KYC and AML For Fintech | A Comprehensive Guide to Fraud Prevention

BEFORE YOU GO...

Check how Shufti Pro can verify your customers within seconds

Request DemoNo thanks

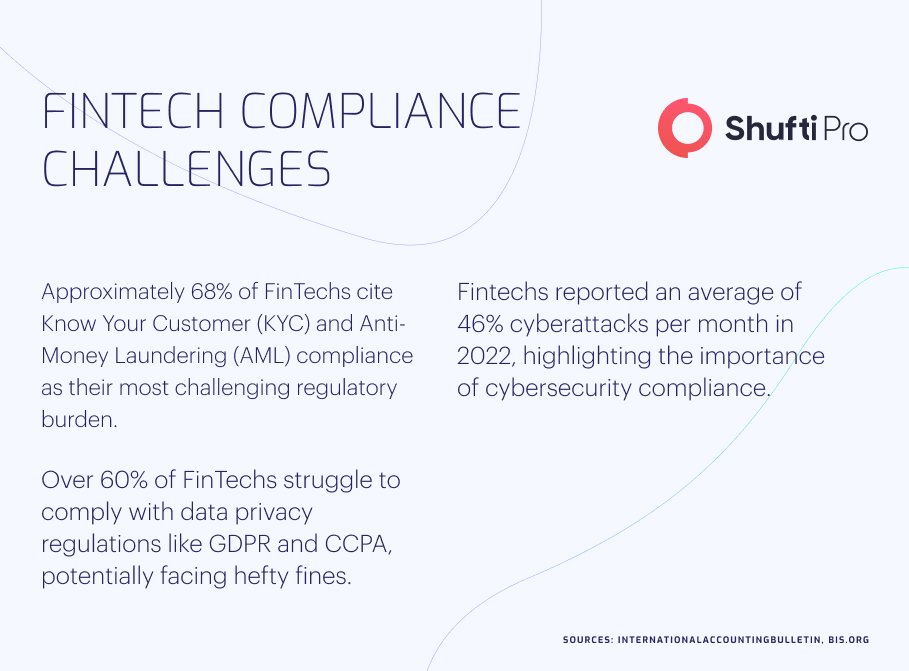

Since governments worldwide are increasing the pressure to regulate, compliance has become a key hurdle for FinTech businesses. So, what are the international rules for FinTech compliance, and how can companies best use them?

All financial institutions, especially fintech ones, must comply with AML requirements to prevent the laundering of illicit funds. Anti-Money Laundering (AML) aims to forestall the funding of terrorism and other forms of financial crime. In the FinTech industry, Know Your Customer (KYC) is crucial to AML protocols.

Due to difficult regulatory hurdles, fintech firms must ensure they fully comply with KYC and AML laws. Companies that care about credibility and the bottom line should implement KYC and AML processes since doing so is mandated by law. These rules exist to protect consumers as well as financial institutions. They help prevent crimes such as identity theft, fraud, and money laundering.

According to Ivana Vojinovic of Data Prot, although 88% of experienced unethical hackers have the potential to infiltrate firms within a single 12-hour time frame, 70% of small businesses still need to prepare to handle rising risks. The total monetary damage caused by cybercrime in 2022 was estimated to be a staggering USD 6 trillion. Vojinovic estimated that more than 33 billion accounts will be at risk of breaches by the end of 2023 using data obtained from various sources. While the certainty of these forecasts cannot be established, they warn businesses that they must take immediate action to strengthen security.

KYC requirements and regulations have grown more complicated for fintech companies, banks, and other financial service providers. To prevent fraud and money laundering, these businesses must verify customer identities in accordance with strict international guidelines. Furthermore, practically every country has its own set of local standards.

The European Banking Authority’s (EBA) Anti-Money Laundering Directives are the foundation of EU law and take precedence over national practices. The Bank Secrecy Act of 1970 created KYC rules in the United States, which were further strengthened by the Patriot Act of 2001.

The Know Your Customer (KYC) procedure can be considerably influenced by factors such as the client type (individual, company) and the business strategy of the financial service provider. The 4th EU Directive sought to address the lack of openness about the true identities of those involved in business deals in the wake of scandals like the Panama Papers. This pushed Know Your Customer to a new level, requiring KYC to function fully. However, businesses may relax Know Your Customer policies for customers making little purchases.

