A Go-To Guide to Proof of Address Verification in 2024

- 01 What is Proof of Address (PoA)?

- 02 Why is Proof of Address Necessary?

- 03 How Does Proof of Address Work?

- 04 Geolocation as Proof of Address

- 05 Submitting Your Proof of Address: Best Practices

- 06 Top 10 Problems with Proof of Address Documents

- 07 Gather Accurate Proof of Address with Shufti

- 08 FAQs:

- 09 What counts as proof of address?

- 10 Is a bank statement proof of address?

Customer identity verification is significant in today’s digital world – from buying products online to transferring funds in nanoseconds, proof of address validation plays a crucial role in this. As global industries and consumer expectations evolve, companies need robust, swift, and fully-automated identity verification solutions – and one key aspect of customer onboarding is proof of address verification.

What is Proof of Address (PoA)?

While verifying customers’ identities, address validation is one of the highest priorities during the IDV process and shouldn’t be neglected. Generally, the digital PoA verification process generally involves gathering valid and recent documents containing the individuals’ addresses. The information and the image on the documents match the data the customer provided during form submission. In addition to this, third-party or government address databases may offer businesses more assurance that the address exists.

All regulated industries require proof of address as a part of KYC compliance. For instance, financial institutions ask customers to provide PoA to verify bank accounts. Additionally, federal, local, and state government agencies may ask citizens to provide additional documents as proof of address to receive benefits, register to vote, or get a driving license.

What Type of Documents are Accepted as Proof of Address?

There is a long list of documents that can be used as proof of address; however, acceptable PoA documents typically vary in countries. Proof of address examples include:

- Utility bills

- Credit card statements

- bank account statements

- Signed lease agreements

- Mortgage statements

- Any correspondence issued by a government agency

- Property tax receipts

- Council tax or municipality bills

- Social insurance statements

- Driver’s license

- Identification card

- Residence permit

- Social security card

In case a customer is under the legal age, they can provide proof of address with their parent’s or guardian’s name. However, it’s noteworthy that customers need to provide different documents for proof of address other than they submitted earlier for identity verification.

Documents for Proof of Address That are not Acceptable

- Any handwritten bill, document, or letter

- Pension statement

- Insurance policy

- Receipts

- Purchase Invoice

- Any document that does not have a date

Why is Proof of Address Necessary?

Gathering and verifying customers’ addresses is one of the key components of a customer identification program [CIP], along with collecting personally identifiable information. Businesses are required to know your customer and anti-money laundering regulations, which require proof of address as part of a risk-based approach to verify customers’ identities and fraud prevention.

But, even when it’s not a regulatory obligation, going the extra mile to gather and authenticate customers’ addresses can help businesses mitigate the risk of fraud and financial losses.

How Does Proof of Address Work?

In some situations, businesses may mandate their customers to visit a branch or office to submit documents proving the authenticity of their provided address. Conversely, companies may also send a code to their newly onboarded customers to verify that an individual genuinely lives there. Once the client receives the code, they can use it to finish the onboarding or online access.

However, these practices are insufficient to sustain today’s digitized world. Instead, businesses need to regularly turn to online proof of address processes, including fully automated address and document verification solutions that can swiftly detect and validate customers’ addresses. With the advanced tools backed by optical character recognition technology, companies can automatically gather, scan, extract, and verify address information while determining that the provided proof of address is not forged, altered, or modified.

A proof of address verification process includes:

- Customers submit government-generated documents along with proof of address documents.

- Address details are extracted using a robust identity verification solution leveraged with document and address verification checks backed by OCR technology.

- The extracted data matches that of information placed in the identity documents using address checks.

- With a perfect match, the customer’s address is verified.

However, it’s noteworthy that businesses can set custom rules for proof of address checks, for instance, whether they want exact matches or partial matches; it all depends on the business requirements. In addition to this, companies can also decide what they will do if the address is a partial match or a mismatch. They can either initiate manual review or request customers to provide new address documents – requiring enhanced address verification checks or simply declining customers’ applications.

Geolocation as Proof of Address

Other than utility bills or identity documents, geolocation can also be used as proof of address as it’s a more convenient, time-saving, and hassle-free alternative to acquiring customers’ physical documents. However, regulatory authorities have not yet wholly accepted geolocation-based PoA compared to traditional document-based verifications; companies can still practice this check as a complementary measure during the know your customer and customer due diligence procedure. However, in the Finanсial Action Task Force (FATF)’s Guidance on Digital Identity and Opportunities and Challenges of New Technologies for AML/CFT, the regulatory authority has mentioned geolocation-based proof of address, which emphasizes the importance of geolocation checks.

