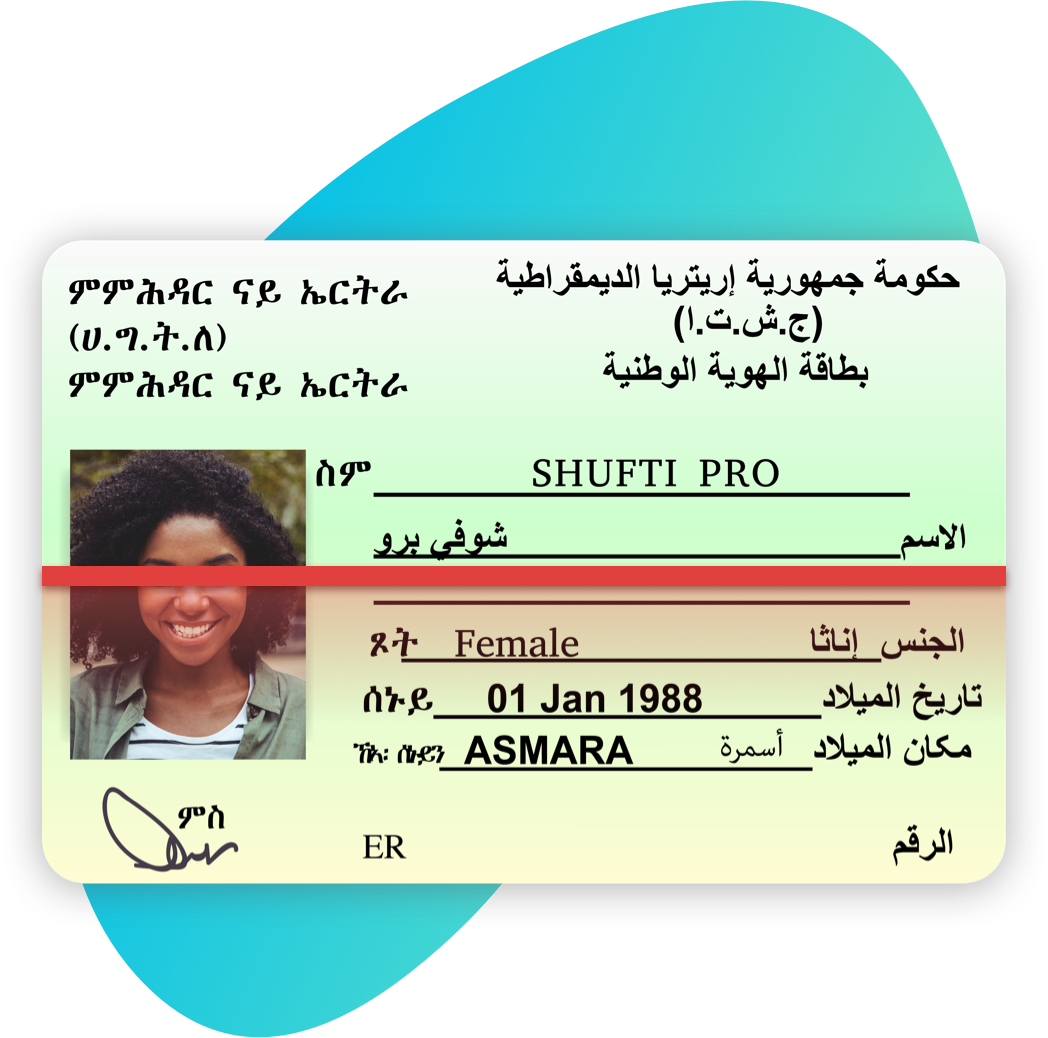

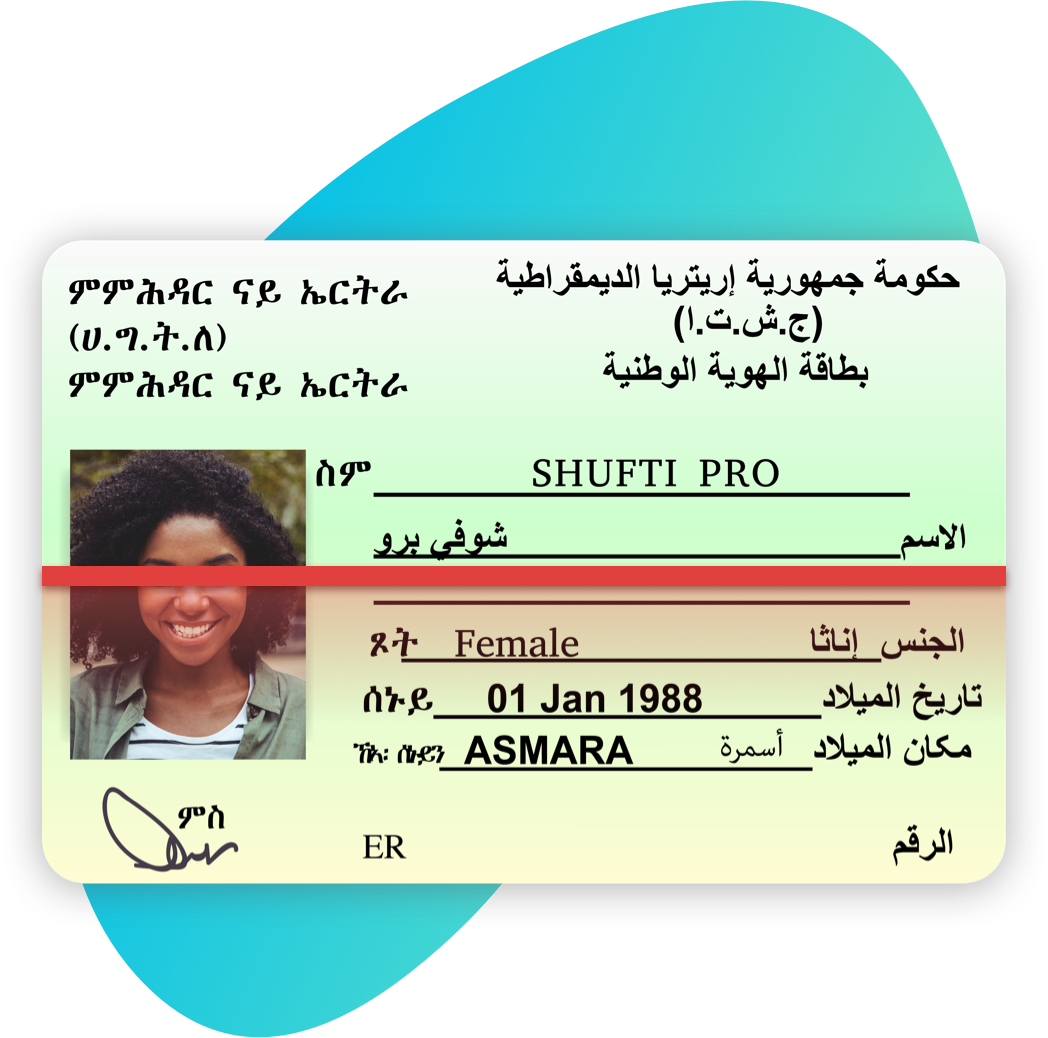

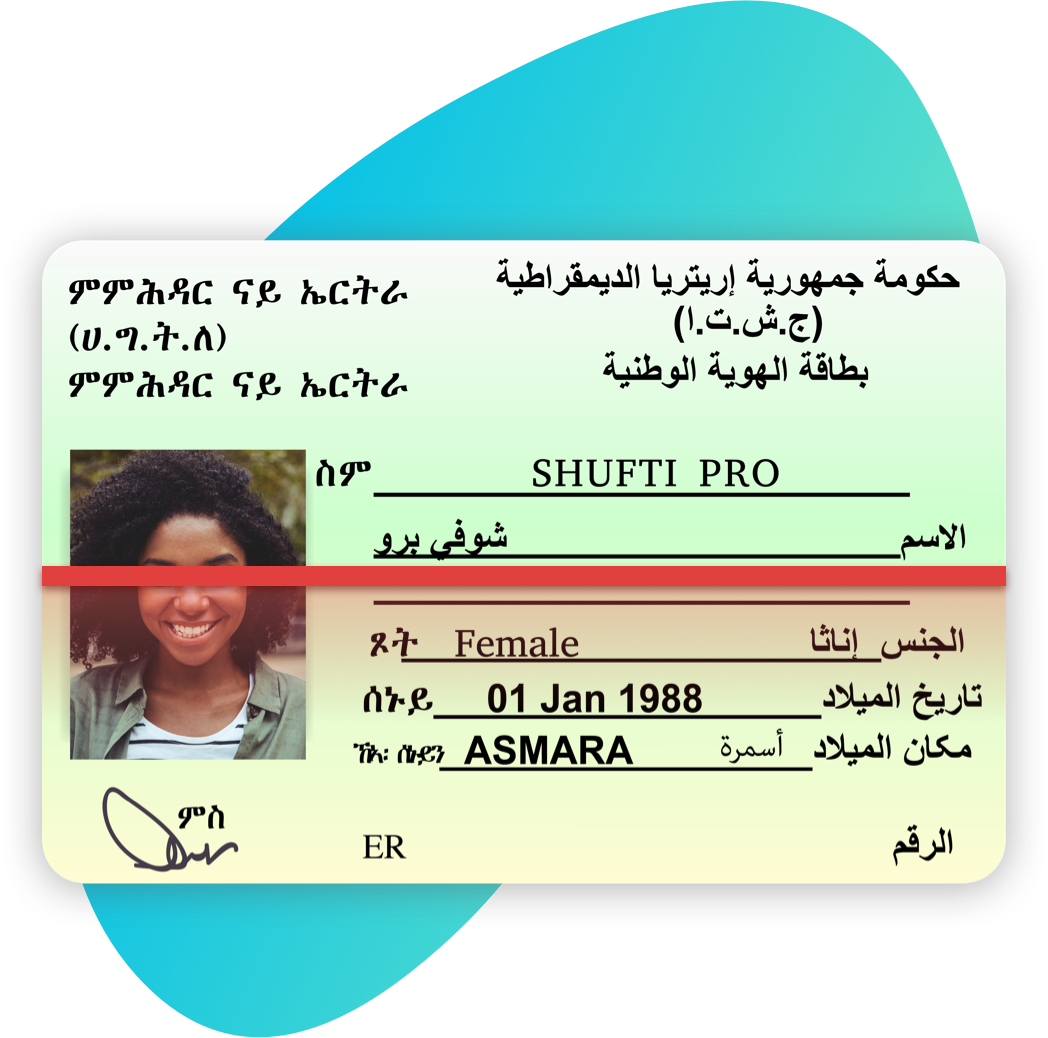

