Integrated Compliance Management – Mitigating the Regulatory Risks

Businesses operating in the financial sector often face organizational and compliance challenges. In the past few years, monetary crime has skyrocketed; as a result data privacy and protecting customer data has become increasingly important. Financial watchdogs are playing their role in enforcing laws on national and global levels, making the regulatory landscape much more complex. These updates are a direct response to combat the increasing cybercrime emerging as a result of the COVID-19 pandemic.

This blog discusses key concerns businesses face while managing policies and procedures for KYC/AML compliance and how to address them.

What is Compliance Management?

A series of ongoing procedures that businesses develop to ensure compliance with state-of-the-art rules and regulations is called compliance management. The purpose of developing such programs is not only to avoid non-compliance penalties but also to mitigate any possible instances of financial crime by monitoring suspicious customer behaviour.

How do Firms Currently Cope With Requirements?

As a rule of thumb, financial institutions and businesses develop an in-house program to ensure compliance with Anti Money Laundering regulations. That being said, they have to take into account appropriate measures and steps to deter money laundering instances and prevent illegitimate customers from onboarding with their business. An AML compliance program basically consists of the following components.

AML Compliance Officer

A designated official is responsible for maintaining Anti Money Laundering compliance within an organization. Following are the duties which an AML compliance officer performs:

- Conduct employee training so that they are aware of current-day practices to prevent financial crime

- Devise strategies and frameworks to implement AML compliance policies and procedures

- Create reports for customer activity based on the size and amount of their transactions

- Make sure that Anti Money Laundering obligations are fully met by all departments

- Stay up-to-date with changes to AML requirements and the global regulatory landscape

AML Controls

Corporate and financial firms that bank on technology trends perform better as compared to those that have currently employed traditional compliance frameworks. Internal AML controls play an essential role in adopting modern compliance practices to streamline Customer Due Diligence (CDD) and to utilise tools better. Here are some procedures to ensure internal control procedures:

- Authenticating transactions by verifying customers

- Screening customers against different watchlists and sanctions

- Ongoing AML monitoring to regularly maintain risk profiles of high-risk entities

- Generating reports for transactions that are categorized as suspicious

Create an Auditing Mechanism

To evaluate AML compliance standards, external and internal audits are carried out on a frequent basis. Usually, this type of assessment takes place within 12-18 months but mostly depends upon the type of organization and the nature of services it provides. If a business has to deal with customers that process sizable transactions, it might need to conduct internal audits regularly to prepare for external inspections.

The Role of Integrated Compliance Management

To perform risk assessment of potential customers, and to manage organizational and compliance needs, an integrated approach is a must-have for organizations these days. While every business has its own set of requirements, its compliance approach can also differ depending upon multiple factors like the industry it operates in, the type of regulations, the state of its AML compliance program, and the specific jurisdiction.

