Blog

Fighting Deepfakes with Fool-Proofed Identity Verification Systems: How Shufti Can Help

Undoubtedly, 21st century is the most innovative time period in human history. With every passing...

Explore More

Explore More

Blog

A Brief Insight into the AML and CFT Framework of Thailand

Thailand has become quite a popular and well-reputed financial hub, attracting investors worldwid...

Explore More

Explore More

Anti Money Laundering, Blog, Business Technology, Identity & KYC

Customer Due Diligence: From KYC to KYB

Why CDD is significant for both Know Your Customer and Know your Business verification?

Banking i...

Explore More

Explore More

Blog

Identification, Verification and Authentication – Cut from the same cloth

The modern era of technology has brought so many frauds to light. The digitized world has urged b...

Explore More

Explore More

Blog

Strong Customer Authentication (SCA) – Factors, Methods, and Benefits

In Europe, new customer authentication requirements for online payments were introduced on Septem...

Explore More

Explore More

Blog

5 AI-Powered Products to Boost Digital Experiences Post Covid

If there’s one thing financial institutions understood within the first year of global shutdowns ...

Explore More

Explore More

Blog

Identity verification for fair and free US elections amid COVID-19

US Elections 2020 is the talk of the town these days. But with COVID-19 pandemic going on how wil...

Explore More

Explore More

Blog

Augmented Intelligence – What 2019 have for AI systems?

Admittedly, Artificial Intelligence or AI has gained a considerable amount of ill reputation from...

Explore More

Explore More

Blog

How Identity Verification Eliminates Social Media Scams to Enhance User Experience

Social media has experienced exceptional growth in the past decade as a result of advancements in...

Explore More

Explore More

Blog

The Importance of KYC Remediation to Prevent Financial Crimes

If we talk about financial institutions including banks and their processes, one can freely argue...

Explore More

Explore More

Blog

The Complete Guide | Transaction Monitoring for Financial Institutions

With technological advancement, financial criminals have also been given a wider range of tools a...

Explore More

Explore More

Blog

Risk Assessment – Building Trust in Financial Institutions

For financial institutions to hold onto their customers, they must build and conserve advanced le...

Explore More

Explore More

Biometric Technology, Blog

Online Facial Recognition Could Drive a New Wave of Digital Transparency

Online facial recognition is a much less explored territory when it comes to online identity veri...

Explore More

Explore More

Blog

5 Ways How AI Is Uprooting Recruitment Industry

Artificial Intelligence is strengthening its position in many industries and the recruitment indu...

Explore More

Explore More

Blog

Which KYC Solution is Right for Your Business?

KYC solutions are vital for assessing consumer risk and a legal necessity for complying with Anti...

Explore More

Explore More

Blog

Online Payment Fraud and the Role of AML Transaction Monitoring

Imposing travel restrictions worldwide after the COVID-19 pandemic led to an unprecedented surge ...

Explore More

Explore More

Blog

AML Verification Services: Fighting Back Financial Crimes in 2023

The Covid-19 outbreak has increased reliance on eCommerce and digital banking — cultivating a lus...

Explore More

Explore More

Blog

The UK, US & Singapore – A Spotlight on the Crypto Regulations

Non-compliance with anti-money laundering regulations has been an issue for the finance and crypt...

Explore More

Explore More

Blog

Money Laundering in the Metaverse – NFTs, DeFi, and the Role of Shufti’s AML Solutions

For more than a decade, the metaverse concept has been picking up pace, and the world is preparin...

Explore More

Explore More

Blog, Financial Crime / AML

AML Screening in the light of Compliance Regimes Around the Globe

AML compliance is inevitable for all types of businesses around the globe. The regulatory complia...

Explore More

Explore More

Blog

Analyzing and Balancing the Variables of an Effective Identity Verification Solution

Today’s constantly transforming digital landscape where technology empowers businesses fast-paced...

Explore More

Explore More

Blog, Identity & KYC, Online Marketplace

Why 2 Factor Authentication is vital for Online Identity Risk Management?

Online identity risk management is becoming harder and harder on cyberspace. It is a headache for...

Explore More

Explore More

Blog

NFTs and Surging Crimes – How Shufti’s AML/KYC Solution Can Secure The Digital Ecosystem

Non-Fungible Tokens (NFTs) are by far one of the most popular topics right now. Artist Mike Winke...

Explore More

Explore More

Blog

COVID-19 Pandemic – What it holds for businesses?

The year of the Rat, 2020, didn’t get a propitious start because of the deadly coronavirus outbre...