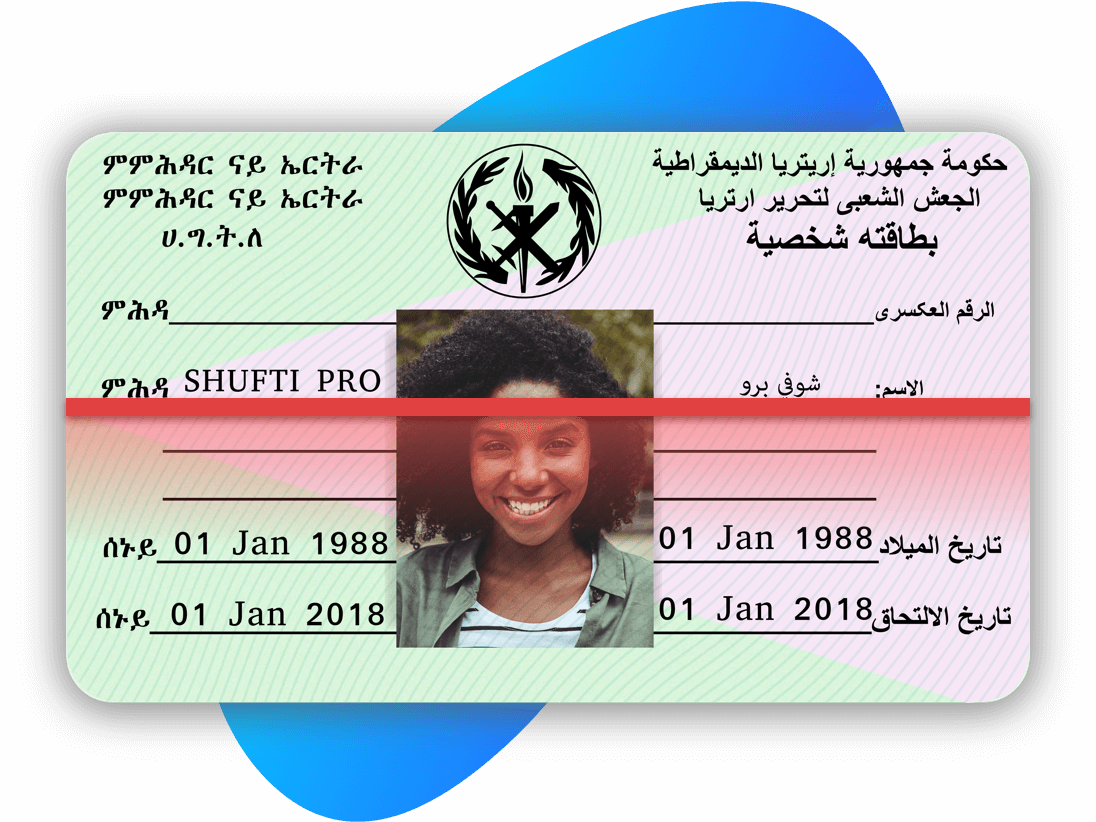

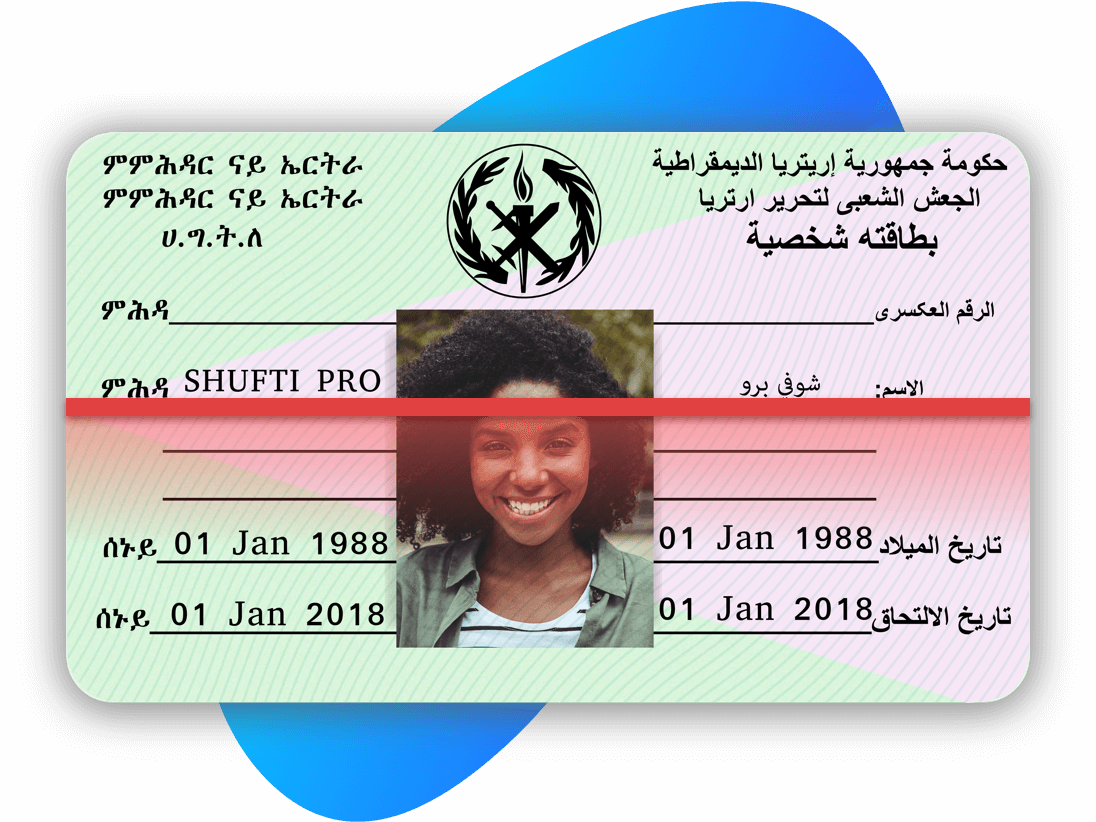

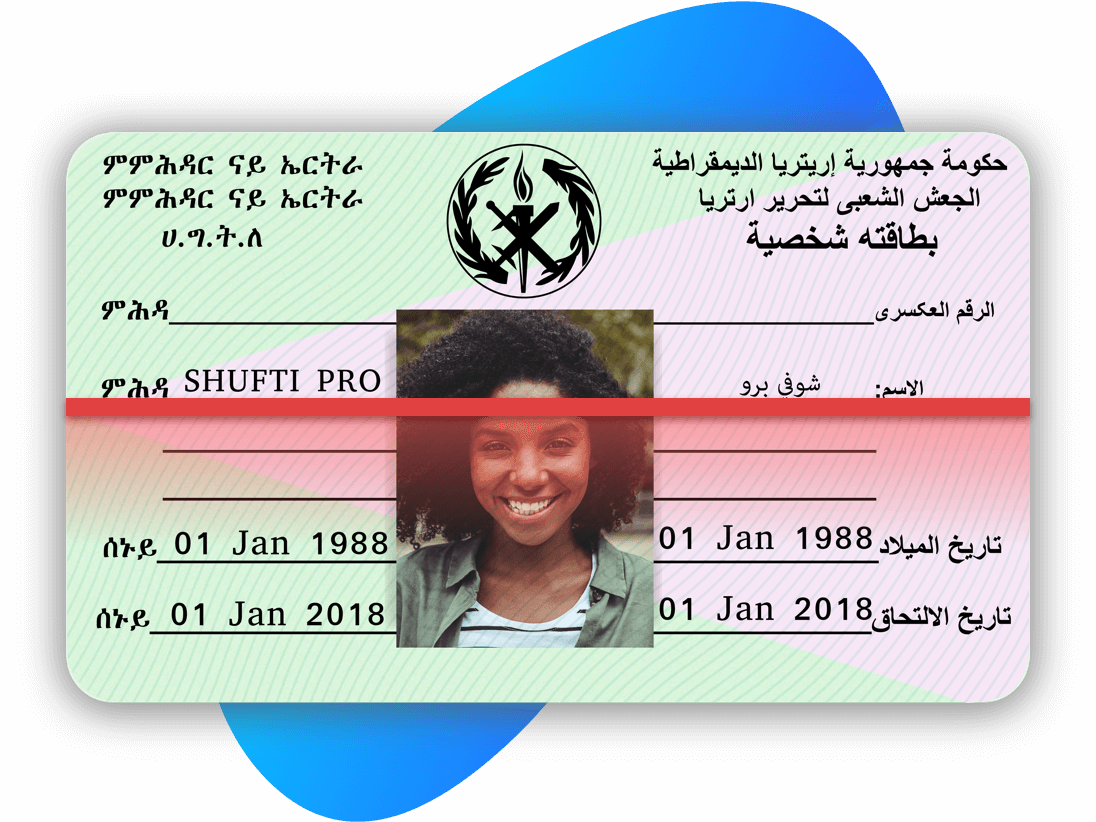

