Red Flags to Detect Money Laundering in the Finance Sector

As the digital landscape continues to evolve at an exponential rate, so do our tools for fraud- despite our collective, worldly efforts to regulate and protect, the rate of financial crime grows yearly. Between 2020 and 2021, the average number of cyberattacks and data breaches increased by a staggering 15.1% (Forbes). The FBI released a statement at the beginning of 2022, announcing that over $43billion had been illegally acquired through compromised business emails since 2016. Financial crime has quickly become the most notorious and expensive form of crime. We’ll be further dissecting financial crime, specifically money laundering and ensuring your organisation is armed with the knowledge to prevent and spot it, as per the red flags from FATF- the Financial Action Task Force, a global authority dedicated to preventing money laundering and terrorist financing.

Continue reading to know more about financial crime and ensure your organisation is armed with the knowledge to prevent and spot it, as per the red flags from FATF.

What is Money Laundering?

Illegally obtained cash cannot enter the mainstream economy unless ‘cleaned’, otherwise a paper trail is left behind to lead authorities to said criminal. This can be applicable to a plethora of criminal income, ranging from gambling and drug trafficking to investment fraud. Money laundering tends to follow three main steps- placement, layering and integration, spanning across depositing cash into a bank, passing through the ‘cleaning’ process and introduction into the legal economy.

The term ‘money laundering’ was first coined in the US during the 20th century, in the Prohibition era. Organised crime was prevalent during this period, and the ill-famed Al Capone (Scarface) used cash only laundromats to clean his ‘dirty money’- and so came the term money laundering. The war against organised crime and specifically concealment of cash was later criminalised in 1986.

What is Anti-Money Laundering (AML)?

Anti-Money Laundering (AML) embodies regulations, laws and procedures implemented to prevent criminals from masking illegally acquired funds as legitimate money. These practices are designed to enable detection, tracking and reporting of suspicious activity. Regulatory bodies and financial institutions are responsible for enforcing anti-money laundering checks and policies and reporting criminal activity (such as suspicious transactions) to necessary authorities.

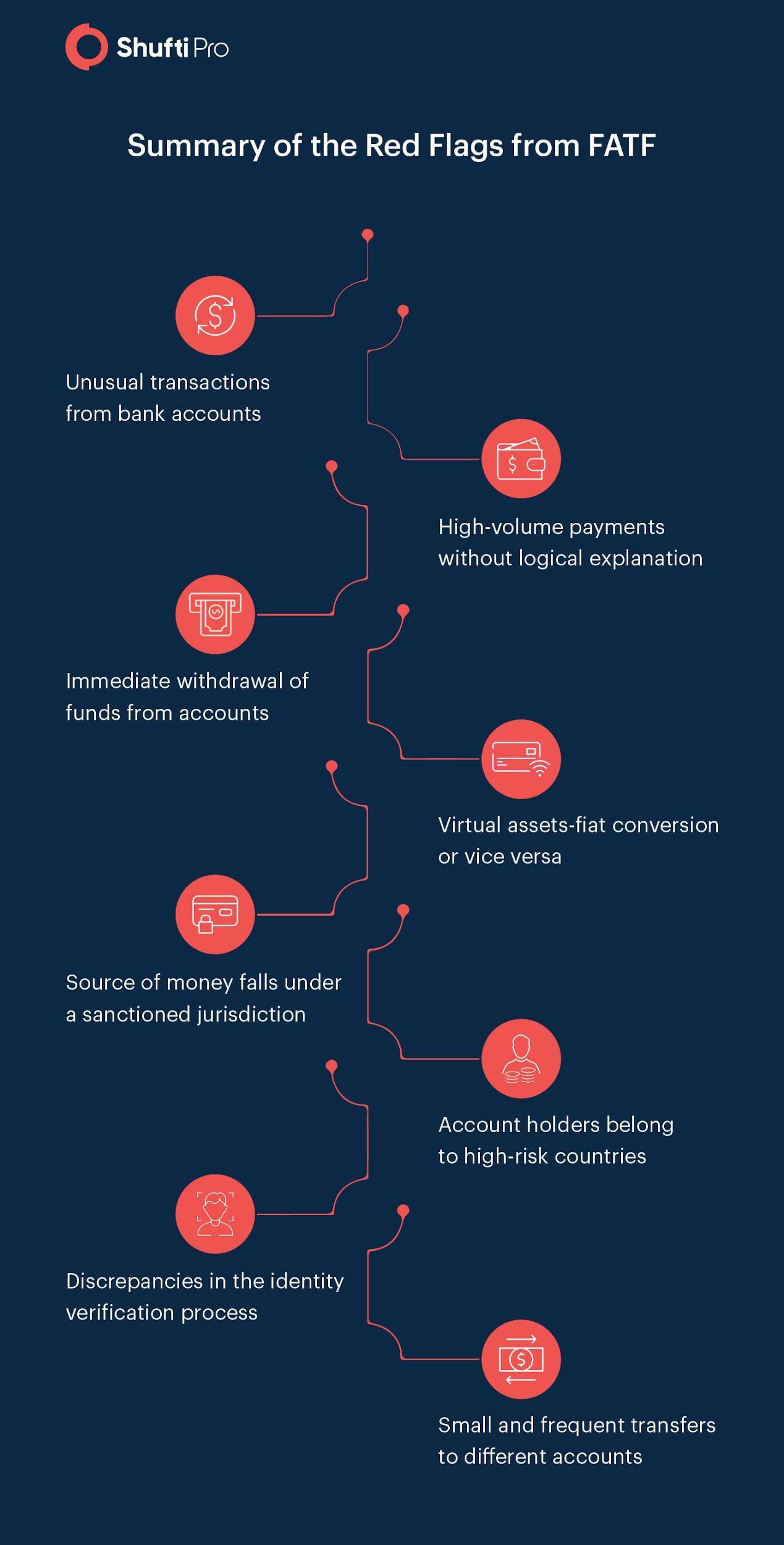

Protect your Organisation by Knowing the FATF Red Flags

It is essential that your business is armed with the appropriate knowledge and resources when it comes to identifying suspicious activity, which may be an indicator of money laundering. Here are the top red flags to prevent money laundering, from the Financial Actions Task Force (FATF).