Using Geolocation verification checks businesses can identify:

- IP Address and Device Type Detection

- Accurate Timestamps Collection

- Precise Latitude and Longitude

However, businesses must obtain customers’ consent before asking for or accessing geolocation data to meet GDPR’s data privacy and protection laws and standards.

Submitting Your Proof of Address: Best Practices

For frictionless, swift, and uninterrupted proof of address verification, some key considerations need to be met while submitting a PoA document. Key practices include:

- Provide Updated Address Proof: Depending upon the businesses’ requirement, proof of address document must be the one having updated information; old papers can halt operations, creating inconvenience. For instance, if a customer is providing a rental deed, it should be the latest version, and the utility bills should be for the current month. However, requirements vary; some companies may accept up to six-month-old documents, too.

- Maintain a Single Document Version: customers must not alter or update the proof of address document after submission. If they find any errors that need correction, it’s always better to resubmit the new document instead of changing the uploaded document.

- Date and Signature Must be Visible: Proof of address documents’ critical information such as date of issue, name of the issuing authority, and the signatures should be clearly visible. This information is viable for streamlining verification procedures despite the fact it is carried out manually or automatically using document verification solutions leveraged with OCR technology. However, having vagueness in such data points can result in delays or rejection.

- Accurate Address Details: A proof of address must contain a precise, legitimate address. While customers can add nearby prominent places or landmarks, they should not substitute the actual address.

- Consider English Documentation: Although OCR scanners can easily interpret information from documents written in multiple languages, submitting a proof of address in English is suggested. For instance, if a business is not using OCR technology for data extraction purposes, the human verifier may not be proficient in other languages; using documents in English can ensure a more seamless process.

Top 10 Problems with Proof of Address Documents

While there are tens of best practices to master the art of proof of address verification suggested by global lenders and experts, it’s worth noting that acknowledging the potential challenges that arise with PoA documents. Common issues include:

- Lack of clarity and readability is proof of address documents.

- Sometimes, address documents lack complete information, which leads to potential complications.

- Interchanging temporary and permanent addresses creates unnecessary delays.

- Misplacement of permanent and temporary addresses can halt the verification process, resulting in rejection.

- Disparities in PoA documents.

- Multiple versions of the same document, submitted many times over time, can create problems for companies when deciding which document version should be used.

- Absence of critical information such as issue date and signature of issuing authority.

- Some critical documents require attestation. Such document types submitted without being attested from credible sources can become a major problem during verification.

- Language barrier, which creates clarity and consistency issues.

- Submitting non-valid, expired proof of address.

Gather Accurate Proof of Address with Shufti

Proof of address is a key component of the KYC compliance program as it fast-tracks the identity verification process by detecting bad actors, mitigating fraud, and verifying the true location of customers. Although verifying proof of address is a regulatory obligation, businesses can choose from multiple options on how they want to verify their customers’ addresses.

Sending postcards with verification codes or asking customers to visit for in-person checks can be costly and hectic and is not an option that can be practiced as it can’t meet today’s customers’ evolving demands. Whereas digital proof of address procedures are often more robust, secure, and accurate – your business still requires tailored PoA solutions that can uplift customer experience.