Payment Service Directive 2 (PSD2) and Know Your Customer (KYC) are essential in Europe. In 2015, the European Commission introduced PSD2, which primarily affects financial institutions and payment processors. Open banking was made more accessible since clients may permit banks to share account information with a broader network of financial service providers.

These facets of KYC add to financial institutions’ difficulties meeting regulatory requirements. The importance of compliance cannot be overstated, as financial institutions might face legal consequences if services are used in a way that breaches anti-money laundering legislation. Companies in the fintech industry must adhere to the same regulations as their more-traditional counterparts.

AML is the broader regulatory realm that includes KYC. Its goal is to forestall the acquisition of illegal funds. Since the FATF was established in 1989, AML has been an integral part of international banking law. Significant changes have been made to AML legislation after 9/11 and the expansion of rules during the 2008 financial crisis. The proliferation of electronic banking and payment systems has also raised the importance of complying with AML regulations regarding crypto transactions.

The Anti-Money Laundering (AML) subcategory known as CFT (Combating the Financing of Terrorism) is concerned with taking concrete steps to thwart the financing of terrorism on a global scale. After 9/11 and the ensuing work of the FATF, it became a requirement for fintech firms, financial service providers, and other financial institutions to comply. As a result of “naming and shaming,” in which the FATF publicly names countries that fail to effectively prevent terrorist financing, more and more nations are adopting CFT legislation. Countries with global economic aspirations should be excluded from the list.

Understanding the business models of fintech companies is the first step in tackling the compliance difficulties these companies face. Typically, fintech firms rely more heavily on technology and automation processes. Payments, loans, and asset management are just some of the expanded variety of services they provide. In addition, their clientele differs from traditional banks due to the emphasis on digital channels. There may be complications in meeting KYC and AML requirements due to these distinguishing features.

FinTech companies must verify a user’s identification before conducting business with them. Strong KYC and AML processes can help fintechs accomplish this goal.

There are three parts to Know Your Customer policy:

Understanding the client’s financial history is the first and most crucial step in adhering to KYC rules. Due to legal requirements, this is an essential part of any Know Your Customer process. In accordance with the Patriot Act, all account holders must provide a CIP for inspection and documentation purposes.

All banking and financial institutions mandate the usage of a CIP on consumers. This helps the KYC verification process by allowing fintechs to identify consumers and keep tabs on financial transactions.

The Financial Action Task Force (FATF) may implement a CIP, but it is up to individual banks and financial institutions to make the call. The bank must evaluate these details for accuracy, reliability, and applicability before concluding that a CIP was successful. Such standards should be satisfied when conducting an AML investigation.

The Know Your Customer process never ends. It’s not enough to take a quick glance at a customer, so banks keep an active system that scans customers frequently. A fintech firm’s commercial ties must be tracked and monitored regularly based on client risk and suspicious activity. Risk management, due diligence, and transaction analysis are standard components of KYC programs.

The fintech might use this continuous surveillance to maintain tabs on each client’s monetary dealings and report any irregularities to the appropriate authorities. Some situations call for a second round of KYC verification. This is especially true when a customer’s personal or professional circumstances shift, such as switching careers or opening multiple bank accounts for the growing family.

The following should be taken into account while designing the monitoring system:

Time-consuming as it may be, continuous client monitoring is an essential part of KYC compliance because any sudden spike in a customer’s financial activity may be indicative of fraud. This round-the-clock digital vigilance fully protects all of the clients. Therefore, a Know Your Customer (KYC) compliance program is a valuable tool against financial fraud of any kind.

Regarding Know Your Customer strategies, the part that requires the most time is Customer Due Diligence (CDD). Fintech firms must understand their clientele to mitigate any potential threats. More information about a customer’s financial dealings is typically requested from those with a higher risk profile. Fintechs can take the following measures to strengthen their CDD procedures:

Money launderers and those looking to fund terrorism can be exposed using an AML risk assessment in the FinTech industry. Making an AML Risk Assessment in the FinTech industry requires achieving goals like identifying risk sources, evaluating controls to lessen such risks, and operating effective AML/OFAC compliance procedures. Key money laundering risk indicators considered in risk assessment include a company’s nature and size, the sorts of consumers it serves, the products and services it provides, how it acquires and maintains customers, and the locations in which it operates. This data is crucial for assessing potential dangers in the FinTech industry. So, how exactly should FinTech handle risk management?