Explore More

Explore More

Blog, Online Marketplace

Secure Online Gaming with Digital KYC

Here is a scenario that shows the importance of having a digital KYC system integrated with your ...

Explore More

Explore More

Blog

The Relentless Rise of Fraud in the FinTech Industry – How CDD Helps

Fraud has always been on the rise ever since the advent of the FinTech industry. As perpetrators ...

Explore More

Explore More

Blog

Third-party Due Diligence – Red Flags, Regulations and 5 Ways to Enhance It

The majority of businesses depend upon a third-party in one way or the other. Contractors, suppli...

Explore More

Explore More

Blog

AML and KYC Compliance – Big Data Optimising the Regulatory Landscape

Today, different sectors face an influx of user data that they need to process and analyse. To de...

Explore More

Explore More

Blog

Online Document Verification – The Role of Shufti’s Optical Character Recognition (OCR) in Eliminating Fraud

Document verification is the most important stage when it comes to doing online business, getting...

Explore More

Explore More

Blog

Avoiding Billion-dollar Fraud & Non-Compliance Costs With Shufti

Businesses deplete millions of dollars each year on outdated technologies, employee training, and...

Explore More

Explore More

Blog

Keeping AI Bias Out of the IDV Game with Shufti

Consider this: 85% of financial institutions today use some form of AI in their products. The tec...

Explore More

Explore More

Blog

Video KYC – Ultimate Solution for Financial Institutions

With social distancing becoming the necessity during the pandemic, more and more companies began ...

Explore More

Explore More

Blog, Fraud Prevention

Face Verification Technology Grooving in the Education Sector

We are now in a golden age of face recognition. The main reason for rapid adoption is recognition...

Explore More

Explore More

Blog

Global Expansion, Digitization, and Crimes – How Shufti Can Help Financial Industry

The financial industry has seen significant technological changes over the past recent years. Man...

Explore More

Explore More

Blog, Online Marketplace

ID Verification Ensuring Safety Deals in Real Estate Sector

Buying and selling properties for people are major, thought-provoking decisions. It requires week...

Explore More

Explore More

Blog

10 Reasons Why Businesses Should Choose Shufti

Started in 2017, Shufti Ltd. has attained a lot of success. Within three years, we have onboa...

Explore More

Explore More

Blog

Shufti’s ID Fraud Report: Reviewing 2022 and a Preview of 2023

Twenty years back, “identity theft” was imagined as pictures of shady figures rifling through gar...

Explore More

Explore More

Blog

Top 5 Non-banking Industries in the Crosshairs of Financial Criminals

The first half of 2021 saw significant disruption in the financial world as traditional criminal ...

Explore More

Explore More

Biometric Technology, Blog

How Liveness Detection is an apt Answer for Facial Spoof Attacks?

The world went haywire on the launch of the new iPhone X; well, to be honest, when does it not? H...

Explore More

Explore More

Blog

Bitcoin ATMs – how it works and KYC compliance

Bitcoin ATMs are everything an ATM is and isn’t.

The world of finance and banking has chang...

Explore More

Explore More

Blog

Age Verification: Data Privacy and User Protection

In recent years, there’s been a lot of speculation surrounding the issue of whether or not ...

Explore More

Explore More

Blog, Business Technology, Financial Crime / AML, Identity & KYC, Online Marketplace

Know Your Business: The Next Step in Identity Verification

The complex regulatory environment and increased exposure to illegal activities indicate that bus...

Explore More

Explore More

Blog

Age Verification: Comply with Global Regulations or Face Reputational Damages

In the digital age, businesses that operate online face a significant challenge when verifying th...

Explore More

Explore More

Blog

Enhanced Due Diligence Checks | The Art of Mitigating Risks Associated with Third-Parties

For multinational businesses, reliance on external third-party vendors is crucial. However, failu...

