Prevalent Crimes in Forex Industry – How Shufti Can Help in Mitigating Financial Crimes

Emerging technologies and digitization are transforming the investment sector, creating opportunities for business. With a trading volume of $6.6 trillion daily, the forex industry is one of the evolving sectors that has contributed to money remittance. Every coming year is witnessing more investors in the forex industry, and it is recognized as the most dynamic platform for investment. Even during COVID-19, the forex industry attracted huge capital due to its high liquidity.

With the influx of investments, forex sector has become highly vulnerable to money laundering and other financial crimes. The criminals are using myriad ways to exploit loopholes in system to carry out illicit activities. Although forex exchanges and global regulators are making efforts to eradicate crimes, money laundering is still prevalent, rising the need for Know Your Customer (KYC) and Anti-Money Laundering (AML) measures.

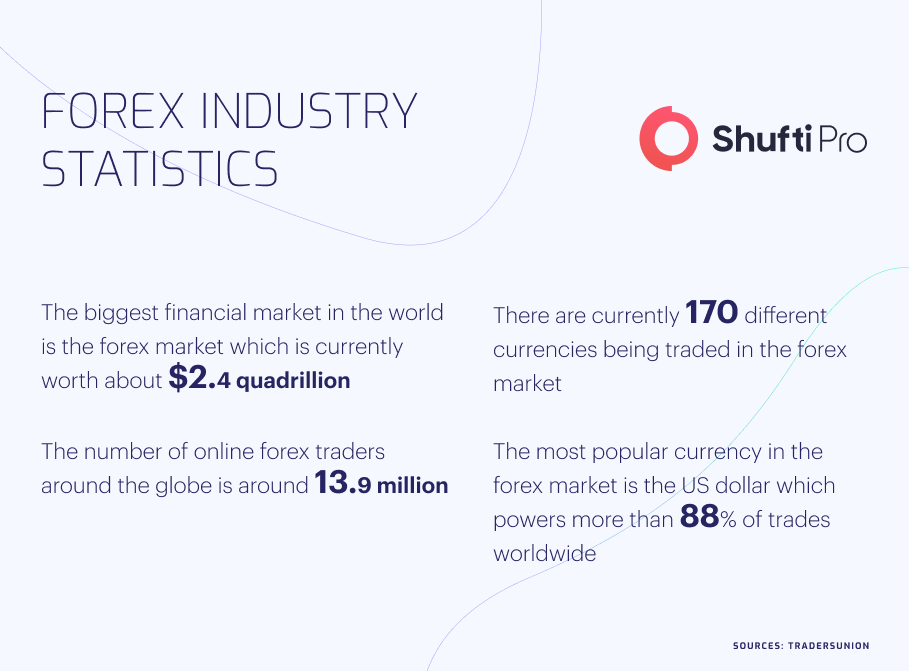

Forex Industry Insights [2022]

Foreign exchange trading, commonly called forex trading or FX—is the global market for exchanging foreign currencies. Forex is the largest industry in the world, and the trades that happen in it affect everything in the global market. Currently, the forex market is worth $2.40 quadrillion with an increase of 29% compared to 2016. The forex industry offers trading in more than 170 currencies. Unfortunately, forex exchanges have become potential targets for criminals posing a huge threat to digital currencies and their users. In the first half of 2022 alone, total amount lost from all types of scams in forex industry is $295 million. It has become crucial to regulate the sector through stringent identity verification and anti-money laundering measures.

Money Laundering Risks in Forex Industry

The growing volume of remittances is helping criminals, including drug dealers and human traffickers, to use multiple methods to launder money. Most forex trading platforms do not have stringent measures for verifying the identities of investors, which ultimately helps criminals get away without any trail. There are many forex exchanges that are involved in money laundering by disguising the illicit funds of fraudsters under their legal money. The scams are not only limited to money laundering but also becoming a source of other heinous crimes, particularly terror financing.

The Financial Action Task Force (FATF), the primary regulatory authority to monitor money laundering, has also highlighted the vulnerabilities of forex industry to financial scams. It has been advised to all the member countries by FATF to regulate forex sector by incorporating AML screening measures. Given the huge worth of forex industry, KYC and AML checks are imperative for the transparency of system, which will keep the financial criminals away while onboarding.