The board of directors should be well-versed in the fundamental operations, safeguards, and level of risk tolerance at FinTech firms. An AML risk assessment should lead to defining and documenting a risk framework that accounts for regulatory and operational threats. Additionally, as new services are developed and new interactions with external parties are established, it is essential to consider all potential risk sources.

Money laundering, complying with regulations, and cybercrime are just a few of the significant threats FinTech firms face. FinTech could be jeopardised if it cannot deal with these threats. One of the most important AML/CTF initiatives, the risk-based strategy, should be used to counteract these dangers. Due to differences in FinTech risk perception and customer risk, using the same AML controls across the board is insufficient; instead, a risk-based approach should be taken for each individual customer and process.

After doing a thorough risk assessment through the use of due diligence, the customer should routinely reevaluate the customers to assess any new threats. The most common approaches to evaluating a client’s potential risk are PEP and negative media scanning.

To assess a client’s risk profile, businesses collect CDD information. The most significant risks come from consumers who engage in illegal activities like money laundering and financing terrorism. Compliance with applicable rules, prevention of money laundering and financing of terrorism, consistent delivery of the requested services, and identifying and analyzing anomalous occurrences are all goals of Customer Due Diligence in the FinTech industry. So, how exactly do due diligence processes work in the FinTech industry?

First, get the customer’s information, including name, address, phone number, email, date of birth, country of origin, citizenship, marital status, and other personal details. Second, authentication via scanning is carried out to use this information if questions arise. The next step is an evaluation of the customer’s actions to determine whether or not Enhanced Due Diligence is warranted. Finally, customer risk may shift during ongoing activities thus, periodic customer screening is performed.

With the help of Adverse Media Screening, you can look for bad press and other unfavorable coverage of a specific person or company. Know your customer; AML procedures will only be complete with checking for adverse media. Companies’ vulnerabilities can be identified and shielded by FinTech thanks to Adverse Media. Fintech institutions use adverse media screening to prevent financial crime and reputational risk. Adverse Media Screening allows FinTech to quickly and easily screen consumers and business partners for negative publicity, and the industry as a whole conforms with EU Directives and FATF recommendations. Adverse Media’s monitoring tools can quickly identify potentially dangerous business relationships.

Daily, a flood of breaking news stories is published worldwide, making it nearly difficult to scan them all manually. Of course, it’s essential to skim headlines like these before trusting them with your FinTech business’s money. Customers could, for instance, be involved in illegal activities, including money laundering, terrorism financing, tax evasion, bribery, fraud, human trafficking, etc. Because of this, FinTech firms can screen consumers for risk using Adverse Media.

Financial institutions’ customers’ transactions can be tracked instantaneously with Transaction Monitoring. FinTech’s contribution to the fight against financial crime is the most successful method: Transaction Monitoring. They can follow Terrorist Financing Countermeasures laws thanks to Transaction Monitoring software. Transaction Monitoring makes it possible to fully automate the scanning of the daily financial transactions at FinTech organisations. On FinTech platforms, criminals can use evolving technology for money laundering, identity theft, fraud, and terrorist financing. With the help of FinTech, customers may conduct safe monetary transactions with just phones. Because of this, crooks have an easy way in. By rapidly scanning transactions, Transaction Monitoring can foil such crimes before they occur.

AML Transaction Monitoring solutions enable FinTech firms to define regulations automatically applied to each transaction. Risk-based scorecards allow sophisticated risk assessments to be performed according to parameters like country and currency. There are many other helpful tools available in Transaction Monitoring. Therefore, Transaction Monitoring helps FinTech businesses safeguard finances, which in turn helps them guard their reputations and avoid regulatory fines.

Shufti Pro empowers the FinTech industry by offering global AML compliance solutions with coverage across 1700+ data sources, including FATF, Interpol, UN HMT, and more, ensuring comprehensive screening against sanctions, PEPs, and adverse media. With watchlist databases updated every 15 minutes and real-time risk insights, Shufti Pro equips FinTech businesses with the tools needed for ongoing AML compliance, cost-effective operations, streamlined onboarding, and enhanced trust and reputation in a rapidly evolving regulatory landscape.

Still trying to understand how KYC/AML helps the fintech industry in fraud prevention.