Explore More

Explore More

Blog

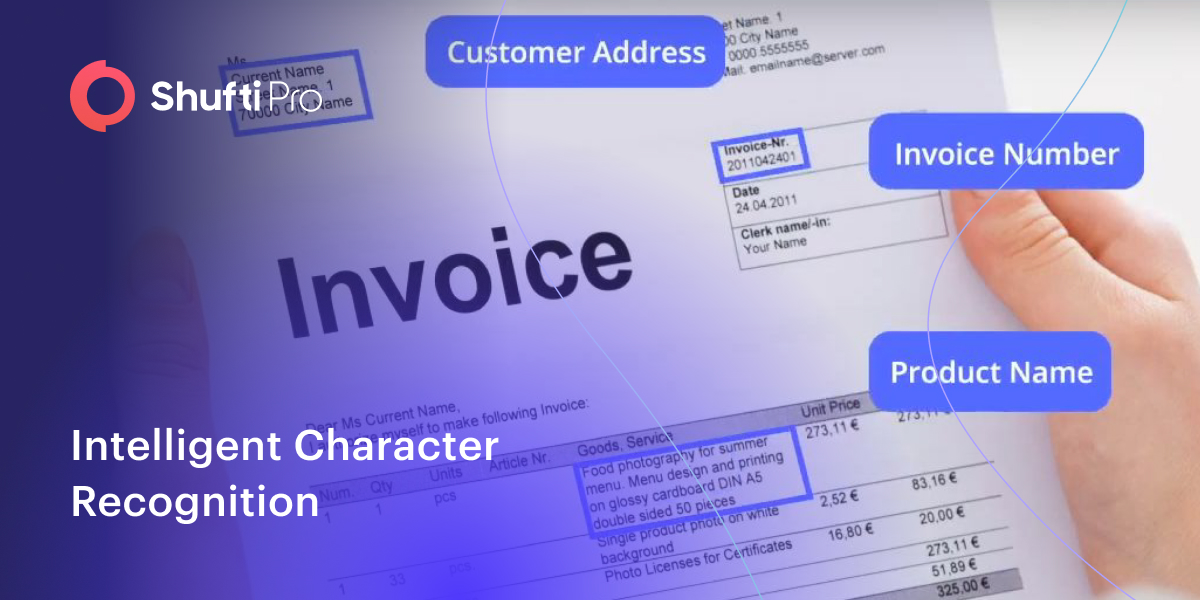

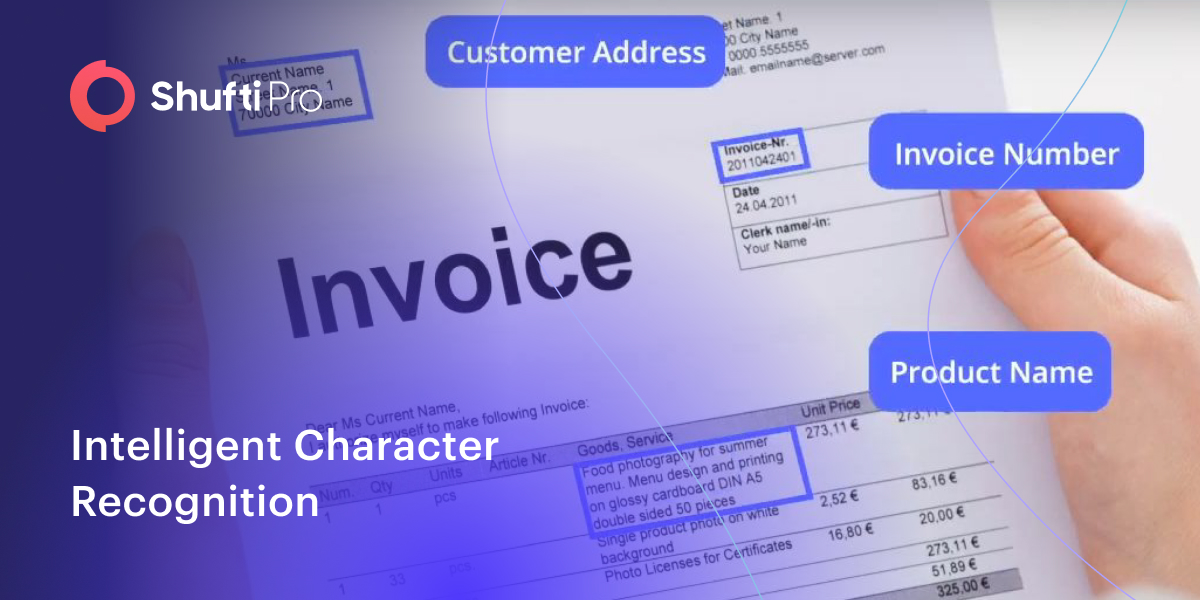

A Basic Guide to Intelligent Character Recognition (ICR)

With technological advancement, businesses are finding new ways to leverage digital sol...

Explore More

Explore More

Blog

Risk Assessment: Building Trust Among Travellers

The travel and tourism industry is among the largest in the world. Many countries, such as the UA...

Explore More

Explore More

Blog

Understanding False Positives in AML Transaction Monitoring

Financial institutions such as banks, neo-banks, insurance companies, investment companies, finte...

Explore More

Explore More

Blog

Stronger Global Identity Coverage… Where it Counts

In today’s globalized economy, businesses are striving to expand their footprint across borders. ...