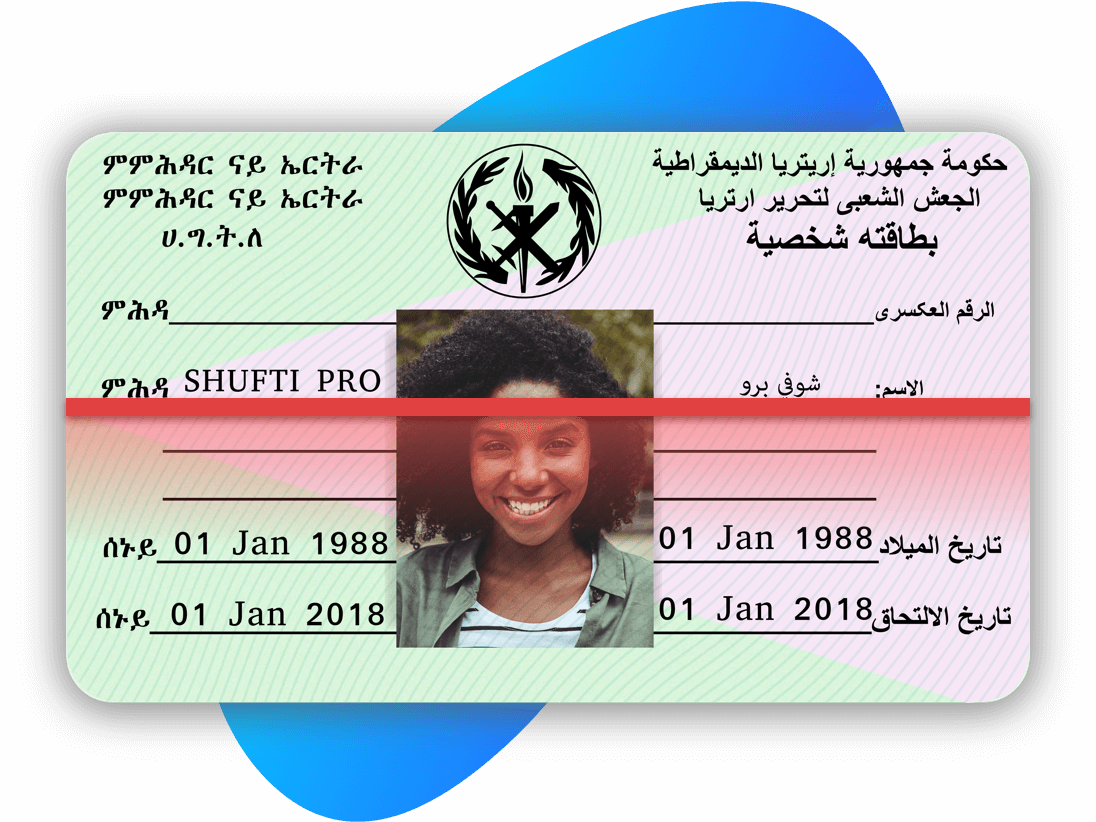

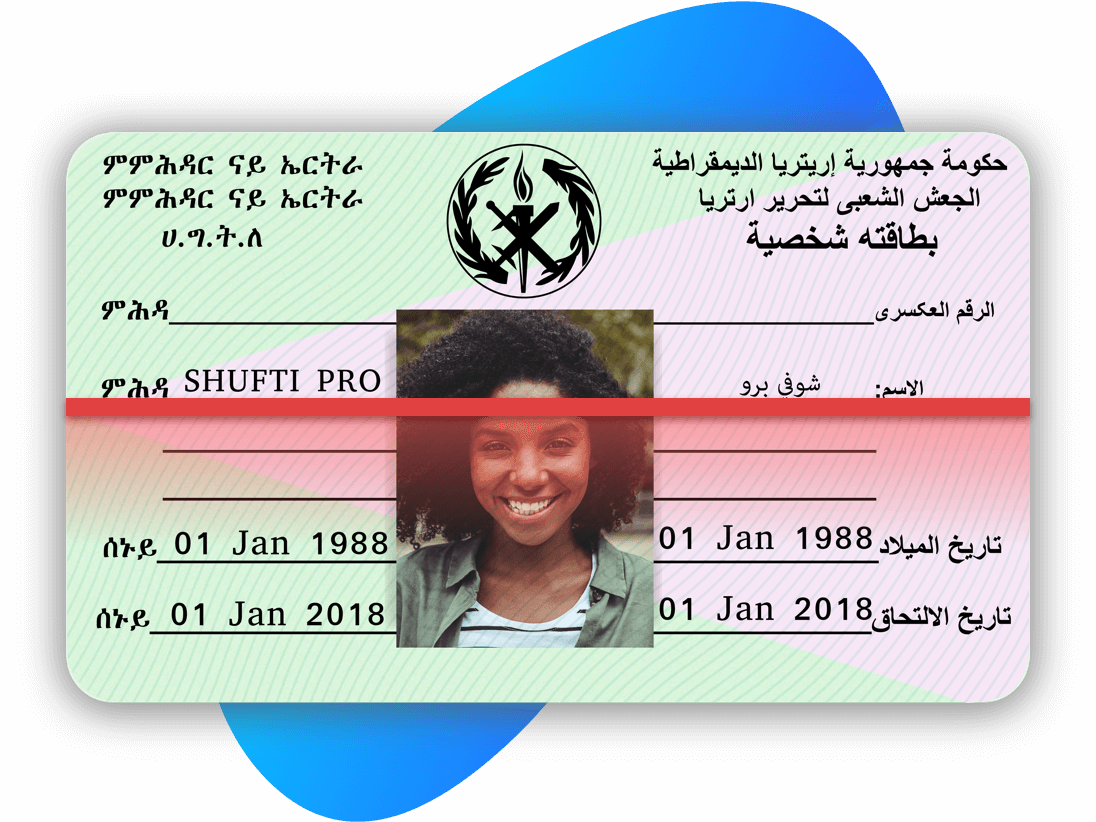

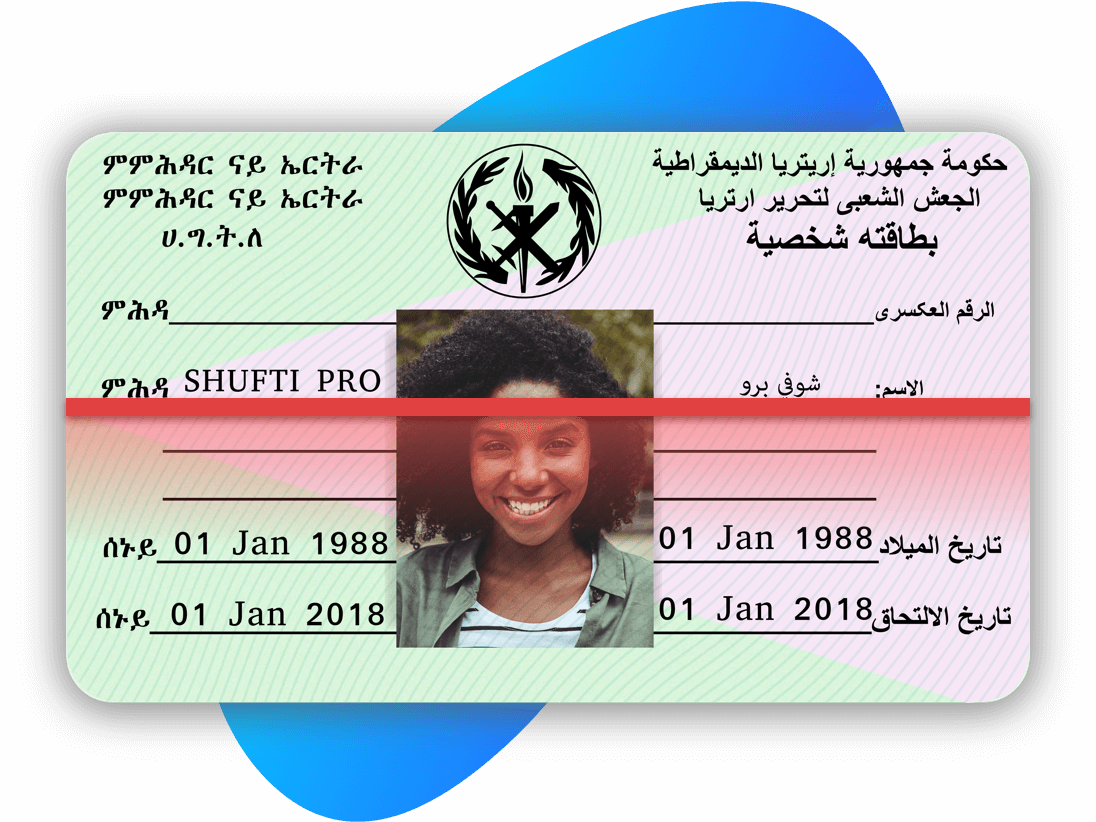

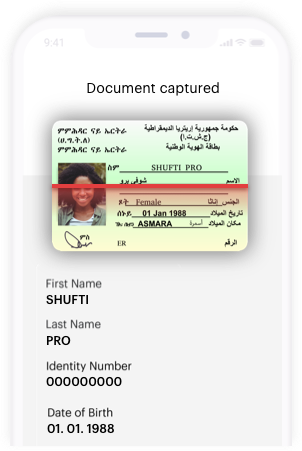

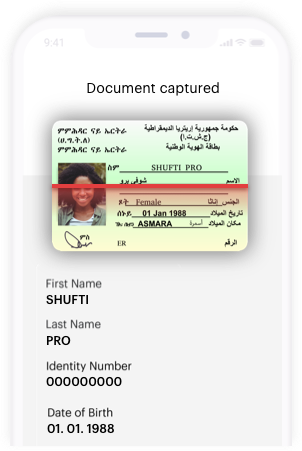

National Identity Card

ID Cards issued by Ministry of Internal Affairs are the primary source of identification in Eritrea.

Shufti Pro scans your customers’ ID cards and authenticates them down to the last pixel.

For ID Card Verification, Shufti Pro:

- Checks for accuracy of format

- Detects crumpled / folded edges

- Checks photoshopped / tampered / forged cards

- Verifies hologram / rainbow print

- Detects blurriness / exposure

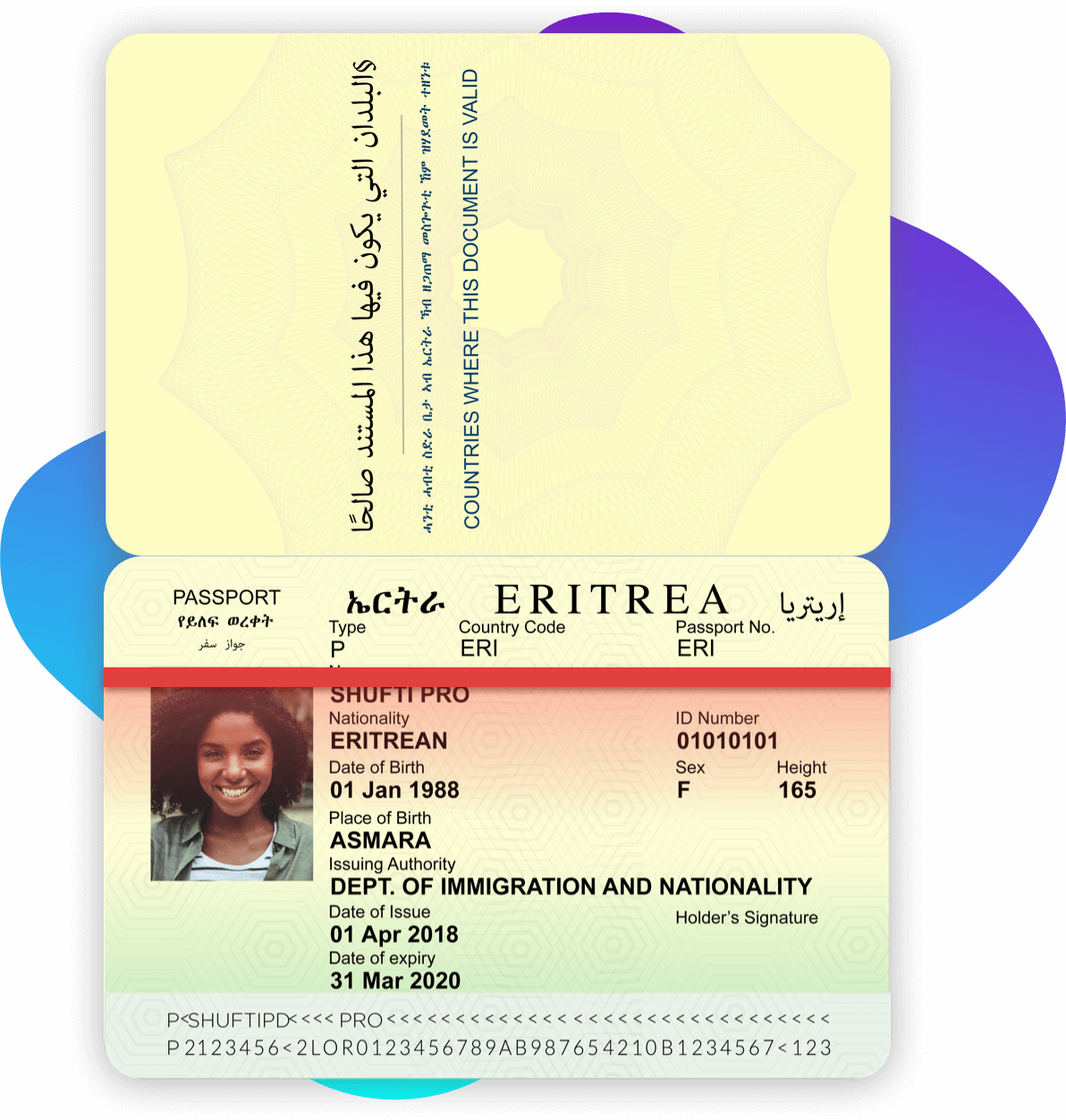

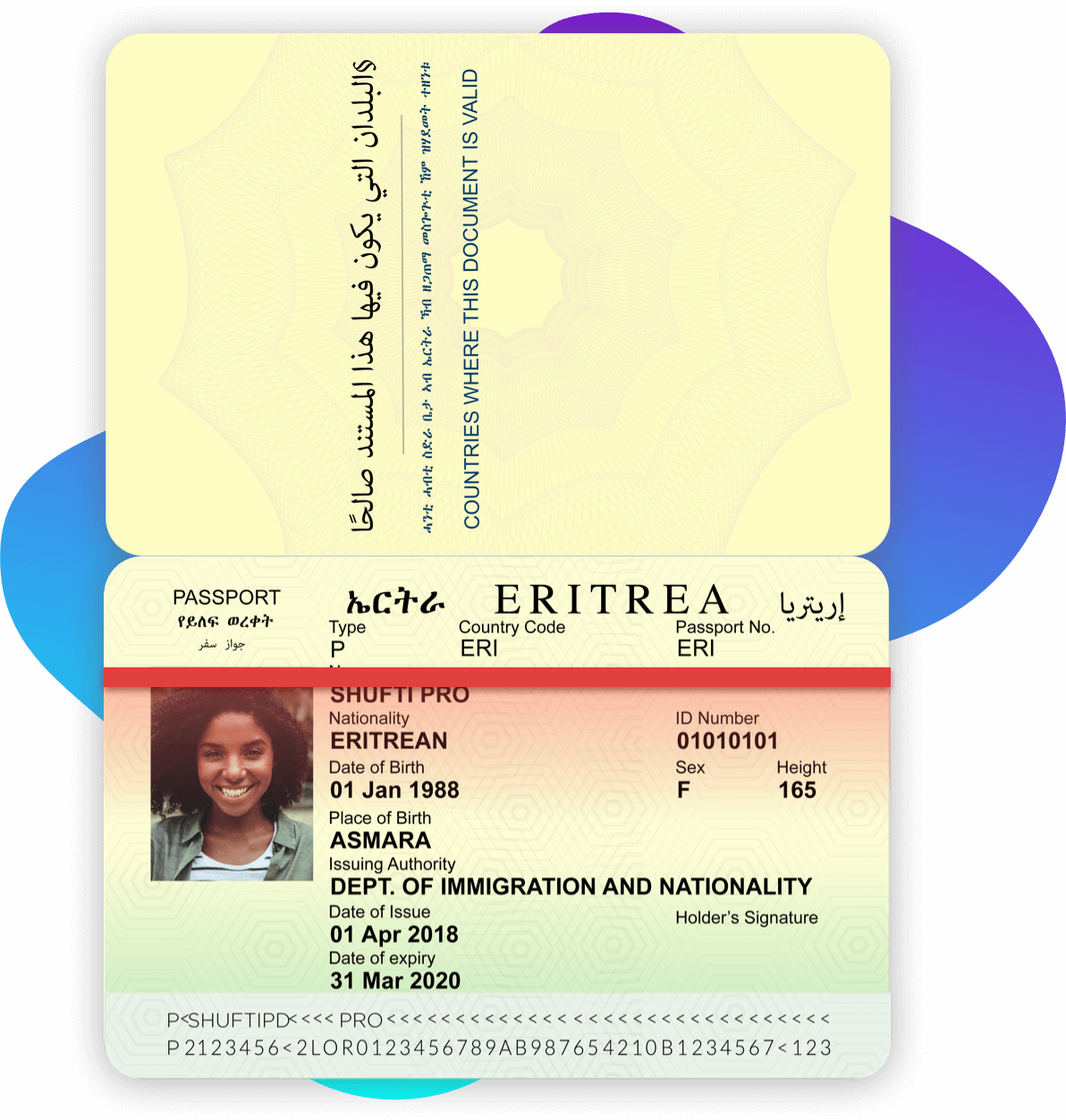

Passport

We offer KYC for Eritrea through passports as well. We verify Eritrean Passports issued by the Ministry of Internal Affairs. Businesses can use it for CDD in Eritrea by verifying the nationality, name, and DOB of customers.