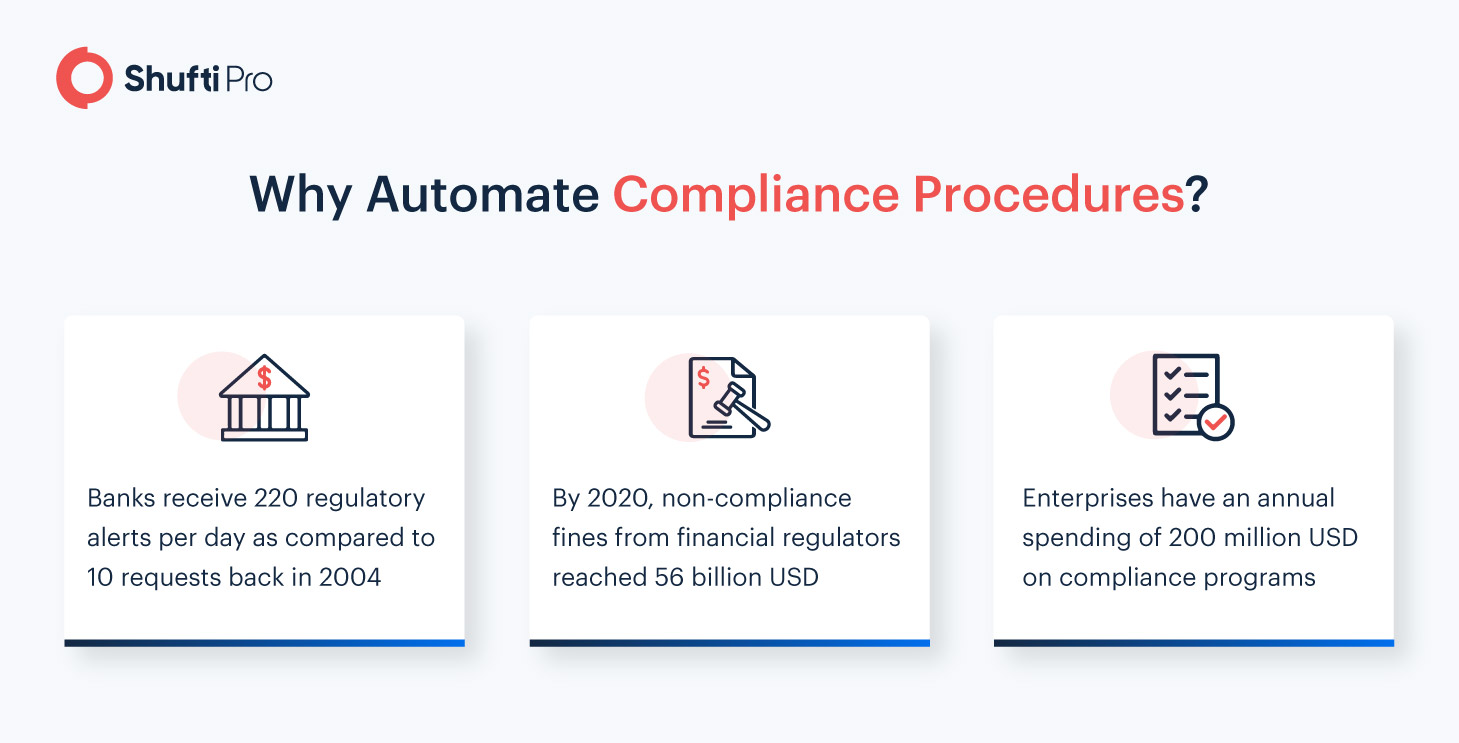

Why Is There a Need for a Better Approach?

Compliance programs are normally built around due diligence practices, risk-based management, policy implementation, organizational concerns and ethics. Although all these aspects are seemingly intertwined, they are not meaningful unless compliance processes share real-time information with each other and old-school methods are replaced with intelligent solutions. Below are listed some aspects/components that enable financial institutions to develop an integrated approach towards addressing these concerns and meeting AML/CFT compliance.

Risk-based profiling of customers

For any AML program to run smoothly, compliance processes need to be designed using an intelligent approach. Reliable reporting mechanisms and using powerful analytics tools offer improved ways and means to address customer misconducts, risk factor changes, and analysing trends for enforcing compliance accordingly. What compliance officers usually do is adopt an approach to evaluate business risks and implement necessary AML controls annually.

Given these factors, the time between two consecutive evaluations is important. An automated AML software integrated with other compliance systems can well examine real-time flags and implement actions as per the situation. Through these smart solutions and real-time insights, firms are able to foresee whether to develop a reactive and proactive compliance approach.

Evaluating the compliance program

Compliance advisory is a significant pillar of integrated compliance management. Determining possible loopholes and examining compliance functions are significant in preventing compliance breaches that can result in costly violations. As a matter of fact, compliance officers now prefer using AML solutions that take into account remediation measures and self-execute mitigation plans. This enables companies to streamline their compliance procedures through frequent audits and evaluations.

Organisational Framework

While meeting compliance metrics and maintaining risk profiles of customers is important, keeping a check on structural concerns is also important. Here’s what businesses need to consider to address these underlying challenges:

Incident and case management: Consistent and well-defined policies/procedures can help identify loopholes, so they can be countered by planning incident use cases. Devising policies for tracking, recording, routing, investigating, and closure can help in better case and incident management.

Managing regulatory engagement: Financial organizations develop a plan to calculate regulatory engagement activities. These often include document management, examinations, information requests, and engagement-related records.

Wrapping Things Up

The changing regulatory landscape of the financial industry has created the need for robust solutions for AML/KYC/CFT compliance. Real-time information sharing among compliance processes can enable organisations to identify, evaluate and combat underlying risks, and develop policies that are better directed towards compliance management. This integrated approach comes with certain requirements that can be met with an intelligent AML solution that instantly generates activity reports, implements compliance control measures, and enables efficient policy and incident management.

What to know about automated AML screening? Find out more.

![Know your patient process explained [Under the GPhC’s guideline] Know your patient process explained [Under the GPhC’s guideline]](https://shuftipro.com/wp-content/uploads/know-your-patient-2.png)

![Harnessing the power of AML Screenings to Uncover Politically Exposed Persons [PEPs] Harnessing the power of AML Screenings to Uncover Politically Exposed Persons [PEPs]](https://shuftipro.com/wp-content/uploads/n-img-harresing.webp)

![A Detailed Insight Into Canadian Gambling Industry [2022 Update] A Detailed Insight Into Canadian Gambling Industry [2022 Update]](https://shuftipro.com/wp-content/uploads/n-img-canadian-comp.png)