Blog

The Path to CX Leadership – An Interview with Saroni Kundu

From Code to Customer: How Saroni Kundu Found Her Passion in CX

In our latest Beyond Borders podc...

Explore More

Explore More

Blog

AML Compliance for Money Service Businesses (MSBs) – How Shufti’s AML Screening Helps

Money laundering has spread like a virus in today’s globalized society. Banks and other fin...

Explore More

Explore More

Blog

KYC Services For ICOs – Why you need to have them now?

KYC services play a vital role in conducting an ICO in more than one way. They can make the entir...

Explore More

Explore More

Blog, Fraud Prevention

Cryptocurrency Scams – Checklist for Protection

Headlines about some cryptocurrency exchange being hacked are not unusual. So far, hackers have s...

Explore More

Explore More

Blog

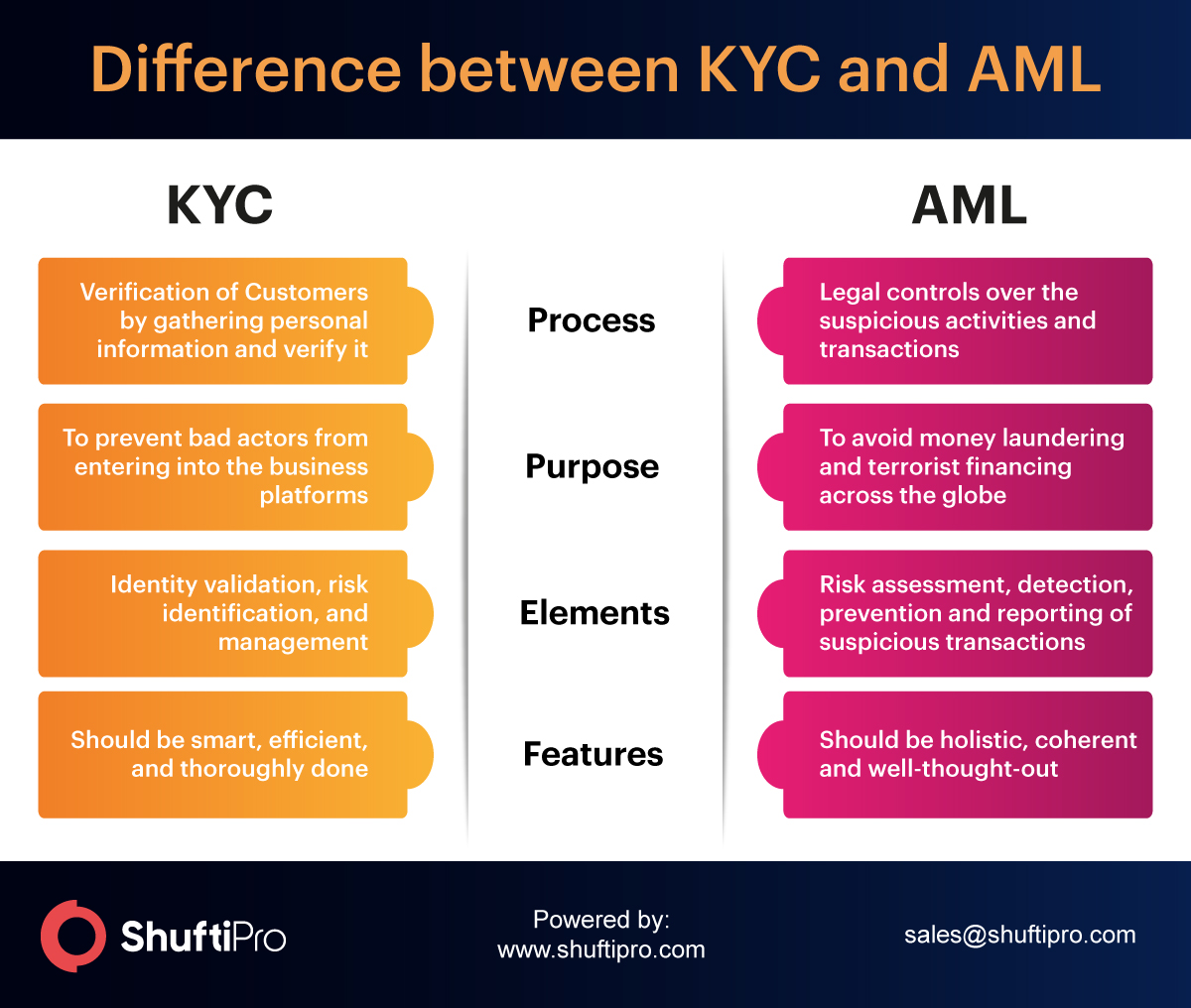

4 Ways How Technology Can Simplify KYC and AML Workflow Management

While the terms AML and KYC are used interchangeably, there is a huge difference between the two....