Explore More

Explore More

Blog, Fraud Prevention

4 Fraud prevention tips that you must follow this Holiday Season

The holiday season is around the corner and it is the time of the year when online shopping and m...

Explore More

Explore More

Blog, Identity & KYC

4 Ways in which KYC for STO can Revolutionise the Crypto World

The year 2019 is expected to see a significant rise in STOs and have been called the future of bl...

Explore More

Explore More

Blog, Identity & KYC

CRA Looking to Launch Digitally Secure Ways with Identity Verification Services

Canada Revenue Agency or CRA in collaboration with an identity verification service called Secure...

Explore More

Explore More

Blog, Fraud Prevention

Fraud Prevention through Secure Payment Processes

Here’s a question, why do people always say things like “the good days”? The fact is a number of...

Explore More

Explore More

Blog

Protecting eCommerce Platforms and Mitigating Crime Risks with Shufti’s IDV Solution

The term e-commerce was tossed back in the 1960s, with the rise of electronic commerce in which t...

Explore More

Explore More

Blog

Protecting Crypto Ecosystem with Effective Compliance Measures and Robust AML Screening

In November 2021, the market capacity of the cryptocurrency went over $3 trillion. With the incre...

Explore More

Explore More

Blog

Top 10 AML Trends to Watch for in 2022

In 2021, the increasing scope of regulatory sanctions has affected businesses globally. The use o...

Explore More

Explore More

Blog

The Emerging Threat of DeepFakes and the Role of Video KYC

With technological advancement, cybercriminals are revising their strategies to commit fraud. Cri...

Explore More

Explore More

Blog

Building Better Customer Experiences from the Inside Out

”I don’t really think that it’s possible to deliver an excellent customer experience without havi...

Explore More

Explore More

Blog

UN Sanctions List: What Every Business Owner Must Know

Businesses must navigate a web of rules and regulations whilst onboarding customers, as one misst...

Explore More

Explore More

Blog

How to Use Shufti’s ROI Calculator to Justify Better Identity Verification Outcomes

As the pressure to grow profits intensifies, many companies are thinking proactively on how to ef...

Explore More

Explore More

Blog

Address Verification: Types, Benefits, and Best Practices

Improving customer service and combating fraud frequently requires swiftly gathering and confirmi...

Explore More

Explore More

Blog

UK Elections: Photo ID Law Change Raising Concerns for Voters

Law changes bring several hassles for the public and government authorities. The recent photo ID ...

Explore More

Explore More

Blog, Fraud Prevention

Identity Theft – One Fraud Multiple Facets

Identity theft is a global crime. All types of identities, including the financial, medical and b...

Explore More

Explore More

Blog

Forensic Document Forgery Analysis – A Landmark Approach to Curb Identity Fraud

With online services picking up pace, cybercriminals are ramping up their digital attacks and us...

Explore More

Explore More

Blog

How Transaction Monitoring Can Ensure Secure Online Services

A safe and comprehensive transaction monitoring system is increasingly important in an era charac...

Explore More

Explore More

Anti Money Laundering, Blog

Danske Bank Scandal: Banks Under Strict AML Scrutiny of FSA

Money laundering is becoming a global phenomenon. As per the United Nations Office on Drug and cr...

Explore More

Explore More

Blog

Top 5 Cybersecurity Trends to Look Out for in 2022

With 2022 just around the corner, new developments in cybersecurity are already beginning to take...

Explore More

Explore More

Blog

Future Prediction of Identity Verification for Businesses

Ensuring a user’s real identification has become crucial in the age of digitisation. Busine...

Explore More

Explore More

Blog

OCR Solution: A Must-have for Every Business to Automate Workflows

Moving documents and files from one format to another is necessary during transactions and busine...

Explore More

Explore More

Blog, Financial Crime / AML, Reg Tech

AMLD5 – Regulations catching up with Technology

In this era of technology, it is a common saying that “Innovation leads and regulation follows.” ...

Explore More

Explore More

Blog

New Regulatory Initiatives to Revamp the US Crypto Landscape

With digital currencies gaining prominence, the US financial landscape has seen major transformat...

Explore More

Explore More

Blog

Prevailing Crimes in Metaverse – How Shufti’s IDV Solution Can Help

Metaverse is a virtual space where people belonging to the same or different physical regions can...

Explore More

Explore More

Blog

Understanding AML Sanction Lists: Key Global Regimes and their Importance

Sanction lists are expanding regularly and sanctions imposed by different authorities do not alwa...

Explore More

Explore More