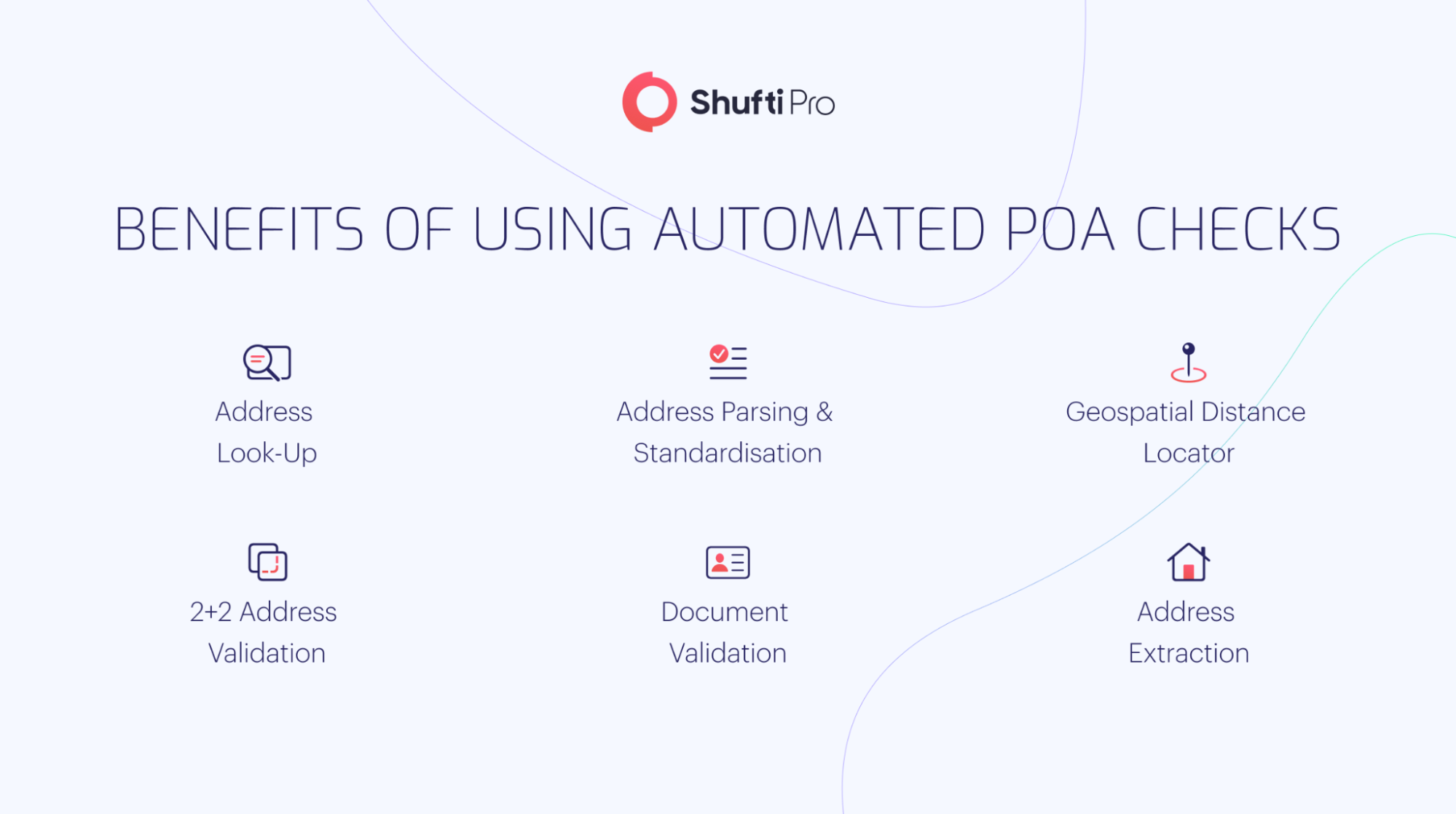

Shufti offered a tailored approach to proof of address verification, powered by state-of-the-art document and address verification solutions. Your businesses can swiftly gather customers’ proof of address documents and customize the verification checks according to experience-tailored data extraction approaches to meet business requirements. With Shufti’s KYC journey builder, you can set your own rules and data points along with the type of proof of address your business wants to accept. Our address verification solution is powered with rigid document authentication checks leveraged with our in-house OCR technology – a perfect solution for businesses seeking to verify customers’ addresses, fight fraud, and improve user experience with no effort.

FAQs:

What counts as proof of address?

There are tens of documents that businesses accept as proof of address. Some of most comment PoA are as follows:

- Utility bills

- Bank statements

- Rental agreements

Proof of address must include the following information:

- Government-issued Identity number

- Name

- Full address

- Date of issue

Proof of address cannot be older than three months (except for rental agreement).

Is a bank statement proof of address?

Yes, bank or financial statements count as proof of address, as they have customers’ addresses on them. However, if you are providing bank statements as PoA, you need to make sure that they are no more than 3 to 4 months old and should contain the transaction history of the last 12 months.

![Insights Into Austria’s Biometric KYC Onboarding [2022 Updates] Insights Into Austria’s Biometric KYC Onboarding [2022 Updates]](https://shuftipro.com/wp-content/uploads/b-img-austria.png)