Explore More

Explore More

Blog

Elevating Payment Security: The Crucial Role of Biometric Authentication

There has been a considerable rise in digital payment methods in recent years. People now prefer ...

Explore More

Explore More

Blog

Identity Verification making online dating platforms secure

The expansion of the internet and mobile devices has led to the rapid adoption of online dating. ...

Explore More

Explore More

Blog

Know Your Patient – Curbing Healthcare Fraud through Identity Verification

With global digitization and emerging technologies, the healthcare sector has adopted a variety o...

Explore More

Explore More

Blog

The Crucial Role of Ongoing Monitoring in Risk Mitigation

The nature of a business-to-clientele relationship subjects organisations to significant risks. F...

Explore More

Explore More

Blog

How Shufti’s KYC Solution Can Ensure Compliance For Call Centers Fighting Crime

With emerging technologies and rapid digitization, the world is relying on the web and a variety ...

Explore More

Explore More

Blog

Identity Verification – Building Trust and Combating Scams in Online Dating

Since the beginning of civilization, humans have always preferred to live in communities. This co...

Explore More

Explore More

Blog

DSAR Under GDPR and CCPA – Understanding the Key Differences

Data protection is one of the key concerns of organisations these days. For the same reason, data...

Explore More

Explore More

Blog

Customer Risk Assessment: Strengthening Security in the Digital Age

Business partners, vendors, and third parties play essential roles in daily operations, contribut...

Explore More

Explore More

Blog

Know Your Donor – Securing NPOs and Charities Through KYD/AML Solution

Emerging technologies and growing digitization have increased financial crime risks in Non-Profit...

Explore More

Explore More

Blog

Deepfakes: AI Fraud Attacks Require Even Smarter AI Countermeasures. Now.

Verifying identities with advanced biometrics was already a challenge—then along came AI-generate...

Explore More

Explore More

Blog

Securing Mobility as a Service (MaaS) with Shufti’s Digital Identity Verification Solution

The transport industry is on the verge of significant disruption, with new emerging technologies,...

Explore More

Explore More

Blog

KYC Outsourcing vs. In-House Systems – What Should Businesses Opt For?

KYC requirements for financial institutions throughout the world come with a basic need for imple...

Explore More

Explore More

Blog

Fraud Detection, Compliance, and ID Verification Solution to Secure the Telecom Industry

The telecommunication industry has played a crucial role in global digitization, innovation, and ...

Explore More

Explore More

Blog

Vendor due diligence – Why it’s important and how it’s done?

In today’s ever-changing corporate landscape, businesses are always looking for ways to make thei...

Explore More

Explore More

Blog

Intelligent Security Systems & Digital ID Verification

Most technology solutions present a compromise between convenience and security to their users. I...

Explore More

Explore More

Blog

Employee Verification – First Line of Defence Against Corporate Fraud

One day you wake up to the fact that the employee you’ve been trusting for years has been embezzl...

Explore More

Explore More

Blog

How Optical Character Recognition Improves the Process of Identity Verification for Businesses

Evolving technologies have created a competitive market where every business strives to optimize ...

Explore More

Explore More

Blog, Identity & KYC

KYC/AML Compliance in light of FinTRAC

Witnessing the updated AML/CTF regime; the guidelines by FinTRAC regarding ID verification have b...

Explore More

Explore More

Blog

Top 4 Reasons that will Increase Money Laundering Risks in 2022

Unlike other frauds, like like tax evasion, drug trafficking, extortion, and misappropriation of ...

Explore More

Explore More

Blog

Money Laundering in the Real Estate Sector – How Shufti’s AML Services Help

Purchasing luxurious mansions is always an attractive way for money launderers to legitimize thei...

Explore More

Explore More

Blog

Facial Recognition | The Principles of Responsible Use and the Legal Landscape

One of the most popular uses of AI nowadays is facial recognition. In all likelihood, it’s ...

Explore More

Explore More

Blog

Biometric Facial Recognition – Combating Identity Fraud with Shufti’s IDV Solution

Since knowledge-based authentication and passwords were first introduced, security systems in ban...

