E-Learning Platforms and Prevailing Crimes – How Shufti Can Help

The global pandemic is prompting a phenomenal increase in online service. From doing groceries to job interviews and more, many daily activities have moved from in-person to online – that includes education. Started by religious institutions, the educational systems, as well as way of teaching, have transformed. Thanks to technological advancements, distance and e-learning services are becoming a new norm.

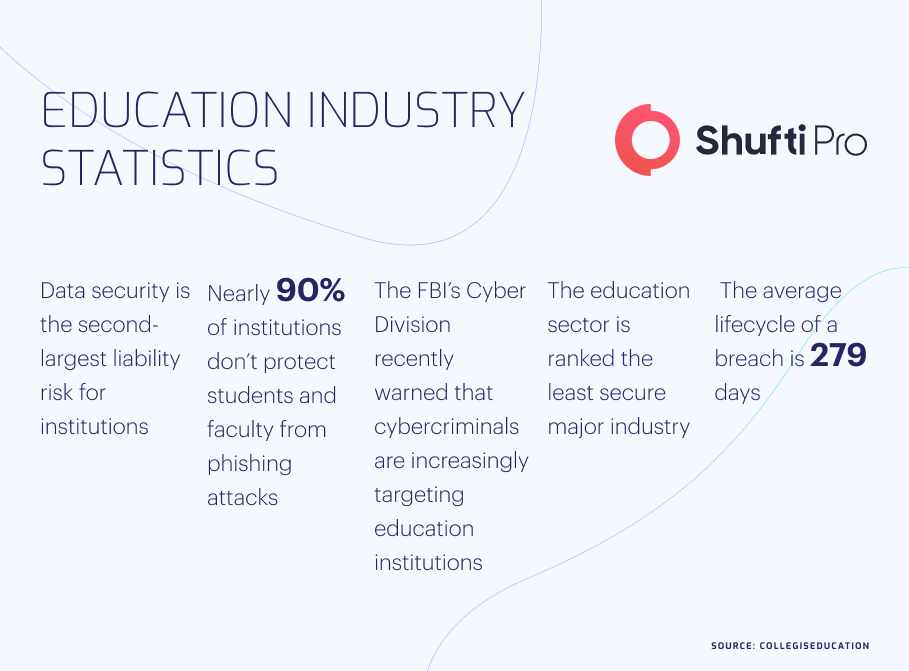

Over recent years, the education industry has faced numerous challenges as a result of digitization. Cyberattacks including data breaches, identity theft, phishing and blackmailing are a few most occurring issues that the sector is struggling to deal with.

Fortunately, these risks can only be mitigated to a large extent, with robust identity verification systems, which are capable of identifying the true identities of students before getting them on board.

The Rise of E-Learning and Crime [2022 Overview]

The online or distance learning sector has significantly grown over the past years, as modern IT infrastructures and instant internet connectivity is aiding the education industry to provide people with new opportunities to gain new skills. Since the coronavirus pandemic, e-education has become more common as millions of people across the globe have accepted the new learning model. The work from home and social distancing norms forced schools, universities and other education centres to provide remote services which surged the use of digital learning. According to Research and Market predictions, the e-education industry is all set to reach $350 billion by 2025. However, the number might be updated after assessing the growth of COVID-19 impacts on the sector.

There are hundreds of online learning portals or websites such as Uudemy, Lynda, Skillshare, and Coursera that are widespread over the digital world facilitating billions of people. Furthermore, top-notch universities are also democratising learning by making courses accessible through online portals. For example, Stanford and Harvard’s university gives access to students to get hands-on educational material as well as courses under different categories.

As new technologies are emerging and rendering heaps of benefits and innovative opportunities, the risk of crimes has also increased. Students, as well as cybercriminals, are manipulating the education centres for their own personal gains. Cybercriminals’ activities such as identity theft, data breaches, malicious attacks, blackmailing, synthetic identities and document fraud are among the commonly occurring crimes pouring adverse impacts over this industry. Due to this, the e-learning sector is being challenged by cyber criminals and is finding it hard to provide secure services while retaining customers along with their reputation.

Popular Cybersecurity Risks Education Sector is Prone To

There are numerous reasons cybercriminals target e-learning platforms. However, out of them, these two are perhaps the most significant, first online education service providers typically gather and store sensitive personally identifiable information of millions of students. This makes a jackpot-like situation for fraudsters, who are capable of getting their hands on the personal details of victims in just one malicious or data breach attempt. Second, the data placed in educational databases are highly valuable on the dark web. The information includes mailing addresses, social security numbers, ID numbers, driver’s licence numbers, and even medicare information. In fact, nearly 11% of all data breaches that occurred in 2017 involved exposure of faculty and student health records. According to the research, adult’s sensitive information sells for around $10 to $25 dollars on the dark web, while students’ data is worth nearly $300.

As a result of gathering data, it’s no wonder that employees or students associated with the education sector are targeted. Through phishing attacks or hacking the databases, criminals can use the victims’ credentials to manipulate students as well as damage the institutions’ reputations.

- Social engineering attacks such as malware and phishing scams are on rise in the education industry. According to the key findings, in 2019, nearly 41% of the data breaches were caused by these attacks. CBC news published that MacEwan University lost $11.8 million after an employee fell prey to a phishing attack.

- Ransomware attacks are another type of technique that fraudsters use to get their hands on databases. This involves infecting data files and systems through malicious viruses. By opening, installing or clicking on a file, the bogus software infects the system resulting in losing admin control.

- Spoof attacks are also becoming common in education centres. In this scheme, the cybercriminals pretend to be a legal entity to gain authorised access to online learning platforms and then infect the data directories with malware viruses. This fraudulent activity happens in multiple ways, but some of them include email and caller ID spoofing.

- Password Hijacking is another most preferred means of gaining unauthorised access to educational centres’ databases. This usually occurs when the passwords are easy to guess like “1234” or “ABC”. A report states that nearly 73% of people have set the same passwords across many accounts, making it a lot easier for criminals to hijack accounts.

How Shufti Can Help

Depending on the current inconsistent situation, where the education sectors are trying hard to fight sophisticated crimes, there are numerous services available at Shufti that can help them in a variety of ways. Ranging from consent verification, document validation, and facial biometric recognition to two-factor authentication that offers the highest level of confidence as those utilised by the banks or other financial service providers. Powered by thousands of AI algorithms, Shufti’s state-of-the-art identity verification services can help the education industry to overcome the risk of cyberattacks, unauthorised access, and identity theft. Ensuring legit student onboarding with 98.67% accuracy.

In addition to this, online education platforms are also finding it hard to authenticate students as well as faculties identity documents before getting them onboard. AI-powered document verification services, capable of verifying 3000+ types of identity documents written in 150+ languages, can aid digital platforms in validating documents in less than a second along with determining the sign of tempering if present.

Want to know more about identity verification for the education centres?

Explore Now

Explore Now