For Passport Verification, Shufti Pro:

- Matches name, DOB and expiry date with MRZ

- Detects fakeness through font, holograms

- Checks for accuracy of format

- Detects crumpled / folded edges

- Identifies photoshopped / tampered / forged image

- Verifies hologram / rainbow print

- Checks blurriness / exposure

Driving License

We check the originality of a driving license issued by Land Transport Authority and verify licenses of all 6 provinces of Eritrea.

For Driving License Verification, Shufti Pro:

- Checks for accuracy of format

- Detects crumpled / folded edges

- Checks photoshopped / tampered / forged cards

- Verifies hologram / rainbow print

- Detects blurriness / exposure

Credit / Debit Card

Shufti Pro verifies credit/debit cards to help you digitise your business, reduce manual labor, prevent fraud and charge-back, and increase conversions.

For Credit/Debit Card Verification, ShuftiPro:

- Validates name

- Validates expiration / issue date

- Validates card number

- Checks for accuracy of format

- Checks photoshopped / tampered / forged cards

- Verifies hologram / rainbow print

- Detects blurriness / exposure

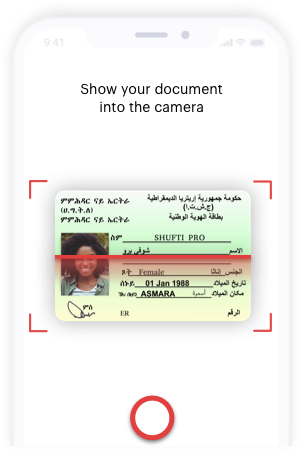

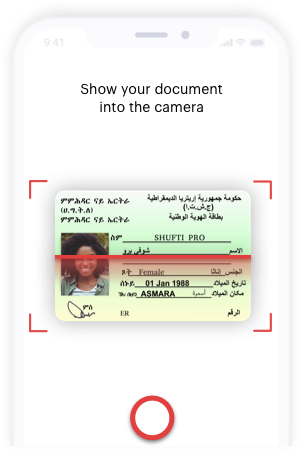

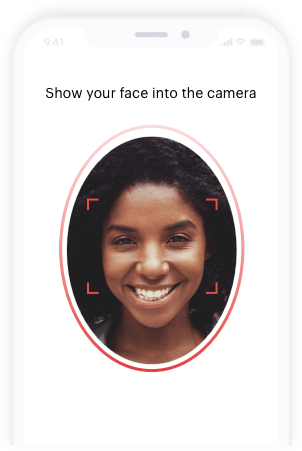

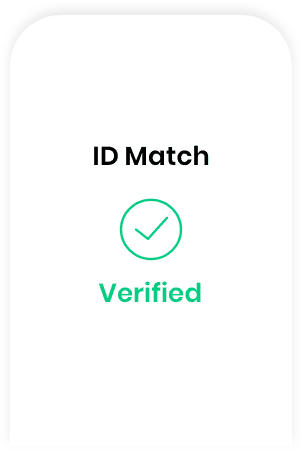

How Our Identity System Works

Document Verification

Data Extraction

Face Verification

Verification Status

We deliver advanced

KYC and AML Solutions for Eritrea

Online monetary transactions are associated with a high risk of cybersecurity threats. With the combination of six distinct ID Verification Services, we help make your digitization process frictionless and risk-free.

Facial

Verification

Next-generation facial recognition – the real-time solution for remote authentication for businesses across Eritrea.

Document

Verification

Document authentication across 6 divisions to help with KYC in Eritrea and to avoid Identity Theft online.

Address

Verification

Address Verification service to protect your business from false deliveries and invalid customer locations. Shufti Pro helps prevent chargebacks and frauds.

2FA

Authentication

Easy and frictionless customer onboarding through 2 factor-authentication, with accurate verification of end-users through their mobile phones.

Consent

Verification

Verify your customers and their transactions in real-time with biometric consent; authenticate with Selfie Verification along with a Unique Message such as printed or handwritten document.

AML

Screening

AML services for Eritrean banks and businesses to identify high-risk clients. Improve client onboarding with faster PEP screening and real-time sanction list monitoring.

Verify Eritrean Documents in Real-Time

Many online services shy away from Optical Character Recognition (OCR) of Arabic, Tigrinya and Tigre language because of complexity in extracting characters.

Shufti Pro Offers OCR for Arabic, Tigrinya, and Tigre Language with 98.67% Accuracy

Truly Global

Identity Verification

We work with all major industries. Learn More About Our Use Cases

Banks

E-commerce

E-Payments

Ride Sharing

Online Service

Providers

Automated AML for Businesses

Shufti pro’s AML services for Eritrean businesses help identify high-risk clients, improve client onboarding with faster PEP screening, and real-time sanction list monitoring.

Shufti Pro uses FATF, EU, OFAC, HMT, Interpol, and other relevant watch lists in the provision of its AML services. Screening is done via our API utilizing global watch-lists and our AML source data is updated every 15 minutes.

Customer Due Diligence in Eritrea

Eritrea is not a member of FATF. FATF promotes efficient measures for combating money laundering, terrorist funding and other threats to the integrity of the international financial system. Its global standards are applicable to organizations operating in all member and non-member countries.

Realizing this, Shufti Pro has expanded its operations to Eritrean banks, and financial and non-financial businesses to strengthen trustful business relationships.