Explore More

Explore More

Blog

AML Screening – Securing Alternative Payment Market and Overcoming Prevailing Risk of Crimes

Escalating demand for innovative, new, and robust alternative payment options across the world is...

Explore More

Explore More

Blog

Identity verification for fair and free US elections amid COVID-19

US Elections 2020 is the talk of the town these days. But with COVID-19 pandemic going on how wil...

Explore More

Explore More

Blog

KYC Compliance – Identity Verification for Brokerage Companies & Trading Platforms

Online trading platforms provide businesses with the convenience to keep an eye on financial mark...

Explore More

Explore More

Blog

E-Signature | Digitise and Verify Agreements in Compliance

The use of electronic signature, or e-signature, has transformed business dealings. The days of s...

Explore More

Explore More

Biometric Technology, Blog

How Liveness Detection is an apt Answer for Facial Spoof Attacks?

The world went haywire on the launch of the new iPhone X; well, to be honest, when does it not? H...

Explore More

Explore More

Blog

Overcoming the Challenges of Proliferation Financing with AML Screening Solutions

On September 23rd, the 2021 UK NRA (National Risk Assessment) was published as part of the govern...

Explore More

Explore More

Blog

AML Screening – Identifying and Overcoming Challenger Banks’ Weaknesses

There are approximately 77 challenger banks in Europe alone, the best range amongst the other reg...

Explore More

Explore More

Blog, Fraud Prevention

8 Fraud Prevention Tips for a smooth business uptake in 2018

The Need for Fraud Prevention

As technology has evolved over the years, the way we do business ha...

Explore More

Explore More

Blog

ID Verification – What new KYC Services Shufti launched in 2018?

Shufti started 2018 with an aim to fight the menace of digital fraud, identity theft, and onl...

Explore More

Explore More

Blog

Cross-Border KYC Compliance | Understanding and Overcoming the Challenges

To handle money laundering incidents and rising regulatory pressure, the banking industry benefit...

Explore More

Explore More

Blog

The need for identity verification solutions spiking in demand

At present, we are living in a digital world. Everyone is on the internet which is an anonymous s...

Explore More

Explore More

Biometric Technology, Blog, Fraud Prevention, Identity & KYC

Multi-factor Authentication is being defeated’ warns FBI

For years, online businesses and organizations have been adopting various strategies and defense ...

Explore More

Explore More

Blog

Secure Your Digital Presence | Combat Transaction Fraud and Cyberthreats with IDV

Financial crimes, especially payment and transaction fraud, have seen a massive surge in recent y...

Explore More

Explore More

Blog

KYC Analysts: The First Line of Defense Against Identity Theft and Fraud

An upsurge in financial transactions has led to heightened money laundering risks and terrorist f...

Explore More

Explore More

Blog

5 Industry Leaders Shared Their Insights on the Future of Biometrics

Modern technology has brought several conveniences to life. From the ease of working at home to s...

Explore More

Explore More

Biometric Technology, Blog

4 Reasons why Facial Recognition is Better at Biometric Verification than Fingerprint Scans

Biometric verification is smartphones was introduced nearly five years ago when iPhone launched i...

Explore More

Explore More

Blog

Top 5 Countries Impacted by Money Laundering – How Shufti Helps Mitigate the Risks

Today, money laundering has permeated almost every regulated market and has become the most occur...

Explore More

Explore More

Blog

Enhanced Digital Security with Facial Recognition and Liveness detection

The increasing number of cyber-attacks and online fraud calls out for strong security measures. U...

Explore More

Explore More

Blog

How to Design an Effective Client Lifecycle Management (CLM) System with ID Verification

The customer journey with a business is very comprehensive. It does not end once the customer is ...

Explore More

Explore More

Blog

The UK “Children’s Code” – Laying New Grounds for Age Verification

A 12-month grace period for compliance with a set of standards, introduced for protecting childre...

Explore More

Explore More

Blog

Customer Risk Assessment – A Landmark Approach to Fight Identity Fraud

Identity theft is the most prominent cybercrime which has raised alarms for global law enforcemen...

Explore More

Explore More

Blog

Know Your Player – Preventing Identity Fraud in Sports Events

The ongoing trend of globalizing sports activities since the last few decades has resulted in a l...

Explore More

Explore More

Blog

Regulatory Compliance | The Importance of Age Verification on Betting Sites

Online betting sites and gambling platforms frequently face significant challenges in adhering to...

