Securing Gig Economy Operations and Contributing to the Growth with KYC Solutions

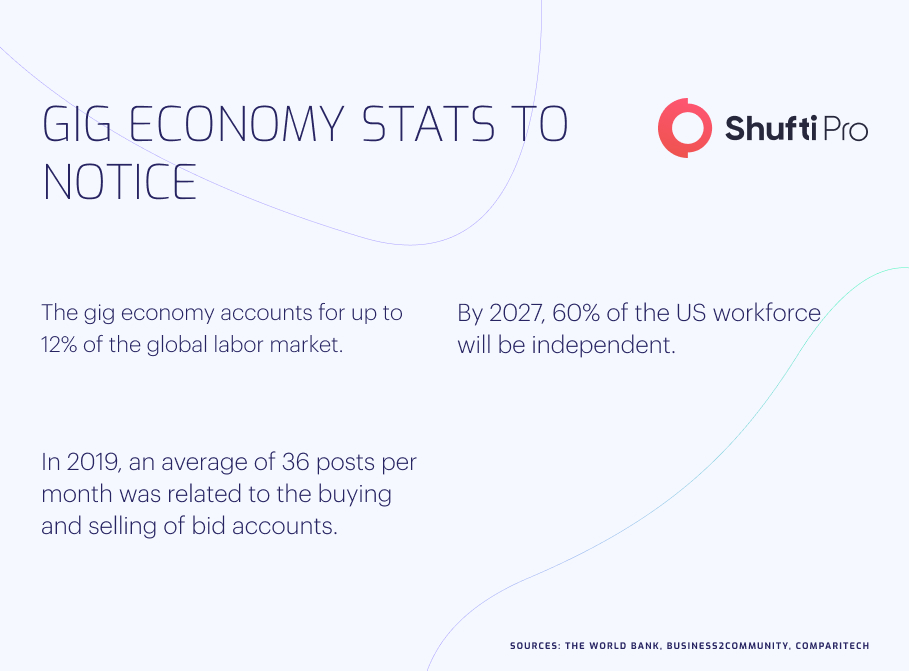

Startups, SMEs, and the gig industry have seen unprecedented growth. Not to mention, COVID-19 was a blooming period for freelancers and gig economy officers. The gig economy offers workers the flexibility to work from anywhere, provides flexibility, and makes cross-border communication or working easier than ever. In the US alone, more than 73.3 million Americans are part of the gig economy, and it is predicted that the figure will increase and will be more than labours, rising to 76.4 million by 2024. As the sector is continuously blooming and growing, payment companies, marketplace platforms, and other institutes need to verify the merchants or contractors to combat financial crimes like terrorist financing and money laundering. Understand the landscape of the gig industry, why it is important in the era of digitisation, and how to protect the identities, ensure security whilst maintaining compliance.

What is the Gig Economy?

The gig economy is made of independent contractors who work digitally part-time or full-time via platforms or on their own. Gig workers, in the era of digitisation, are a great contributor to the economy. According to a report revealed by Forbes, 29% of the US economy is considered as an independent contractor. Since the emergence of the gig economy, a broad prospect of people ranging from taxi drivers to field experts has contributed to the economy’s growth. It is estimated that it will be contributing $864 by the end of this year.

The Gig Economy and KYC Verification

Since COVID has passed, many sectors have seen a downfall that cost millions of people being laid off from their jobs and made the survival of many startups, SMEs, and even big organisations difficult. Nonetheless, the gig industry saw unprecedented growth and continued blooming even after. The industry makes the work easy, but with the hundreds of billions of dollars circulating cross-borders, it is easy to get manipulated and become a victim of bad actors.