Secretive Customers

The process of opening a bank account, or any other account dealing with finances, is a lengthy process of verification for safe measures, paramount in ensuring institutes uphold their reputation and are in accordance with financial regulation. If a customer is exhibiting evasive behaviour and fails to meet the criteria of providing several documents for verification or shows reluctance to share required personal data- this is an instant money laundering red flag. Knowing your customer is crucial in maintaining the integrity of your business, the onboarding process is a pivotal point in the company to customer relationship, you are now armed with the information you need to call off business with a potential fraudster or proceed if all checks are passed.

Find out more on Shufti KYC identity verification here.

Suspicious Transactions

Recurring suspicious transactions on a weekly or monthly basis from a questionable account can also reveal money laundering. If sums of money are moving in and out of your customer’s account at a fast pace, this may be indicative of the smurfing, dispersing illegal funds to skew the source, furthering it from the origin. Other things to look out for are funds from sanctioned countries, funds being received from accounts blacklisted by other banks and multiple high-volume transactions in less than 24 hours.

Immediate Cash Withdrawals

FATF regulations state all financial institutions must monitor accounts that receive funds and immediately withdraw cash. This is a big AML red flag, often an indicator of further layering or the integration step of introducing ‘clean’ money into the mainstream and legitimate economy; criminals often tend to hide this money further by the acquisition of assets or investing into a legal business at this point. FATF also advises that you pay attention to the frequency of such occurrences, if large sums of money are transferred into your customers account every three days and withdrawn immediately- this is a key money laundering red flag.

Conversion to Virtual Assets or Vice Versa

Virtual assets (VAs) are a digital representation of value, it is a form of digital currency that can be used to make purchases, digitally transfer and trade. Those using VAs (such as bitcoin or blockchain) must abide by the same regulations applicable to the financial sector. Similarly, to immediate cash withdrawals, it isn’t customary practice for funds to enter an account and immediately be converted to VA. This tactic is often employed to further complicate the trail of illegally sourced funds. Alternatively, recurring VA conversions to government-backed currency (fiat money: British Pound, Euro, American Dollar etc) is also just as indicative of money laundering.

Transactions with Unregistered Geographic Location

An instant AML red flag is transactions with unregistered countries or sanctioned states. A client receiving funds or making transfers to unregistered locations should be contacted immediately, if no reasonable explanation can be given to justify such activity, it is wise to restrict account access.

Account Holders from High-Risk Countries

During the onboarding process, some potential clients may be flagged as they’re from high-risk countries. For example, Andorra and San Marino are ranked some of the higher AML risk countries and third-world countries generally tend to be flagged as higher risk. This should not be seen as a deterrence, just ensure that you perform the necessary background checks, such thorough checks will often be mandatory procedure in these circumstances; this may also entail verifications through sanctions and PEPs.

Recommended: Anti Money Laundering – What is AML compliance and why is it important?

Clients with Multiple Accounts

Regular verification should be enforced for clients who have several accounts registered under the same details due to risk of money mule scams. This refers to someone who transfers ‘dirty’ money on behalf of someone else in the money laundering process. Ongoing anti-money laundering checks are pivotal and necessary in identifying financial crime.

Irregularities in Customer Due Diligence Process

Clients that exhibit evasive behaviour when coming to AML checks often have discrepancies in the Customer Due Diligence (CDD) process- a series of checks that gives you your potential customer’s risk profile and verifies their identity. If issues are encountered through KYC verification, your safest option is to stop the onboarding process for said client for being unable to pass mandatory checks, as there is no way to legally bypass this.

The FATF Red Flags Could Save Your Business from Financial & Reputational Damage

It’s essential that your business screens customers appropriately and is in line with financial regulations to ensure AML standards are being met. Financial crime has dire consequences for individuals and financial institutes involved, alongside debilitating economic stability and eroding trust in the financial system. With vast digital change across all sectors, recent ThoughtLab surveys showed 41% of Executives to believe that current security plans and implementation was not sufficient in providing adequate security because of fast digital transformation (ThoughtLab). Protect your organisation by staying on top of anti-money laundering red flags and news. Find out more on Shufti’s AML screening services.

For further information on KYC identity verification to strengthen your company’s onboarding process and overall security, find out more here.

Get in touch with our experts to find out more on FATF guidelines or further advice to prevent money laundering and wider financial crime.

![AUSTRAC’s ML/TF Risk Assessment Report on Major Banks [Part 1] AUSTRAC’s ML/TF Risk Assessment Report on Major Banks [Part 1]](https://shuftipro.com/wp-content/uploads/aust.png)

![Anti-Money Laundering Compliance for Crypto Exchanges [2021 Update] Anti-Money Laundering Compliance for Crypto Exchanges [2021 Update]](https://shuftipro.com/wp-content/uploads/onsite-blog-Anti-Money-Laundering-Compliance-for-Crypto-Exchanges.jpg)