High Profile Cases in Forex Industry

The majority of the countries have lax regulations or have not taken significant preventive measures against forex industry scams, including money laundering, terror financing, and other financial crimes. Due to these reasons, several multi-million scams have surfaced, highlighting the need for effective KYC AML solutions.

Fraudulent Forex Trading Platform Charged in $59 Million Scam

A US-based forex trading firm “EminiFX” has been put under investigation for its involvement in wire fraud exploiting legit investors. The CEO of the company has been arrested who has admitted to collect $59 million from users and further using these funds in money laundering.

The company has been found involved in urging investors to invest money and get weekly profits in return. The court has ordered law-enforcement agencies to further investigate the company’s financial transactions to decide the culprit’s penalty.

Banks Fined With €344 Million for Forex Trading Fraud

The law-enforcement authorities in Germany have imposed a fine of €344 million on three different banks, including Barclays, RBS, and HSBC, for their involvement in forex industry fraud. The investigation has found that banks were involved in sharing users’ sensitive information and trading plans with fraudsters through private chat rooms.

Moreover, the banks also assisted criminals in laundering illicit funds and converting them into legal assets. The court has stated that banks have undermined the integrity of the financial sector at consumers’ expense.

Global Regulatory Authorities Monitoring Forex Trading

The rising crime ratio and monetary losses have compelled major jurisdictions along with global regulators like FATF and Interpol, to take strict action against criminals. In the wake of this, several laws have been legislated which have stressed the need to implement KYC and AML measures in the forex industry.

US

The Financial Industry Regulatory Authority (FINRA) is the primary body working to restrict criminal activities in the forex industry. FINRA is working under the guidelines of Bank Secrecy Act and USA Patriot Act, imposing strict penalties on culprits. Not only the individuals but forex companies are also liable to law, and any violation could result in a minimum fine of $1,000,000.

UK

The Financial Conduct Authority (FCA) governs all the forex trading companies in the UK while setting operational standards for the whole sector. FCA is working closely with the Bank of England to ensure that all the forex trading platforms remain compliant with the regulatory obligations. FCA is also tasked with licensing all the UK forex entities and reporting to law enforcement authorities in case of any violations.

Australia

The Australian Securities and Investment Commission (ASIC) regulates forex trading in country while setting requirements for forex companies to register. It has made mandatory for firms to provide name, address, nature of business, and details of directors along with other documents before starting any forex business.

ASIC is working with the collaboration of Australian Transaction Reports and Analysis Center (AUSTRAC), which is responsible for monitoring AML compliance of financial companies. Every new company has to pass strict AML checks by AUSTRAC to register and start working. In case of any violation, a minimum penalty of AUD4.4 million for individuals and AUD22.2 million for corporations has been set.

Why KYC/AML Compliance is Important for Forex Industry?

The forex industry is a highly dynamic and profitable sector with a huge potential for investment. A large number of investors are mainly carrying out their business activities through forex firms which has increased the need for monitoring and regulatory measures. Huge risks of money laundering and terror financing are not only resulting in financial crimes but also damaging the reputation of whole sector. It is need of the hour to implement robust KYC measures to verify true identities of users before onboarding while ensuring a seamless customer experience. The KYC solution must be efficient enough to authenticate investors through document verification and facial recognition. Only in this way forex trading firms can be made transparent and secure for investors.

Furthermore, it is also mandatory for the sector to implement stringent AML screening measures in system. Global regulatory authorities, particularly Interpol, EU, FCA, and FATF, have gathered huge data of money launderers in the form of sanctions and Politically Exposed Persons (PEP) lists which must be considered while onboarding. Data screening of users against these lists can help the forex companies to keep money launderers away from system.

How Shufti can Help?

Shufti’s state-of-the-art KYC and AML measures can help forex trading companies incorporate enhanced customer monitoring checks. Powered by thousands of AI algorithms, KYC solutions will authenticate the users through document verification and facial recognition.

Shufti’s AML screening solution has access to 1700+ sanctions lists by global watchdogs and screens data against them to identify criminals. The system is efficient enough to generate output in less than a second with 98.67% accuracy.

Want to get more information about KYC/AML solutions for forex trading companies?

Explore Now

Explore Now