Explore More

Explore More

Blog

Building an Effective Customer Due Diligence (CDD) System with Shufti

There are various factors that businesses have to consider while implementing measures to gather ...

Explore More

Explore More

Blog

5 Ways How Online Age Verification Promises Growth for the Gaming Industry

The online gaming industry is booming since the last few years. Due to the pandemic, the trend fo...

Explore More

Explore More

Blog

Effective Sanctions Screening | A Guide for Compliance Professionals

Sanctions are crucial in combating financial crimes and maintaining national and international se...

Explore More

Explore More

Blog

Top 10 Cybersecurity Trends for 2021

Cybersecurity in 2020 became the biggest challenge thanks to the COVID-19 pandemic. Global lockdo...

Explore More

Explore More

Blog

Build Trust and Secure Online Dating Platforms with Identity Verification Solutions

Online dating scams, such as the one filmed in the recent Netflix Original documentary “ The Tind...

Explore More

Explore More

Blog

Addressing Regulatory Compliance in Online Gambling with Effective AML Screening

The internet is a key risk element for gambling because it gives the user a sense of obscurity, t...

Explore More

Explore More

Blog

ETSI Identity Proofing Standard – How to Meet the New Regulations

Rapid digitization trends have led banks and financial institutions into competition for providin...

Explore More

Explore More

Blog, Online Marketplace

KYC Services and AML Compliance Services for Forex Industry

Forex Industry stands to benefit a lot by incorporating KYC services in addition to AML Complianc...

Explore More

Explore More

Blog

GDPR Checklist – Practices to adopt as Business Norms

It’s been a little over eight months since the GDPR came into effect on 25 May 2018. From that po...

Explore More

Explore More

Blog

Trade-Based Money Laundering – How Shufti’s AML Screening Solution Helps

International trading instruments have significant features that are making them potentially attr...

Explore More

Explore More

Blog

Shufti Turns Three – A journey of building trust globally

October 31, 2020, marks the third anniversary of Shufti and three successful years of buildin...

Explore More

Explore More

Blog, Online Marketplace

The Urgency for Know Your Customer’s Customer (KYCC) in Businesses

It is not just the financial services sector that is required to comply with anti-money launderin...

Explore More

Explore More

Blog

Know Your Patient (KYP) | 4 KYP Compliance Trends for 2024

Nothing is more constant than change, and this is never more evident than in the Know Your Patien...

Explore More

Explore More

Blog

6 industry experts explain the role of KYC in cybersecurity

Cybersecurity is no more limited to firewalls and antiviruses. It is protecting your system, empl...

Explore More

Explore More

Blog

International ID Day – An Overview of the 2021 Identity Landscape

The International ID Day is not marked on everybody’s calendar but is of significant value for ma...

Explore More

Explore More

Blog

The Top 6 Holiday Season Scams to Avoid in 2023

As we move further into digitisation, our methods of giving gifts have changed drastically. In to...

Explore More

Explore More

Blog

e-IDV | Combatting Fraud in a Remote World

Know Your Customer (KYC) is a method to identify and verify clients’ true identities and re...

Explore More

Explore More

Blog

Forex Market – Are there Enough KYC/AML Regulations to Keep Perpetrators at Bay?

Regulatory pressure, hefty penalties and increasing criminal instances are some risks associated ...

Explore More

Explore More

Blog

Video KYC Onboarding: Fintechs meeting KYC compliance with video identifications

The Financial industry is introducing a digital revolution globally. The term Fintech corresponds...

Explore More

Explore More

Blog

China’s New Data Security and Personal Information Protection Laws [2022 Update]

For the purpose of identification, interdiction, and prevention, many governments, regulators, an...

![China’s New Data Security and Personal Information Protection Laws [2022 Update] China’s New Data Security and Personal Information Protection Laws [2022 Update]](https://shuftipro.com/wp-content/uploads/b-img-china-1.jpeg) Explore More

Explore More

Blog

Age Verification – Ensuring the Protection of Minors on Digital Platforms

In today’s technologically advanced era, digital products and services have transformed the way s...

Explore More

Explore More

Blog

Top 5 Ways to Improve Transaction Monitoring in Fintech

Fintech is a fast-growing sector that combines finance and technology to assist businesses and cu...

Explore More

Explore More

![China’s New Data Security and Personal Information Protection Laws [2022 Update] China’s New Data Security and Personal Information Protection Laws [2022 Update]](https://shuftipro.com/wp-content/uploads/b-img-china-1.jpeg)