The gig economy deals with billions of dollars and has now greatly attracted a significant number of fraudsters and cybercriminals who have found automated as well as sophisticated ways of money laundering. A report revealed that 48% of employers in almost all industries had to deal with identity fraud among the freelancers in the gig economy. Impersonating as a gig freelance worker is on the rise. Someone pretends to be a field expert, bids on the project, offers competitive prices, and sweeps away without businesses even noticing. Since impersonating is on the rise, companies do not have adequate KYC verification tools to validate the gig workers’ profiles. The fact that they can impersonate anyone and sweep away without any consequence is concerning. To combat financial crimes and secure the identity of users, it is important to incorporate kyc verification services.

Process of KYC Verification in the Gig Sector

The gig sector is in the blooming period, but with the rise of financial growth, identity theft has grown, too in the sector. Quickly and efficiently verifying the merchants or contractors, however, is still challenging. The need to manage new business models posed by the gig economy does not eliminate compliance responsibility or fraud concerns. Nonetheless, to successfully approach that, it requires a different, proactive approach to kyc verification as the different businesses require different verification methods. Since the merchants, contractors, and most of the startups or SMEs are not registered or incorporated, verifying them is even harder. Gig economy workers, who are often onboarded as ultimate beneficial owners (UBOs) or merchants, are harder to verify since they don’t have any business registration numbers, making it overwhelming to verify them as a business entity. However, the process of verifying them includes three simple KYC steps: capture, retrieve, and verify.

Capture

In the initial stage, the gig worker is asked to submit the essential documents needed and to take a picture of them for further verification. The gig worker is asked to provide government-issued or authorised identity verification documents, including an identity card, driver’s licence, passport, etc.

Retrieve

Once the documents are submitted, the information needed, including address or UBO criteria, is retrieved using the OCR technology. The automated processes make it easy to retrieve the information accurately in seconds, minimising the human effort or involvement needed.

Verify

Last but not least, all the information extracted is verified in real-time to validate there is no loophole or leaving the benefit of the doubt. The automated process in real-time takes out the information needed and matches it against the government or private databases available. It also screens them against the PEP and AML Screening lists to confirm that the individual doesn’t have any association with the terrorist groups or is a bad actor.

Is KYC Solutions Enough for Gig?

Since the risk has advanced and the cybercriminals have found sophisticated ways to steal identity and wipe off finances, KYC checks alone are not enough. To enhance the verification processes, it is important to integrate liveness detection into the verification system. In liveness detection, the person is verified in real time. Once it is confirmed that the person is exactly the same as he claims to be, they are considered safe to work with and granted access. If any minimal risk is shown, the individual will be further screened till it is tamed down.

With strong verification like liveness detection, the break-in of the spoofing attacks will be reduced. It stops biometric spoofing from occurring and introduces a fresh method to validate a person’s identity that requires the system to see beneath the skin’s surface to authenticate that it’s not a bot or fake profile. With this, businesses can in real-time distinguish whether it is the same person and can even identify if that person behind the screen is actually the same as they claim to be.

Gig Economy and 2024: What to Expect?

The gig economy has seen surges and seems not to stop anytime soon in the future. Without any doubt, it brings in many benefits and connects individuals as well as businesses across the border, but it also welcomes unnumbered sophisticated crimes. With this advancement and involvement of Artificial Intelligence (AI) and Machine Learning (ML), more crime is expected, making it crucial to work with kyc verification providers. Whether it’s money laundering, terrorist financing, or identity theft, the gig economy faces stumbling losses due to fraud and scams in the sector. By implementing KYC solutions and liveness detection into the solution, crime can be prevented, and identities can be secured.

How Can Shufti Help?

Protecting users, meeting legal and compliance requirements, and reducing vulnerabilities are some of the benefits of implementing robust kyc verification methods. It is Shufti’s mission to make the KYC process as simple for its clients as possible. With Shufti, businesses can verify contractors’ or merchants’ identities securely in real time. In addition to enhancing the user experience and reducing friction during onboarding, our solutions ensure compliance by providing reusable and interoperable gateway passes.

Want to learn more on how to secure the gig sector and ensure compliance whilst maintaining secure operations?

Explore Now

Explore Now